Illinois Promissory Note Template

When you lend money to someone, you expect them to return it someday. The Illinois promissory note, signed by the borrower, may serve as a warranty. If something goes wrong and the borrower breaks their promise to give the money back on time, this note acts as proof that you may use to initiate a case in trial.

It is essential to incorporate several details in the form to make it valid, like:

- The borrower’s signature

- The borrower’s and lender’s full names

- The sum received by the borrower

- The due date when the borrower should cover their debt, including the dates when to pay installments

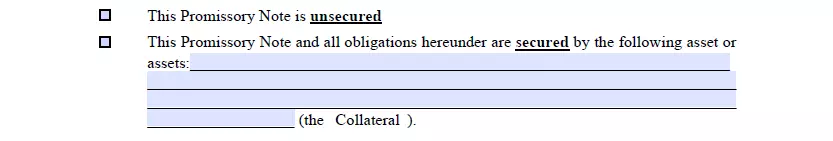

If you want to complete and sign the promissory note in Illinois, you need to decide which type of free printable promissory note for a personal loan you prefer. There are secured and unsecured promissory notes. They differ in that the secured note guarantees the refund by valuable items that the borrower can provide (if they fail to refund with money).

The unsecured note does not provide such guarantees. It is typical to sign unsecured notes when borrowers and lenders know each other well or the lent sum is not significant. However, there are no limits, and you may choose any template you like.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Illinois Usury Laws

Laws and norms dedicated to the topic of usury, business transactions, and loans are included in Chapter 815 of the Illinois Compiled Statutes (or ILCS).

According to Section 815 ILCS 205/4, the interest rate should not exceed 9%.

Illinois Promissory Note Form Details

| Document Name | Illinois Promissory Note Form |

| Other Name | IL Promissory Note |

| Max. Rate | 9% – general usury limit |

| Relevant Laws | Illinois Compiled Statutes, Chapter 815, Section 205/4 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (often referred to as just note) is considered a simple lending tool used by both individuals and companies through all states as a funds resource and a substitute for banks. Discover more about the most popular states searched by our website users concerning promissory note templates.

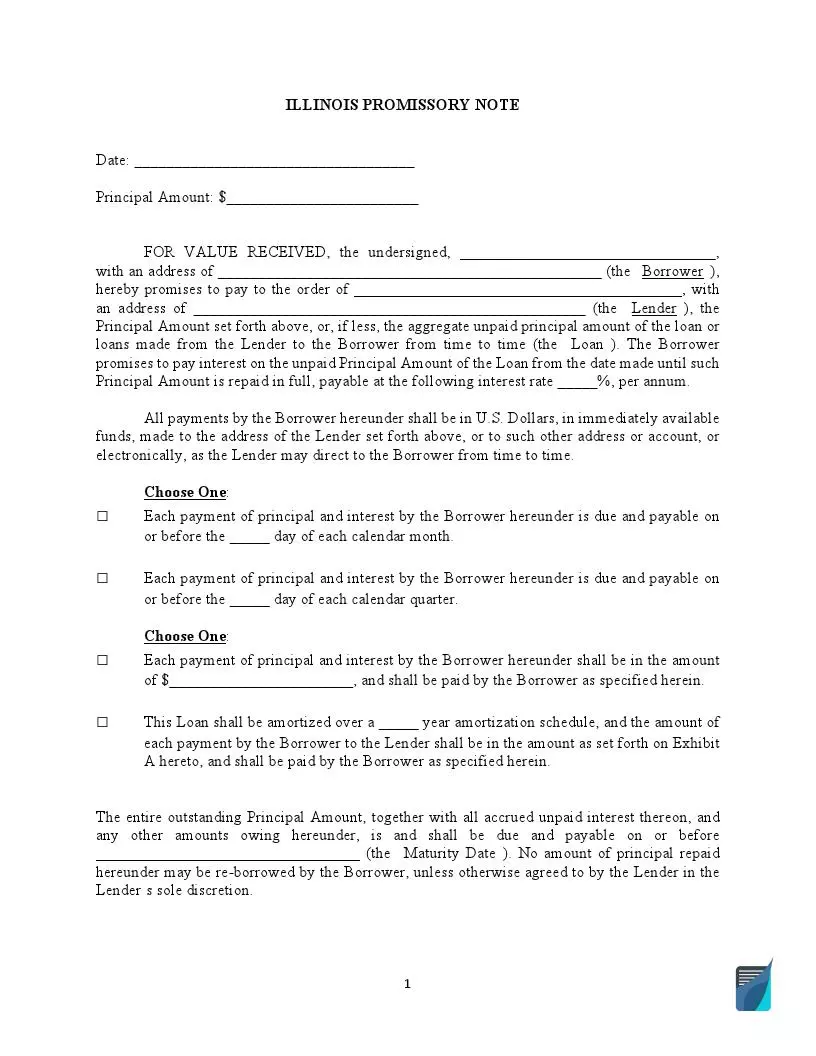

Filling Out the Illinois Promissory Note

To avoid getting stuck with completing the Illinois promissory note template, use our instructions below.

- Get the Correct Template

To begin completing any legal document in the United States, you have to download the proper template. Our form-building software will generate the relevant Illinois promissory note template for you at any time. Get two copies so both the borrower and lender can sign and keep one.

- Date the Note

The first blank line is for dating the note. Insert the date when you are signing the document.

- Indicate How Much Was Borrowed

Below the date, add the principal amount. How much did the borrower get?

- Name the Parties

The first paragraph in the note reveals the borrower’s and lender’s details. Initially, name the borrower and indicate their address. Then, do the same for the lender.

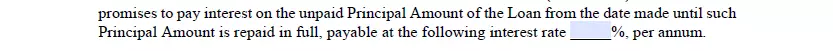

- Write the Interest Rate

Parties typically discuss the interest rate and approve it. Write the decided interest rate in a suitable blank line in the first part’s end.

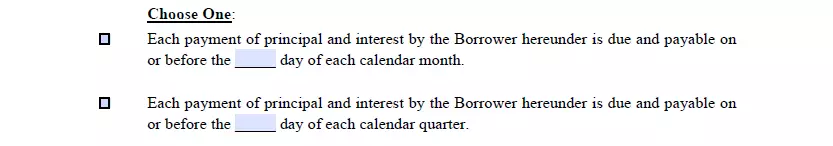

- Outline the Schedule

Then, you should choose the options from the list. These options will define the schedule of payments. Fill out the lines you have selected.

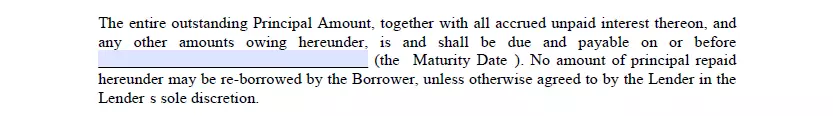

- State the Maturity Date

The maturity date, or the due date, should be disclosed in the promissory note. Write it in the relevant line.

- Define the Type

As we have already explained, promissory notes can be either secured or unsecured. Choose the type. If you opt for a secured note, insert information about the items guaranteeing the refund (or the “Collateral”).

- Sign the Promissory Note

Both parties have to append their signatures and names on the promissory note.

Interested in more Illinois documents? We provide free forms and straightforward personalization experience to everyone who prefers less hassle when facing papers.

Other Promissory Note Forms by State