Minnesota Promissory Note Template

The Minnesota Promissory Note Template is meant to be completed when two individuals have agreed upon lending and borrowing a definite amount of money. It serves as a guarantee that the debt will be compensated together with the accumulated interest. The principal of the Note is paid as follows:

- The Borrower possesses the right to repay without a prepayment penalty.

- The Holder of this note shall not be deemed to have waived any of its rights and remedies.

- If a legal argument occurs, it should be controlled by the terms of this agreement.

- The Note may not be modified and changed in any way exempt, re-written, and re-signed by both the borrower and the lender.

- Each part of this template for a promissory note shall be interpreted to be valid and effective under applicable laws.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Usury Laws

According to the state Minnesota law (Section 334.01), the legal usury rate for indebtedness is 6% unless different conditions have been provided in the contract. If the loaned sum does not exceed 100,000 US dollars, the interest must not be higher than 8%. The lender may be paid in money, goods, or things in action.

If the debtor has lent more than 100,000 US dollars, the loan interest rate can be higher than 8%.

Minnesota Promissory Note Form Details

| Document Name | Minnesota Promissory Note Form |

| Other Name | MN Promissory Note |

| Max. Rate | 6% – legal rate of interest; 8% – usury limit |

| Relevant Laws | Minnesota Statutes, Section 334.01 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

When lending or borrowing money, consider signing a promissory note. It is a simple legal document commonly used by companies and people in all states. Here are the state promissory note templates our users research the most.

Filling Out the Minnesota Promissory Note

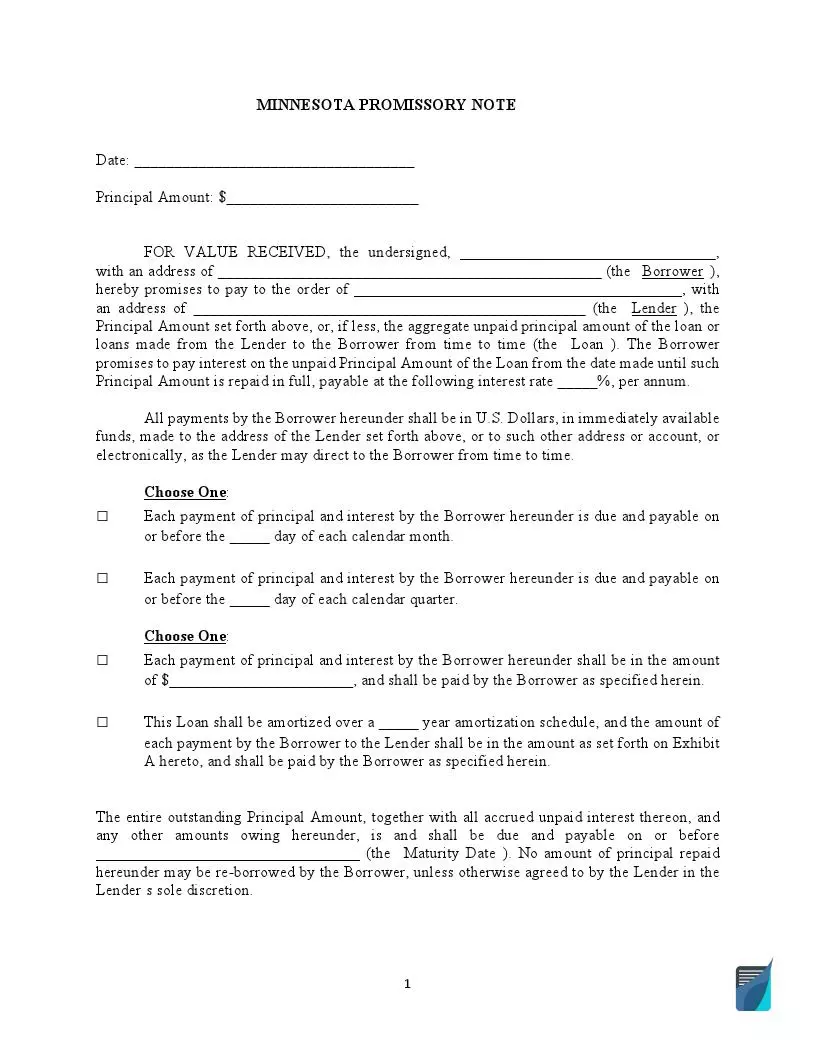

The promissory note template is available online and will require submitting the following data:

- The maker’s and holder’s names

- The principal sum of the written dollar amount

- The amount of money provided every month

- Witnesses’ data

- The date of the agreement

You may use our form-building software and create your own customized Minnesota Promissory Note Template. To ensure the best result, follow our step-by-step guidelines:

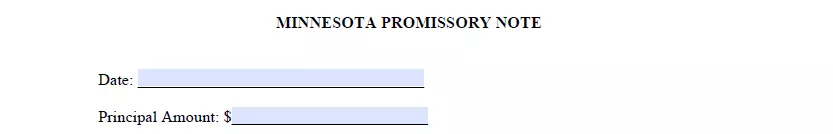

- Submit the Date and the Principal Amount

The first section of the paper requires the date both parties append their signatures and the amount of money loaned indicated in US dollars.

- Provide Both Parties’ Info

The lender and the borrower have to write down their names and residential addresses. The interest rate negotiated before signing the form has to be stated herein, too.

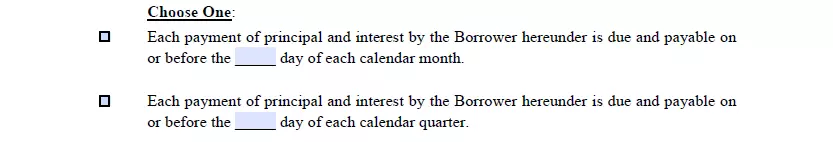

- Indicate the Payments Details

The owed money is usually transmitted monthly or quarterly (choose the option appropriate for both parties). If the payment is delivered in parts, input the amount the lender accepts to receive at a time. Attach the amortization schedule if applicable and write down the number of years you expect the loan to be compensated in. The Maturity Date, being the last day for the payment to be provided in full, should also be indicated.

- Identify the Promissory Note Type

The document may be either secured or unsecured. Suppose the borrower executes the Note as secured. In that case, they will be responsible for transferring ownership and possession of the designated property if they fail to pay for the indebtedness (as well as provide the usury rate and the late fees) before or on the Due Date.

- Write Down Your State

The form is governed by the state you reside in (or where the document is being executed).

- Sign the Form

The document should be witnessed by a competent adult. Both parties need to provide their titles and full names.

We provide a multitude of printable Minnesota templates to anybody in quest of simplicity when handling all sorts of agreements, contracts, and other paperwork in the state.