Michigan Promissory Note Template

The Michigan promissory note is a legal instrument that proves money was borrowed and obliges the one who borrowed to refund.

The form should be signed in conformity with the state law and the basic rules. For instance, parties have to reveal certain information in the document, including:

- The borrower and lender’s names

- The sum that was borrowed and the interest rate

- The schedule by which the borrower will cover the loan.

Whether you complete the loan note template in Michigan or any other American state, the details listed above are essential.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

When choosing a template to complete, define the relationship between parties and the borrowed sum. If the sum is large and the lender does not trust the borrower enough, signing a secured promissory note is a great idea. This kind of note guarantees the refund with tangible items that belong to the borrower (the value of such items should commensurate with the borrowed sum).

However, we often lend insignificant sums to people we know well. In cases like this, the signing of an unsecured promissory note is an option. The borrower will guarantee the payment by signing but will not propose any items instead of the money.

The promissory note type you choose does not affect the structure much. You still have to include the details we have mentioned above.

Michigan Usury Laws

Section 438.31 of the Michigan Compiled Laws (or MCL) answers the questions about the interest rate. The maximum in this state is set at f 7% per year if the agreement between the borrower and the lender exists in writing.

Overall, Chapter 438 of the MCL provides readers with the regulations and laws tied to the money and interest in the state of Michigan.

Michigan Promissory Note Form Details

| Document Name | Michigan Promissory Note Form |

| Other Name | MI Promissory Note |

| Max. Rate | 7% – if a written contract; otherwise – 5% |

| Relevant Laws | Michigan Compiled Laws, Section 438.31 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

If you need to borrow or lend money, think about signing a promissory note form. It’s a useful binding document frequently used by businesses and individuals in many states. Listed below are the state-level promissory note templates our users research the most.

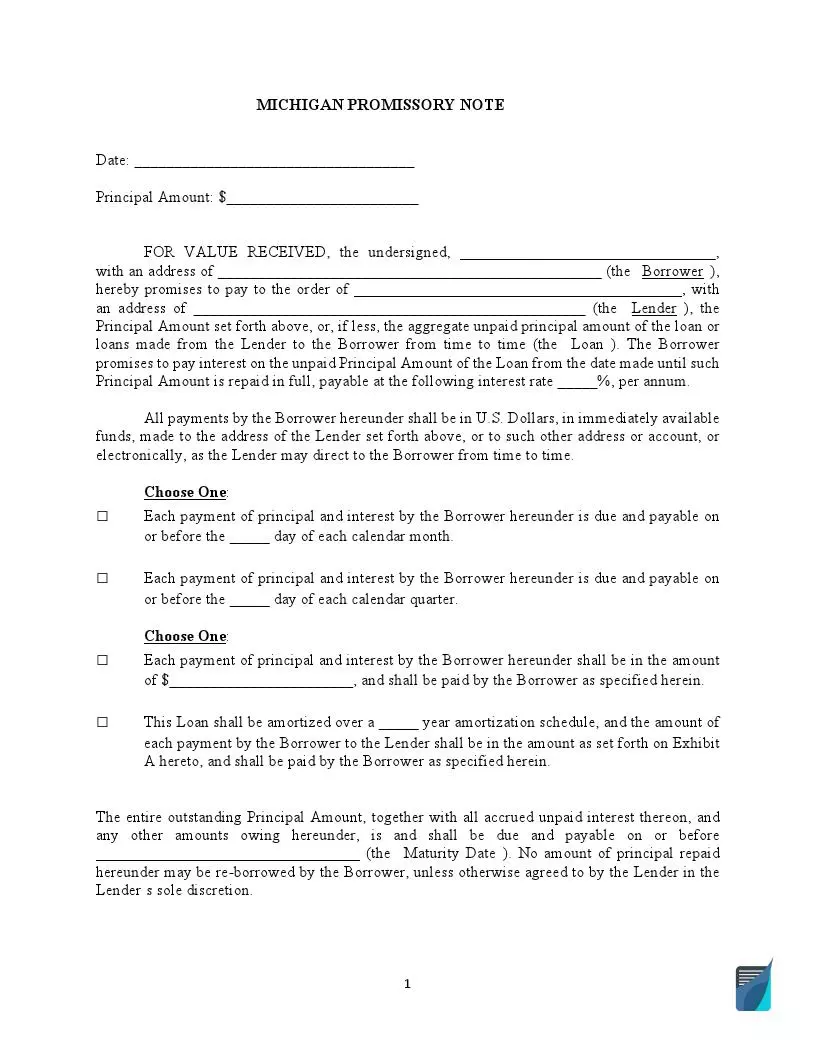

Filling Out the Michigan Promissory Note

Creating legal documents in the United States, including Michigan, is quite challenging. You have to take into account many things and details. Our instructions will facilitate the completion of the Michigan promissory note template.

- Get the Template

Each time you need to complete any legal document, a long search of the relevant template occurs. Try using our form-building software to download the correct promissory note template for Michigan straight away.

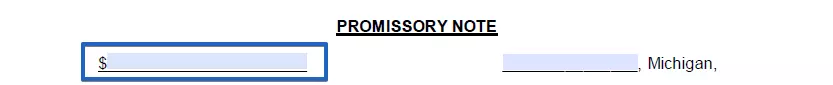

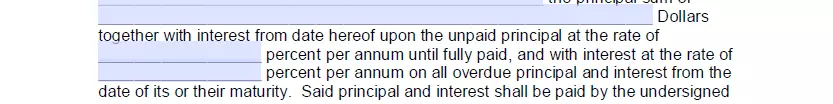

- Reveal the Borrowed Amount

Under the heading, you will see two blank spaces. Insert the sum that the borrower has obtained on the left-hand side.

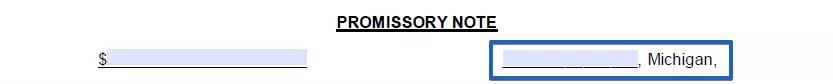

- Indicate the County

On the right-hand side below the heading, add the county’s name in Michigan where the document is being signed.

- Date the Document

In the next line, write the date of signing this note.

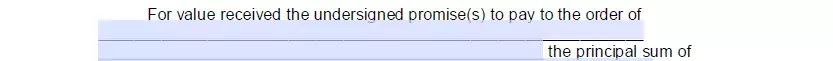

- Add the Lender’s Name

You should write the lender’s full name in suitable lines.

- Write the Sum in US dollars

After the lender’s name, write how much the lender has given to the borrower. The sum should be stated in US dollars. Then, include information about the interest rate.

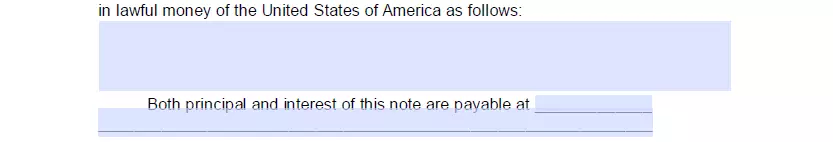

- Describe the Payment Timeline

After stating the sum, you have to describe the dates when the payments will be made. Also, indicate the last day when the payment should be completed.

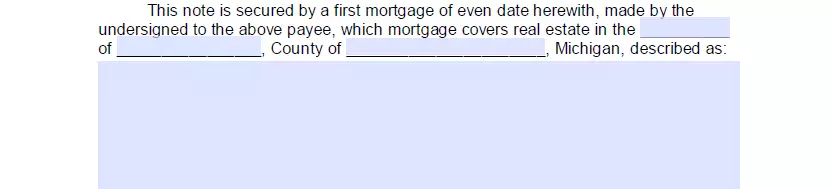

- Insert the Item that Replaces the Money (for Secured Notes)

If you have decided to complete the secured promissory note, state the item guaranteeing the payment here.

- Sign the Document

After you have filled out the blank fields and all details are provided, sign the document ( both the lender and the borrower). In Michigan, you are not obliged to notarize the form, so the parties’ signatures are sufficient.

Other popular Michigan templates available for download here and that can be customized in our hassle-free document builder.

Other Promissory Note Forms by State