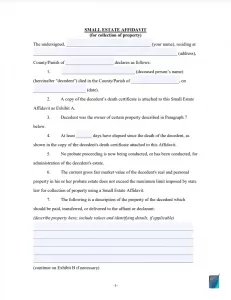

Small Estate Affidavit Form

There’s a way to streamline probate and make it much faster. If the decedent didn’t leave a large estate in their name, the probate procedure can be reduced and made much faster with a small estate affidavit.

How small an estate can be to be eligible for this document depends on the state laws. Some states like Alabama consider anything over $25,000 to be too large to qualify for an affidavit for a small estate. Some states allow the inherited sums to be as high as $150,000.

You know that your inheritance is eligible for this form or you are about to seek legal advice from your attorney on this matter and only lack the form? You can download a free small estate affidavit form at FormsPal.

To learn more about the small estate affidavits, read this article to find out all you need to know before creating and signing this document.

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Utah

- Virginia

- Washington

- Wisconsin

When to Use a Small Estate Affidavit

Small estate affidavits are a great option that allows you to spend less time handling inheritance matters in probate court. When filed correctly, notarized, and approved by the probate clerk, you can use this document for the collection of personal property from a bank, executor of an estate, or any other person or entity. However, you can’t use this legal instrument in all cases. There are some considerations to follow.

First off, a small estate affidavit only applies when there is no last will and testament. At least, that is the case in most states. If the person died with a valid last will, you should go through the formal procedure of probate.

Even if the person dies in intestacy (without a will), the overall value of inheritance should meet the maximum standard set by the local laws. This varies greatly from state to state. For instance, Vermont sets the maximum amount of property that can be distributed via a small estate affidavit as $10,000. Kentucky sets a limit of $15,000. If you live in Alaska or Arkansas, this document may be applied to estates under $100,000. In California, the limit is even higher at $150,000.

The other major thing to consider is that this affidavit may not be used to distribute real estate property. The only exemption is a homestead. If the decedent only had a homestead that is used by a spouse and children, it can be distributed via this affidavit. If they hold multiple homes, this affidavit is not viable.

Consult with your attorney or a law firm to make sure you qualify for filing a small estate affidavit form. If you’re eligible to do so, you can start filing with a few further considerations.

What to Consider First

The small estate affidavit requires a lot of pre-filing research. If you don’t do your due research and make sure that you filled the form correctly, the document may get rejected by the probate court.

Before you start filing the document, you need to make sure that the probate process hasn’t started yet. If the court started the process of distributing the property of the person who died without a will, a small estate affidavit cannot be filed.

Granted this is not the case, the next thing you should consider is finding all the heirs of the deceased person. If you don’t list all eligible descendants and the proper amount owed to them, the document may be discarded by the court.

The final thing that you spend time researching and getting right is the exact list of the deceased’s possessions. The small estate affidavit requires you to list all the property owned by the individual and state the value of each item.

Note that this should include bank accounts, immovables (if it’s a homestead for the surviving spouse), vehicles, furnishings, and any other possessions. If the decedent owned a share of communal property with their spouse, you should specify the percentage.

It may take a while to gather this information, so it’s best to start before you legally file an affidavit.

Affidavit of Heirship vs Small Estate Affidavit

A small estate affidavit and affidavit of heirship both serve the purpose of shortening the probate process. However, you should not mix the two up because they serve different property types.

Affidavits of heirship are applicable when solving real estate matters. When you sign this document in the presence of two witnesses and notarize it, it creates a presumption of heirship.

It cannot transfer the title to the heir, but only acts as evidence of their right to receive the title to the property. You will still need to go through the probate process, but it does save a lot of time since the court may not need to call upon witnesses. It will have to call upon them if the affidavit is challenged.

A small estate affidavit, on the other hand, only deals with personal property and homestead real estate. It cannot transfer the title to other real estate, and you will need to go through the probate process to receive that.

However, it does not require you to deal with the full probate process if the necessary requirements are met.

Small Estate Affidavit Laws by State

| STATE | MAX. AMOUNT | Waiting Time After Death of Decedent | STATE LAW |

| Alabama | $30,608 | 30 days | Alabama Code, Section 43-2-692 |

| Alaska | $100,000 (for vehicles) and $50,000 (for non-vehicles) | 30 days | Alaska Statutes, Section 13.16.680 |

| Arizona | $75,000 (for personal property) and $100,000 (for real property) | 30 days | Arizona Revised Statutes, Section 14-3971 |

| Arkansas | $100,000 | 45 days | Arkansas Annotated Code, Section 28-41-101 |

| California | $166,250 | 40 days | California Probate Code, Section 13000 |

| Colorado | Twice the amount set forth in Sec. 15-11-403, as adjusted by Sec. 15-10-112 | 10 days | Colorado Revised Statutes, Section 15-12-1201 |

| Connecticut | $40,000 | No Statute | Connecticut Revised Statutes, Chapter 802b, Section 45a-273 |

| Delaware | $30,000 | 30 days | Delaware Code, Title 12, Section 2306 |

| Florida | $75,000 and $10,000 (if decedent has died intestate) | No Statute | Florida Statutes, Chapter 735 |

| Georgia | $15,000 | No Statute | Georgia Code, Section 7-1-239 |

| Hawaii | $100,000 | No Statute | Hawaii Revised Statutes, Section 560:3-1201 |

| Idaho | $100,000 | 30 days | Idaho Statutes, Section 15-3-1201 |

| Illinois | $100,000 | No Statute | Illinois Compiled Statutes, Chapter 755, Section 5/9-8 |

| Indiana | $50,000 | 45 days | Indiana Code, Section 29-1-8-1 |

| Iowa | $50,000 | No Statute | Iowa Code, Sections 635.1-635.13 |

| Kansas | $40,000 | No Statute | Kansas Statute, Section 59-1507b |

| Kentucky | $30,000 | No Statute | Kentucky Revised Statutes, Sections 391.030 and 395.455 |

| Louisiana | $125,000 | No Statute | Louisiana Code of Civil Procedure, Article 3421 |

| Maine | $40,000 | 30 days | Maine Probate Code, Title 18-C, Section 3-1201 |

| Maryland | $100,000 (for spouse) and $50,000 (for descendants) | No Statute | Maryland Annotated Code, Estates and Trusts, Section 5–601 |

| Massachusetts | $25,000 | 30 days | Massachusetts General Laws, Chapter 190B, Section 3-1201 |

| Michigan | $15,000, (as adjusted by § 700.1210) | 28 days | Michigan Compiled Laws, Section 700.3982 |

| Minnesota | $75,000 | 30 days | Minnesota Statutes, Section 524.3-1201 |

| Mississippi | $75,000 | 30 days | Mississippi Annotated Code, Section 91-7-322 |

| Missouri | $40,000 | 30 days | Missouri Revised Statutes, Section 473.097 |

| Montana | $50,000 | 30 days | Montana Annotated Code, Section 72-3-1101 |

| Nebraska | $50,000 | 30 days | Nebraska Revised Statutes, Section 30-24,129 |

| Nevada | $100,000 (for spouse) and $25,000 (for other claimants) | 40 days | Nevada Revised Statutes, Section 146.080 |

| New Hampshire | No Statute | No Statute | New Hampshire Revised Statutes, Section 553:32 |

| New Jersey | $50,000 (for spouse) and $20,000 (for heirs) | No Statute | New Jersey Statutes, Sections 3B:10-3 and 3B:10-4 |

| New Mexico | $50,000 | 30 days | New Mexico Annotated Statutes, Section 45-3-1201 |

| New York | $50,000 | No Statute | New York Court Acts, Sections 1301-1312 |

| North Carolina | $20,000 | 30 days | North Carolina General Statutes, Section 28A-25-1 |

| North Dakota | $50,000 | 30 days | North Dakota Century Code, Section 30.1-23 |

| Ohio | $100,000 (for spouse) and $35,000 (for other claimants) | No Statute | Ohio Revised Code, Section 2113.03 |

| Oklahoma | $50,000 | 10 days | Oklahoma Statutes, Section 58-393 |

| Oregon | $275,000 ($75,000 for personal property and $200,000 for real property) | 30 days | Oregon Revised Statutes, Section 114.515 |

| Pennsylvania | $50,000 | No Statute | Pennsylvania Consolidated Statutes, Title 20, Section 3102 |

| Rhode Island | $15,000 | 30 days | Rhode Island General Laws, Section 33-24-1 |

| South Carolina | $25,000 | 30 days | South Carolina Code of Laws, Section 62-3-1201 |

| South Dakota | $50,000 | 30 days | South Dakota Codified Laws, Section 29A-3-1201 |

| Tennessee | $50,000 | 45 days | Tennessee Code Annotated, Sections 30-4-102 and 30-4-103 |

| Texas | $75,000 | 30 days | Texas Statutes, Estates Code, Section 205.001 |

| Utah | $100,000 | 30 days | Utah Code, Section 75-3-1201 |

| Vermont | $45,000 | No Statute | Vermont Statutes, Title 14, Section 1902 |

| Virginia | $50,000 | 60 days | Virginia Code, Sections 64.2-601 to 64.2-605 |

| Washington | $100,000 | 40 days | Washington Revised Code, Section 11.62.010 |

| West Virginia | $100,000 | No Statute | West Virginia Code, Section 44-3A-5 |

| Wisconsin | $50,000 | No Statute | Wisconsin Statutes and Annotations, Section 867.03 |

| Wyoming | $200,000 | 30 days | Wyoming Statutes, Section 2-1-201 |

How to Get a Small Estate Affidavit

Getting a small estate affidavit is a long process, but considering the fact that it will save a lot of time in the long run, it’s worth it. Here are all the steps you need to go through to receive an affidavit.

Wait for the minimum period of time.

Most states require you to wait at least 15 days from the date of death of the individual before you can file the document. Figure out how many days your state law requires and do your research while waiting for this time period.

Gather information on the decedent’s property.

The small estate affidavit requires you to list all possessions of the decedent and provide estimates of their value. Judging a person’s net worth can be straightforward when it comes to bank accounts, but listing all vehicles, furniture, and smaller possessions can be a lot of work. Considering the fact that you need to provide market value assessments, it’s even harder. You can do that while you’re waiting for the minimum period of time.

Gather information on the deceased’s heirs.

To be considered legally binding, this document should include information on any surviving descendants of the decedent. The list of heirs includes the following:

- Spouse or domestic partner

- Children

- Mother or father in case there are no surviving children

- Grandfather or Grandmother and their descendants

- Brother or sister and their descendants

All of these people should be listed in the affidavit and notified via certified mail.

Gather legal documents.

To create a small estate affidavit, you need to collect a death certificate at the Bureau of Vital Statistics as well as bank statements about the person’s finances. All reasonably big property titles like vehicles should also be proven via a document that indicates ownership.

Download a small estate affidavit form and fill it out.

When you have all this information at hand, you now can fill out the form. If you don’t have one, feel free to download a free small estate affidavit form here. We provide forms for all states and jurisdictions. Just pick one from the list and start filling it out. The guide can be found down below.

Notarize the form.

The next step on the list is to schedule a meeting with a notary public and gather two disinterested witnesses. The witnesses should meet the following criteria:

- Both witnesses are over 18 years of age

- Both have known the family of the deceased for some time

- Neither is entitled to any property of the deceased

It can be a distant family member, but it’s important that they’re not a legal heir of the decedent.

Note that not all jurisdictions require notarization. However, most statutory forms have a notary public section at the bottom of the document. Hence, it is always advised to notarize your small estate affidavit. Seek advice from your local attorney if you have doubts.

File the document.

The last step of the process is to file the paperwork with the clerk at the probate court and pay the filing fee. After some time, the document will get reviewed, and you will receive an official statement. If the probate office rejects the document, you will normally be given a direction of what you need to improve.

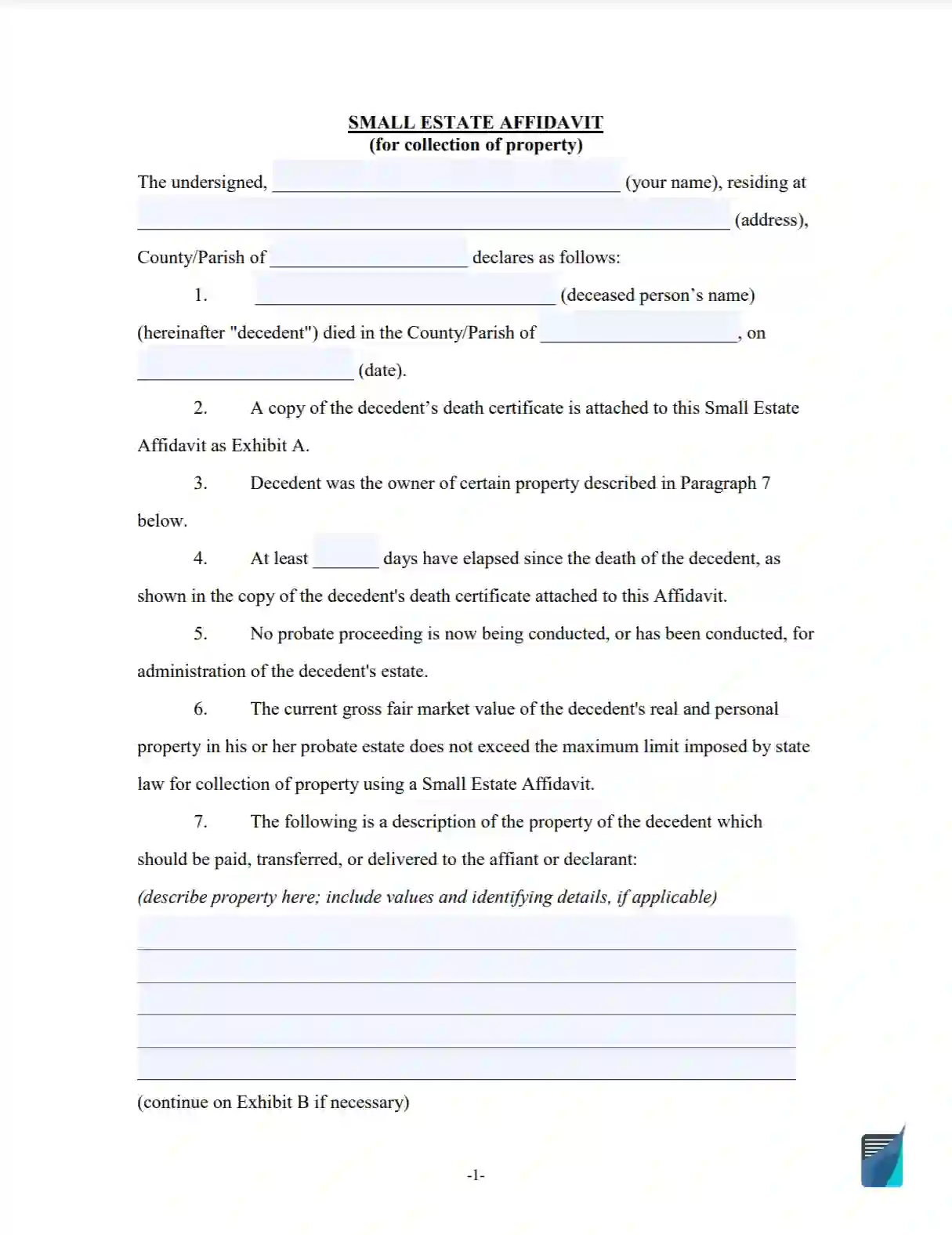

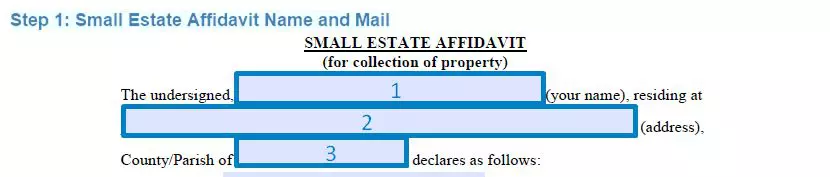

How to Fill Out a Small Estate Affidavit Form

Filling the small estate affidavit form itself is not much of a challenge. The real challenge is doing the research right. When you’ve done that, completing the form will be a fast process. Just make sure you get everything right.

Here is what you need to indicate.

- Your name and mailing address. Start with filling in your name, place of residence, and a valid mailing address in case these two differ.

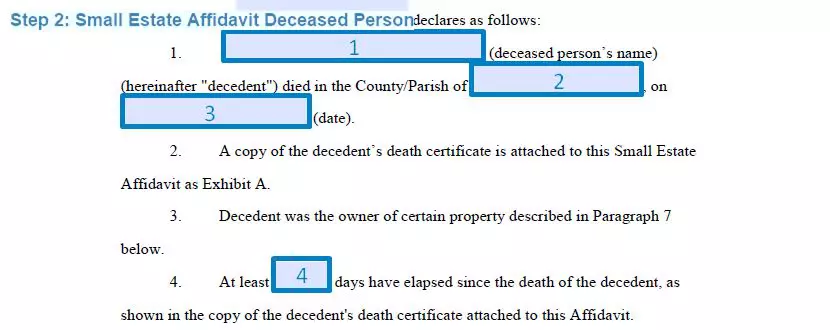

- Information about the deceased person. The next point on the list is filing the legal information about the deceased person. This includes their full name, the place of their last residence, and information from the death certificate.

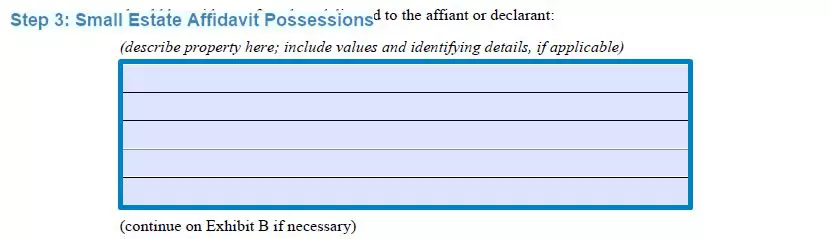

- List of possessions. The next item on the list is a bit tacky. You need to file all the possessions of the deceased person. This should include all financial deposits, personal property like vehicles and jewelry, as well as shares in communal property with their spouse or domestic partner. Apart from material possessions, you should list any business or shares in the business that the decedent co-owned with someone. If they owned copyright or any other intellectual property, it should be listed as well.

Make sure you include estate value assessments for all personal possessions.

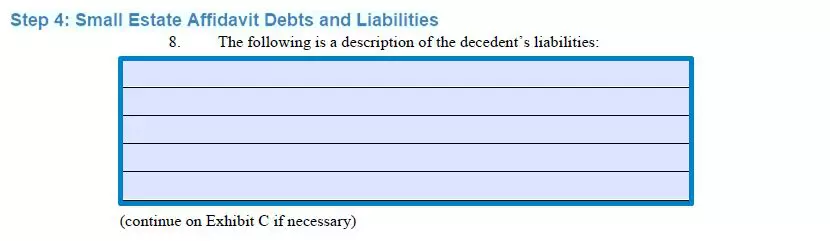

- List of debts and liabilities. To be eligible for the inheritance, you need to handle the debts of the deceased person first. This is why you should include the list of debts and liabilities and pay what the deceased person owes to the creditors. The executor of the estate should settle all debt claims before distributing the estate. The expenses are taken from the decedent’s net worth before family members receive the amount they’re owed. The same goes for funeral expenses.

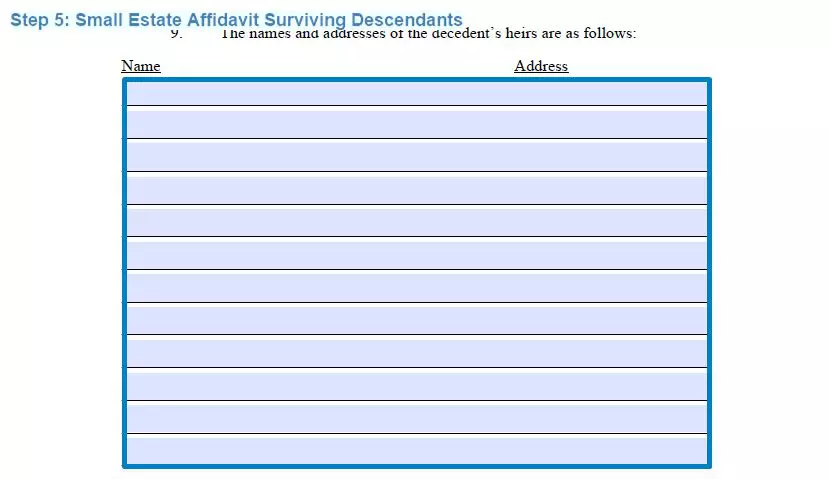

- List of surviving descendants. Next up is the list of all surviving heirs of the deceased person. Compile a list of all heirs and claimants with their names and addresses. While listing all beneficiaries of the estate is not hard, what can be challenging is listing the percentages they should get. This is regulated by state law and you should research this before stating the shares of the inheritance. Filing this out incorrectly may lead to rejection.

- Other legal information. SEA templates that you can download on FormsPal can serve as an example, and they provide all the necessary legal wording to make the document efficient. However, there may be some specific terms that local authorities might require you to add.

Consult with your lawyer to make sure that you include everything that your state laws require you to; otherwise, a generalized document may not work in your jurisdiction. However, we always provide a statutory form if such is required by the state’s code.

Frequently Asked Questions

How much would it cost me?

The only set cost for a small estate affidavit is the filing fee at the probate office. From then on, the range is very wide. You may pay a fee to the lawyers for assistance in writing the form or just download a PDF for free at FormsPal and print it out.

If you want to customize the document to suit your needs and local laws, use our small estate affidavit builder to create a highly personalized form. It will lead you through every step and help you create a form that meets all of your needs.

The price of notarizing the document will differ depending on your location. So will the price of trying to get the document in line with the statutes and the guidelines of the state you live in.

Researching the information on the company that the decedent owned or co-owned, their full range of investments, and net worth may be quite time-consuming at best and expensive at worst. If the affidavit is challenged in court, this may mean having to employ attorneys and go through the whole probate process.

That said, in the best scenario, you shouldn’t have to pay more than $200 for the whole ordeal. Note, however, that filing fees vary in different states.

Are there any alternatives?

There are a couple of alternatives to the distribution of the money and property of the deceased. If they had more than one house and they weren’t used as a homestead, you may need an affidavit of heirship. If not, the estate will be distributed by a court in accordance with the local statute. The court will appoint a representative who will pay the bills and cover all debt claims on the behalf of the decedent before distributing the property.

If you’re looking for the perfect alternative, it’s signing the last will and testament. This document paired with a self-proving affidavit will make sure that every possession and item is given to the right people. With the self-proving affidavit, surviving relatives will not have to go through the court procedure, either.