Indiana Promissory Note Template

A promissory note or a contract payable builds legal responsibilities between two people when the note’s issuer decides to borrow monetary funds from another party (referred to as payee). There is no officially tailored Indiana promissory note template, as in most cases, this type of agreement is a DIY contract designed for a particular situation. However, every contract should contain specific data, and we will draft a “how to fill out the form” guide later in the review.

Indiana promissory note should be indispensable when someone asks you for financial support, and the value is high enough. A free promissory note template creates a shield protecting both parties from violating the agreement’s conditions. Therefore, one should read the form attentively before appending their signature—any breach results in penalties. Thus, after the authorization, the parties should make every effort to comply with the contact’s requests.

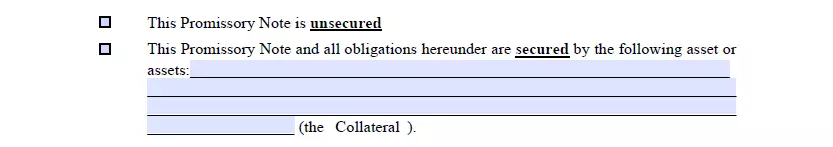

There are two types of promissory notes available in Indiana: a secured contract and an unsecured note payable.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Secured Promissory Note

A secured promissory note implies an obligatory guarantee secured by the borrower’s property. As a rule, the issuer can offer their real estate, vehicles, personal property (jewelry or other valuable assets). If the borrower defaults or fails to refund the payee due to any reason, the lender has a legal right to compensate for the damage immediately.

Secured promissory notes usually contain information about penalties for late-payments and the collateral (a list of assets).

Unsecured Promissory Note

The unsecured promissory note contains more risks as it doesn’t imply any guarantee of immediate compensation. Should the borrower fail to reimburse the loan, the lender must file a petition in court to obtain amends. Therefore, this type of contract is common among relatives or reliable friends. Usually, unsecured promissory notes are tailored for a short period and rarely include penalties and late fee charges. However, it depends on how well the parties know each other.

Regardless of its type, an Indiana promissory note template should contain the following:

- the signatories’ identities

- the full amount of the loan and the date of the loan

- method and schedule of payment

- penalties and fees for late payment

- security assets (if applicable)

- the maturity date

- the parties’ signatures

Whether to notarize the promissory agreement or not is a matter of choice. However, a notary acknowledgment is always preferable because a licensed state representative can provide a higher level of reliability and safety verifying the parties and the contract. Should you have any doubts or misconceptions, it is recommended to seek a legal professional’s assistance.

Popular Local Promissory Note Forms

People and businesses usually require promissory notes to borrow money from other individuals and companies and steer clear of credit institutions. Here are some of the most popular local promissory notes looked up by the users of this site.

Indiana Usury Laws

In Indiana, interest rates are regulated by § 24-4.6-1 of the Indiana Code. Under the usury laws, the interest rate equals 8% per annum, even if there has been no agreement made between the parties. Therefore, if the issue is taken to court, the afore-mentioned conditions go into effect.

Following § 24-4.5-3-201 of the Indiana Code, the lender obtains a legal right for a loan finance charge, 25% annum and lower. More details can be found in the respected Section of the Indiana Code.

Indiana Promissory Note Form Details

| Document Name | Indiana Promissory Note Form |

| Other Name | IN Promissory Note |

| Max. Rate | 8% – if no agreement; 25% – for consumer loans other than supervised loans |

| Relevant Laws | Indiana Code, Sections 24-4.6-1-102 and 24-4.5-3-201 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Filling Out the Indiana Promissory Note

Creating an Indiana promissory note template can be challenging as there are many rules to observe. Thus, we recommend our advanced software to build a respected document effortlessly. Here is the guide on filling out the form:

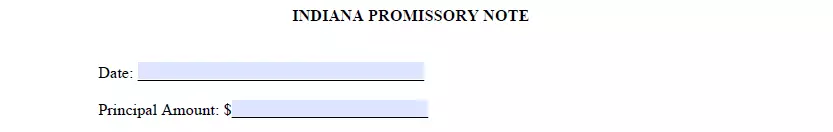

- Specify the Date and the Loan Amount

Enter the required calendar date and the sum in US dollars.

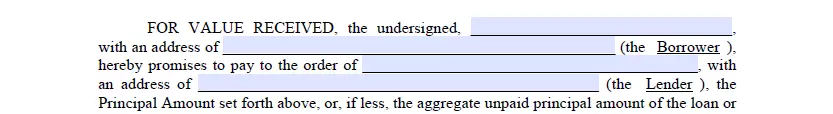

- Introduce the Parties

Submit the borrower’s and the lender’s legal names and physical addresses.

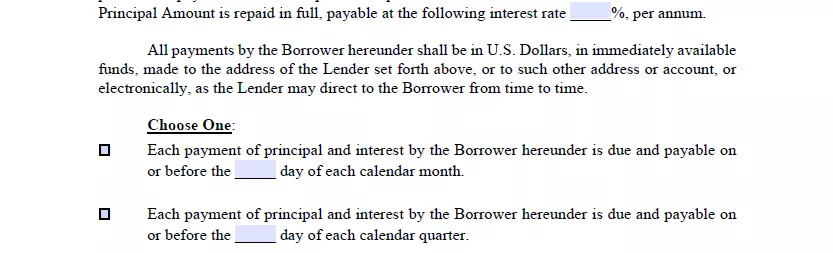

- Determine the Interest Rate and the Payment System

Define the percentage of interest charges (per year). Follow the document and choose the preferred alternative of repayment. The parties should select one checking the corresponding box.

Determine the maturity date as well.

- Specify the Note Type

Choose the appropriate variant of your promissory note type—select between a secured and an unsecured one. If creating a guaranteed promissory contract, give a list of assets that ensure the loan repayment.

- Authorize the Document

Read the “Collateral” part attentively, insert the jurisdiction (here, Indiana), and append signatures. Both parties should submit their names (printed) and sign the paper.

- Clarify the Amortization Schedule

The last section of the form contains amortization schedule attachments that should be defined and distributed to the borrower.

We provide a wide range of fillable Indiana templates to anybody seeking convenience when handling various agreements, contracts, and other paperwork.