Arizona Promissory Note Template

Once you feel the need for assistance and additional financial support, search among friends, colleagues, and relatives to find a reliable and consistent one to give you a helping hand. An Arizona promissory note template becomes a perfect solution to resolve such unforeseen situations and provide secure business relations.

A promissory note is a legal contract between two people dealing with an appointed amount of money borrowed for a definite period under specific terms. The one granting the funds is recognized as “the lender.” The one incurring debt is called “the borrower.”

You can draft two types of promissory note forms in Arizona: a secured promissory note and an unsecured one. These agreements introduce a fundamental difference: a guarantee (or its absence as in the case of an unsecured contract) that the borrower reimburses the money in full by the end of the recognized period.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Secured Promissory Note

A secured promissory note contains terms that warrant a money refund. Should the borrower default on the repayment, the contract of guarantee (known as “Collateral”) will become operative. As a rule, collateral includes the borrower’s estate property, vehicles, jewelry, or any kind of valuable possessions. Exposing these conditions, the borrower ensures their promise to repay the loan.

Unsecured Promissory Note

An unsecured promissory note doesn’t contain any warrant ensuring the loan refund. This type of contract drives more risks and is advisable only if the signatories know each other well and find the other party trustworthy. Unsecured promissory notes are typical between family members and good friends. However, no one can interdict you from building a contract of guarantee.

Regardless of promissory note type, every contract in Arizona should contain the following data:

- signatories identities

- the amount of money borrowed

- interest rate (if any)

- the date and the method of reimbursement

Any specific conditions are discussed and registered in the agreements using supplements. Under Arizona laws, the borrower should authorize the promissory note and obtain acknowledgment by a licensed notary.

Popular Local Promissory Note Forms

A promissory note (sometimes referred to as just note) is a common lending instrument used regularly by many companies and individuals throughout all states as a money source and an alternative to loan providers. Discover more about the most popular US states searched by our users when it comes to promissory note templates.

Arizona Usury Laws

A promissory note is usually more advantageous than a standard credit or a loan from a bank or any other financial institution. As a rule, to borrow a necessary amount of money, people turn to someone they know and consider dependable. Often, negotiations benefit both parties while the borrower may be officially free on paying interest. It depends on the relations between the signatories of the contract.

In Arizona, the usury laws are regulated by § 44-1201 of the state Revised Statutes. The rules hold that interest cannot exceed 10% yearly. The parties can agree upon a lower percent and include the promissory contract conditions. The interest rate remains unchangeable throughout the agreement.

Arizona Promissory Note Form Details

| Document Name | Arizona Promissory Note Form |

| Other Name | AZ Promissory Note |

| Max. Rate | No limit – for loan agreements in writing; 10% per annum – if not in writing |

| Relevant Laws | Arizona Revised Statutes, Section 44-1201 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Filling Out the Arizona Promissory Note

An Arizona promissory note can be tailored exclusively (following the state recommendations) or regarding an officially suggested form. We empower you to use our advanced software to generate a respected template.

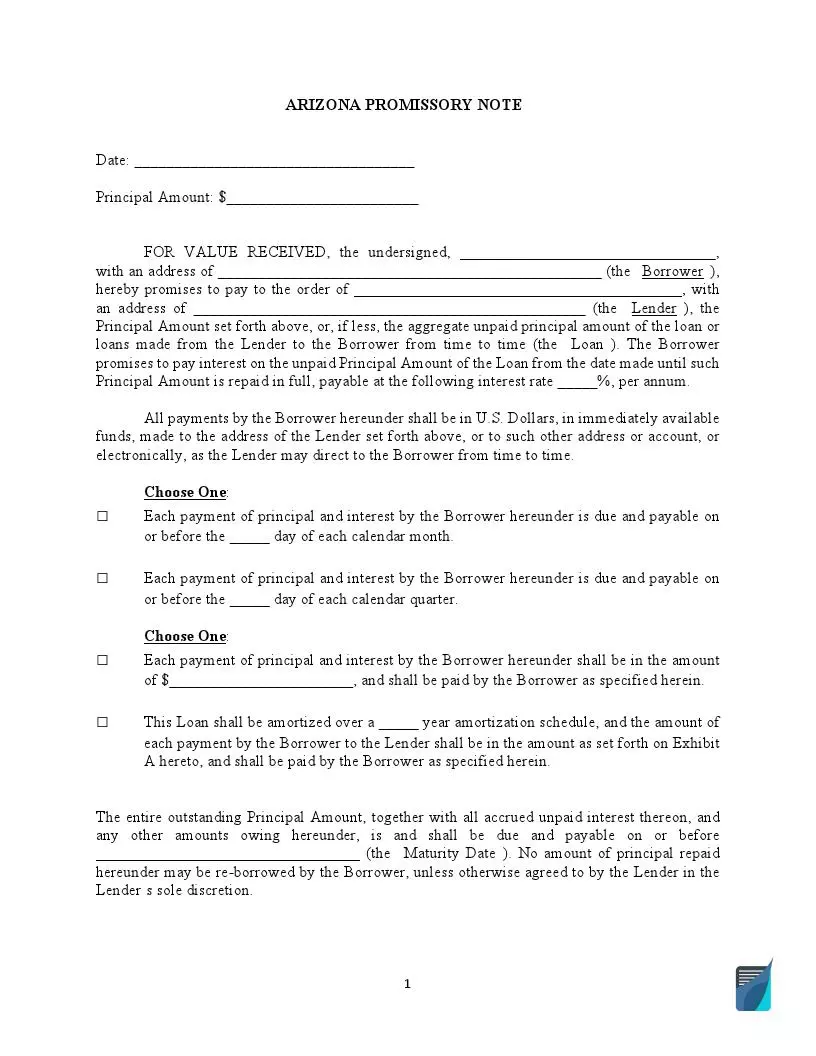

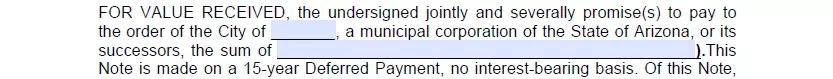

The official Arizona Promissory Note is recognized as a Conditional Deferred Payment Plan. The contract is sequenced the following way:

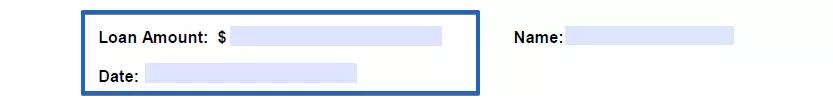

- Determine the Loan Amount and Date the Form

Enter the amount of the borrowed funds in US dollars. Submit the current calendar date when the agreement is being signed.

- Identify Yourself

Write down your legal name.

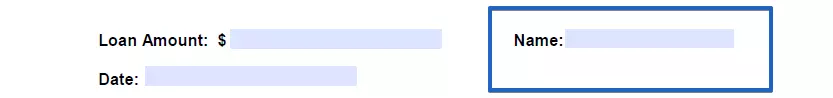

- Determine the Amount of Reimbursement

Enter the appropriate amount of the repayment, whether it equals or differs from the loan.

- Append Signatures

On the last page of the Arizona agreement, one should append their signature and date the form if the contract’s afore-mentioned conditions are gratifying. Therefore, read the promissory note attentively and approve by signing the paper.

- Acknowledge the Form by a Notary

Arizona demands a compulsory notarization of any promissory note. After signing the document in the presence of a notary, let them verify your intentions by affixing the state seal and signature.

Below are other Arizona documents completed by our users. Try our simple creator to personalize any of these forms to your requirements.