Texas Promissory Note Template

In the United States, including Texas, sometimes lending (or borrowing) of money leads to the completion of documents that prove the deal. The Texas promissory note template is used in such a case.

Usually, the promissory note example is created and signed by two parties: a lender (who gives the money) and a borrower (who receives the money and needs to give it back). Like other legal forms, a promissory note has several details that parties need to include. Among them are:

- Information about the lender and the borrower

- The sum and the interest rate

- The date when the money should be returned

Typically, promissory notes in Texas are either secured or unsecured. There is one key difference: with a secured note, the borrower proposes some property to cover the debt if they cannot return the money.

The unsecured note is less safe because the lender cannot receive anything in place of the money. Typically, people use this type of template when they lend money to their reliable relatives or friends.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Texas Usury Laws

The laws and provisions covering usury in Texas are included in the Finance Code (Texas Statutes). Title 4 regulates the interest, loans, and financed transactions in Texas.

According to Chapter 302 (Subtitle A of Title 4), the interest rate should not exceed 10% (however, there might be exceptions by law).

Texas Promissory Note Form Details

| Document Name | Texas Promissory Note Form |

| Other Name | TX Promissory Note |

| Max. Rate | 10% (unless otherwise stated in contract law) |

| Relevant Laws | Texas Statutes, Finance Code, Section 302.001 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (sometimes referred to as just note) is considered a common monetary document used regularly by both individuals and companies around all states as a funding source and a substitute for banking institutions. Learn about the most common states requested by our users in terms of promissory note templates.

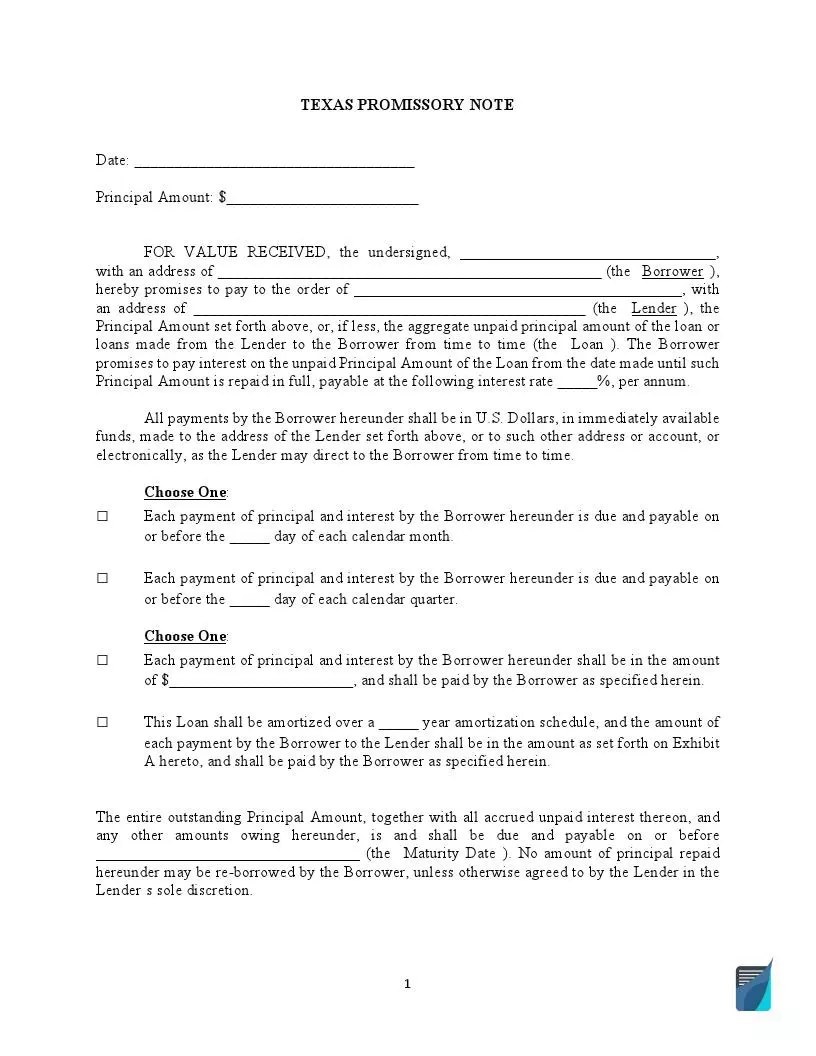

Filling Out the Texas Promissory Note

If you need to complete the Texas promissory note template, read our instructions explaining how to create this document step by step.

Download the Template of the Texas Promissory Note

First of all, download the correct template of the Texas promissory note. You may use our form-building software to get the file quickly.

Add the Names of the Parties

The promissory note form in Texas begins with the names of the lender and the borrower. Write them here.

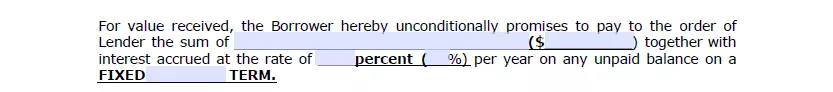

Write the Borrowed Amount with the Interest Rate

Then, write how much money was borrowed and state the interest rate per anum applicable to the situation.

State the Term of Payment

Indicate the period in which the borrower has to cover the debt: for example, “two months,” “three years,” and so on.

Complete the “Payable on Demand” Section

Insert the date when the sum might become payable on demand. Add the terms in which the borrower has to cover the debt after receiving the “payable on demand” notice from the lender.

Read the Statements

The note includes statements revealing the conditions of the lending (borrowing) deal. Both parties should read and acknowledge them.

Sign the Texas Promissory Note

After everything is clear and all the required details are incorporated, both parties should sign the form. The date should also be added. Besides, witnesses of both lenders and borrowers usually sign the document in Texas.

Use our tool to personalize any form offered on our site to your requirements. Here is a range of some other common Texas documents we offer.