Utah Promissory Note Template

When you lend money in Utah (and in any other American state), the lender can secure their money by ensuring that the borrower signs the Utah promissory note. The document proves that the lender lent the money and provides additional details like:

- Lender’s and borrower’s personal details (including names and contact details).

- The date of refund, accompanied by a schedule of payments.

- The exact sum and the interest rate acceptable for both parties.

When the lent sum is large, or the lender wants a guarantee of a refund, the lender should choose a secured promissory note. That way, the borrower will give security just in case they cannot give the money back.

If the borrower is your family member, friend, or someone you can trust, you can opt for the unsecured promissory note. The free promissory note does not provide any information about any security that can be used to cover the debt.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Utah Usury Laws

Each state has its norms that tell about usury, and the state of Utah is not an exemption. You may find the relevant laws in the Utah Code (Title 15).

Section 1 of Chapter 1 in the mentioned Title advises on the maximum interest rate at the level of 10%. However, borrowers and lenders may agree on different conditions. To make those conditions valid, the parties have to include the information in the Utah promissory note template.

Utah Promissory Note Form Details

| Document Name | Utah Promissory Note Form |

| Other Name | UT Promissory Note |

| Max. Rate | 10% (unless otherwise agreed between parties in a written contract) |

| Relevant Laws | Utah Code, Section 15-1-1 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

In case you need to lend or borrow money, think about creating a promissory note form. It’s a useful legal document commonly used by businesses and individuals in many US states. Here are the state promissory note forms our visitors research most often.

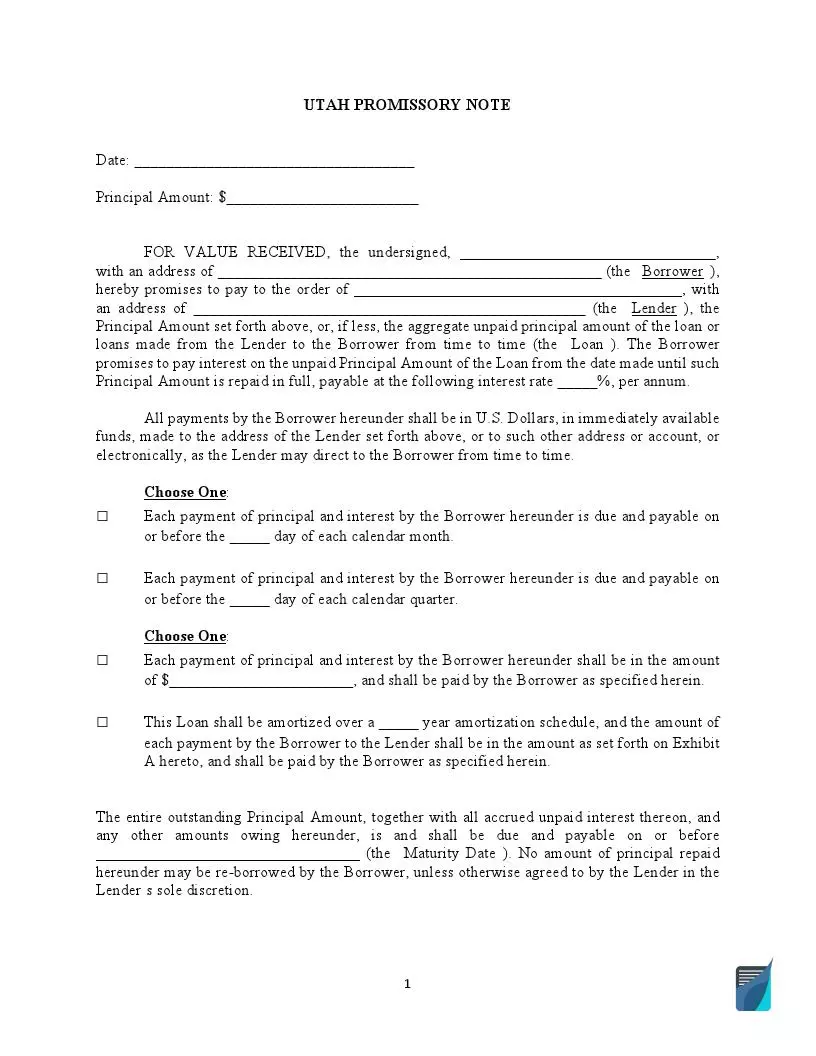

Filling Out the Utah Promissory Note

We have prepared a brief list of steps you should complete for the successful Utah promissory note obtainment.

- Download the Form Template

It is crucial to find the correct template of a promissory note. Use our form-building software to get one.

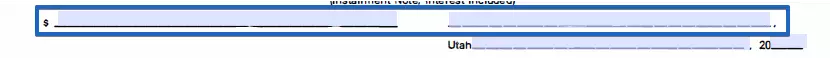

- Enter the County and the Borrowed Sum in US dollars

Below the heading of the form on the left-hand side, write the borrowed sum in US dollars. On the right-hand side, insert the name of the County in Utah where the note is signed.

- Write the Date

There is a blank line for the date of signing below the name of the county. Insert the date here.

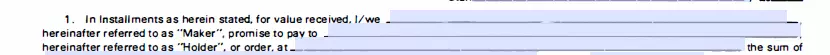

- Write the Lender’s and the Borrower’s Names

In the suitable lines, add the name of the borrower (or “maker”) and the lender (or “holder”).

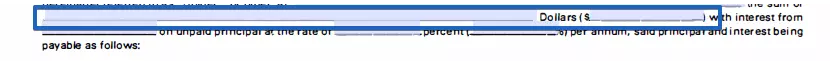

- Enter the Sum Again

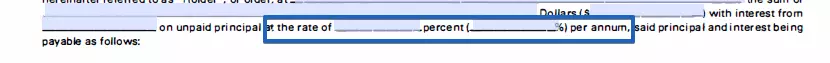

Again, you have to insert the sum in US dollars that the lender has given to the borrower. Write it both in letters and numbers.

- Define the Interest Rate

Both parties should agree on a certain interest rate. Discuss and insert it in the document.

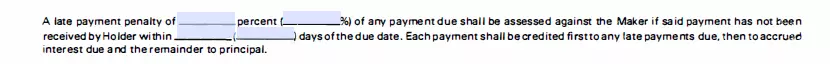

- Include Information about Penalties

If the payment is delayed, the borrower may face penalties. Describe them in this section.

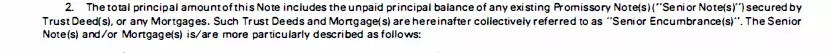

- Describe Additional Encumbrances (If Applicable)

If there are other promissory notes signed by the borrower, add details about them.

- Read the Statements Carefully

The template contains a list of statements. The maker and the holder should read them carefully.

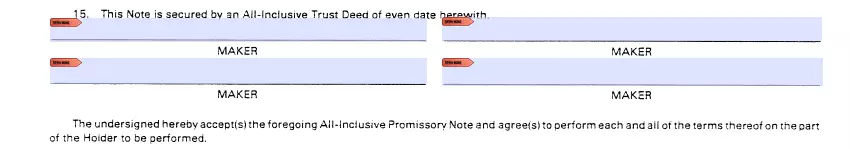

- Sign the Promissory Note

Both the maker and the holder should sign the note in Utah.

Need other Utah forms? We provide free forms and straightforward customization experience to everyone who hopes for less hassle when facing documents.

Other Promissory Note Forms by State