Free Power of Attorney Forms

Power of attorney is a legal document that describes the relationships between two parties, the principal and the agent, or, as it is commonly referred to, the attorney-in-fact. When signed, this document transfers the ability to represent the principal in decision making to the attorney-in-fact. The attorney-in-fact will be granted the power to act from the name of the principal in matters of handling financial affairs, decisions about healthcare, personal property, or other affairs. The exact capacity of the attorney-in-fact’s legal powers is defined in the document itself.

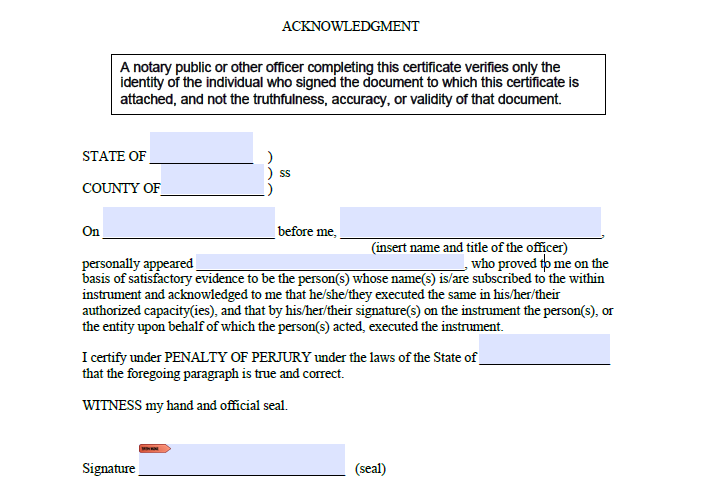

While under certain circumstances, the power of attorney can be given orally if witnessed, most POA forms need to be filled out and signed. Only a handful of states allow it to be signed while witnessed by two people. Most states require it to be signed in the presence of a notary public. You can draft a copy yourself or develop one with your notary public.

If you’re asking yourself, “Can I download the power of attorney form?” the answer is yes. There are countless options on this website and you can download a free template that you can rewrite to fit your needs.

State-specific Forms

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

As is the case with all legal documents, wording matters. This is why you should know the terminology before you start drafting a power of attorney form or working with a template.

The thing that many people confuse when it comes to POA forms is the distinction between attorney-in-fact and attorney-at-law. Attorney-at-law is a term that is sometimes used to refer to a solicitor or lawyer, a person who can represent you in court but doesn’t have the power to act in your name. An attorney-in-fact is a representative that can sign documents for you if you have signed and notarized a POA form.

Note that even though your agent technically has the word “attorney” in the name, the attorney-client privilege does not apply here. It only applies to communications with licensed lawyers. The 2005 Kokoros vs Kokoros et al. case also set a precedent that attorney-client privilege does not transfer from the agent to the principal. This means if your attorney-in-fact sought legal advice, their communications will be protected under attorney-client privilege, but your privacy is not under protection.

The next important distinction is between a general and a special attorney-in-fact. A general attorney-in-fact can represent you in all affairs while a special one can only with particular matters that the POA defines. You can also limit their power to a specific occasion or for a duration of a specific period.

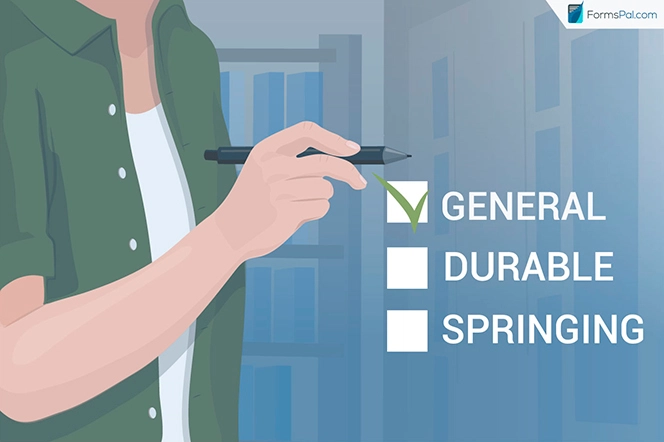

There are four basic forms of power of attorney documents: general, special, durable, and springing. You can infer the first two types based on the description above. A durable power of attorney document will stay in power if the principal becomes incapacitated. General and special forms will lose power upon such an event since the principal can no longer grant permission. A springing POA form will only come to power if the principal is incapacitated, making it a good choice for medical cases.

If you’re sure that you already know all you need to create and sign a power of attorney document, use free resources at FormsPal to make it easier for you. Follow the guide on creating your own PoA form that you will find below to make sure that you do not miss any important details. You can download a power of attorney sample form for any occasion on our website, print it, and use it completely free of charge.

If the power of attorney templates aren’t enough, customize the form using a PoA form builder. It will help you create any type of power of attorney form, fill it out, and print it, all completely free of charge.

Do you need more information and tips on how to create a legal power of attorney form? Read this extensive guide below.

When Do I Need to Create a PoA?

Understanding this legal device is the first step towards using it correctly. Power of attorney forms are extremely useful when it comes to elderly people who may become incapacitated. With a springing PoA form, they can transfer the right to act on their behalf should they be unable to make decisions for themselves.

However, it’s far from the only use for having an agent or attorney-in-fact. Business people who travel a lot or have businesses in different countries may find that having a special attorney-in-fact is rather useful. The beneficiary of PoA can conduct business on their behalf, sign any documents from home purchases to real estate planning activities, etc.

Other uses for this document are giving a relative that your child resides with the power to make decisions on their behalf or getting an agent to convey a real estate purchase when you cannot be present. The agent is legally obligated to act in the principal’s best interest.

In short, if individuals or companies cannot tend to some matters of importance themselves due to any reason, creating a PoA is one of the best strategies.

What Are the Power of Attorney Types?

The power of attorney is a legal document that allows the principal to appoint someone to act on their behalf. However, there is more than a single way that it can benefit you. To understand what type you need to create to handle your matters, start by learning about the four general types of PoA documents.

What are the four types of power of attorney? Learn that below.

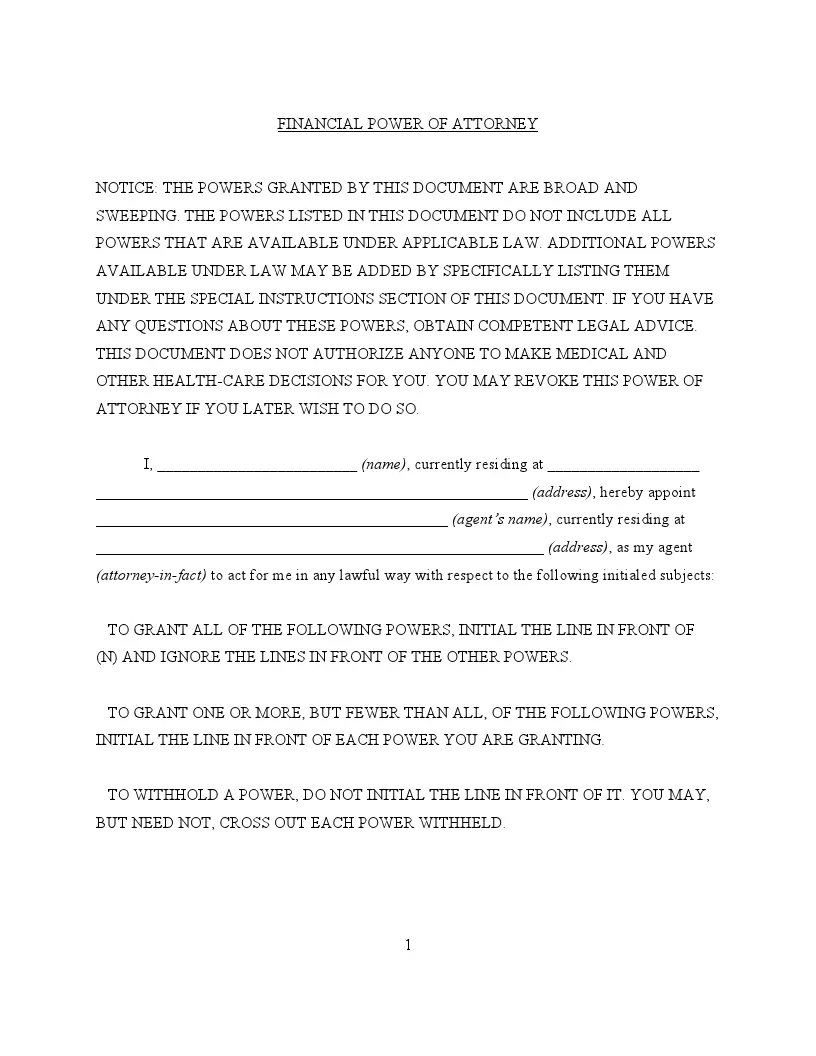

General Power of Attorney

The most general power of attorney form can grant the agent or attorney-in-fact rights to act on the behalf of the principal. The principal may be an individual or a business entity. The general authority covers all actions that may require a signature and can be a useful document if you want your agent to handle multiple affairs for you.

The most general power of attorney form can grant the agent or attorney-in-fact rights to act on the behalf of the principal. The principal may be an individual or a business entity. The general authority covers all actions that may require a signature and can be a useful document if you want your agent to handle multiple affairs for you.

For instance, the principal may need their agent to perform financial transactions in the event of their illness as well as manage their estate plan, business affairs, and make medical decisions. A document that combines the right to buy and sell stocks and bonds for retirement plans with medical powers may be too long. In this case, the basic power of attorney would be preferable to a limited one.

The attorney-in-fact can exercise the power given to them at all times and to any extent provided they act in the principal’s best interests. However, the document will cease to be viable should the principal become incapacitated. If that happens, the principal no longer has the ability to consent and the general power of attorney form will be legally void.

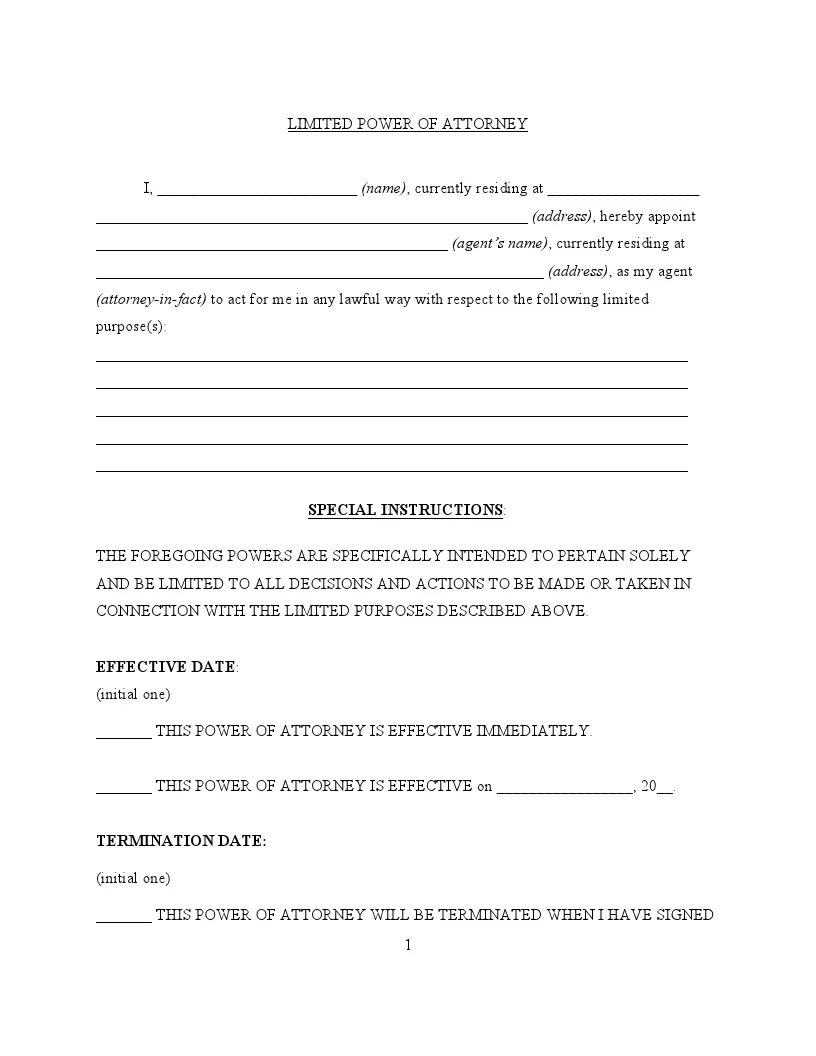

Limited (Special) Power of Attorney

A limited power of attorney form, sometimes referred to as special, grants agents only certain powers or limits the time frame that these powers can be used in.

A limited power of attorney form, sometimes referred to as special, grants agents only certain powers or limits the time frame that these powers can be used in.

For instance, with a special power of attorney, a firm’s attorney-in-fact receives the right to access the safe deposit box to withdraw money and sign property deeds, but it limits their ability to make any other financial decisions on the firm’s behalf. This PoA can also be written to cover just a single case or be viable during a time frame that you specify.

Special power of attorney stops functioning if the principal becomes incapacitated unless specified otherwise.

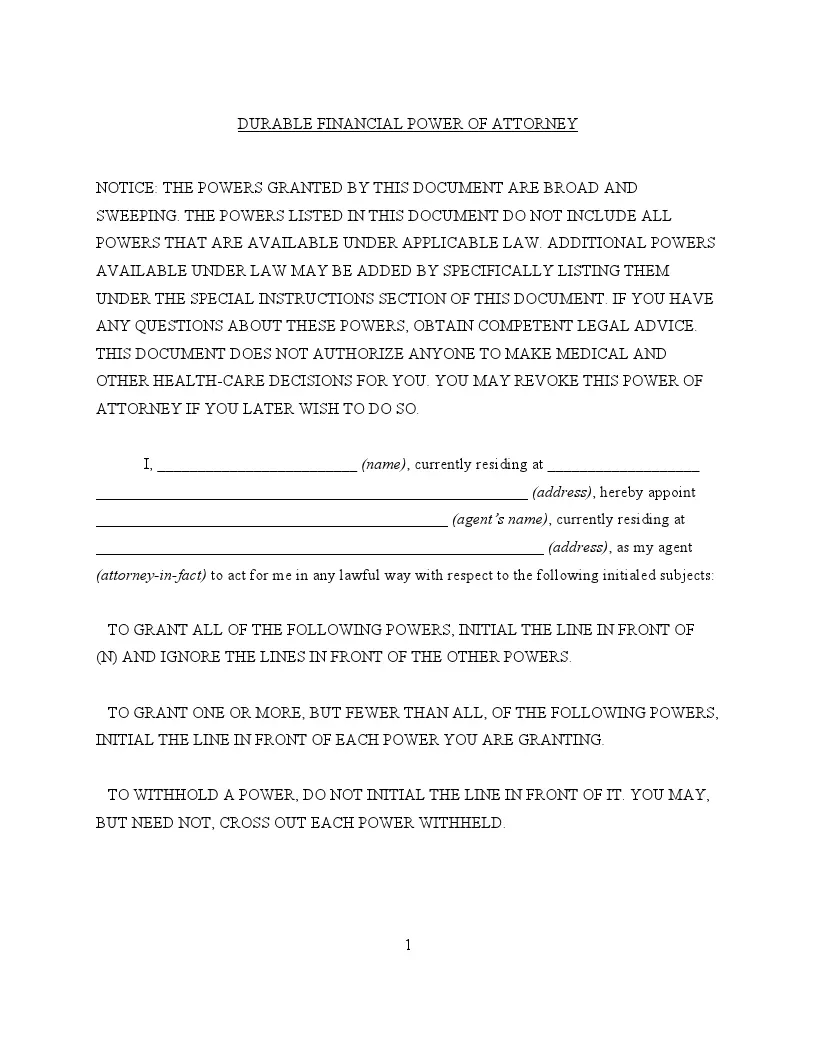

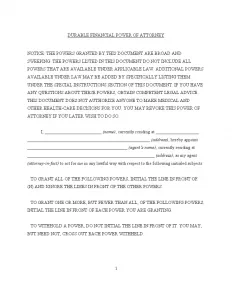

Durable Power of Attorney

Any of the above forms can be made durable. A durable power of attorney form will remain in power even if the principal becomes incapacitated either mentally or physically. This ensures that any matters that you require the attorney-in-fact to attend to will be taken care of regardless of your health condition.

Any of the above forms can be made durable. A durable power of attorney form will remain in power even if the principal becomes incapacitated either mentally or physically. This ensures that any matters that you require the attorney-in-fact to attend to will be taken care of regardless of your health condition.

Springing Power of Attorney

The springing power of attorney only comes into effect when the principal becomes incapacitated. This makes this document a good choice for handling medical matters in case the principal becomes severely ill, suffers a stroke, gains a disability, due to an accident, etc. However, this is just a legal instrument, and you’re not limited to creating medical springing power of attorney forms for the advance directive.

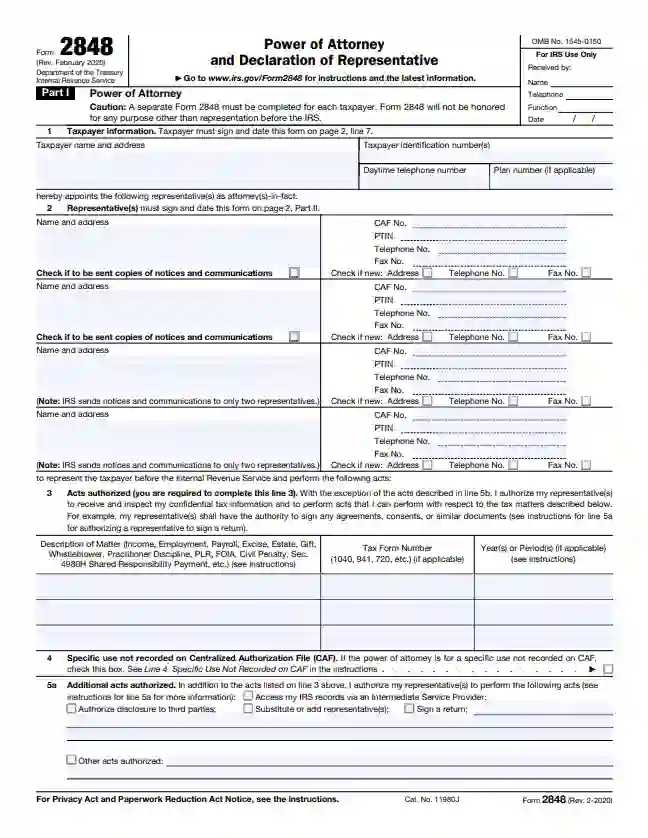

IRS 2848 Power of Attorney Form

IRS form 2848 is a document that allows your tax attorney or accountant to represent you before the IRS. This includes filing taxes and reviewing otherwise private tax information. Spouses that file taxes jointly need to submit two forms even if they’re being represented by one individual.

IRS form 2848 is a document that allows your tax attorney or accountant to represent you before the IRS. This includes filing taxes and reviewing otherwise private tax information. Spouses that file taxes jointly need to submit two forms even if they’re being represented by one individual.

Note that if the individual you want to represent you is your fiduciary, you may not need 2848 for some operations. However, even fiduciaries need limited power of attorney to check the principal’s bank accounts or bank statements, insurance policy, social security, or retirement plan. Also, there are separate POA forms for state tax matters, which in most cases are different from one another.

IRS 2848 only covers tax representation and does not grant the agent or agents the power to buy, sell, or lease possessions such as homes, vehicles, or anything finance-related.

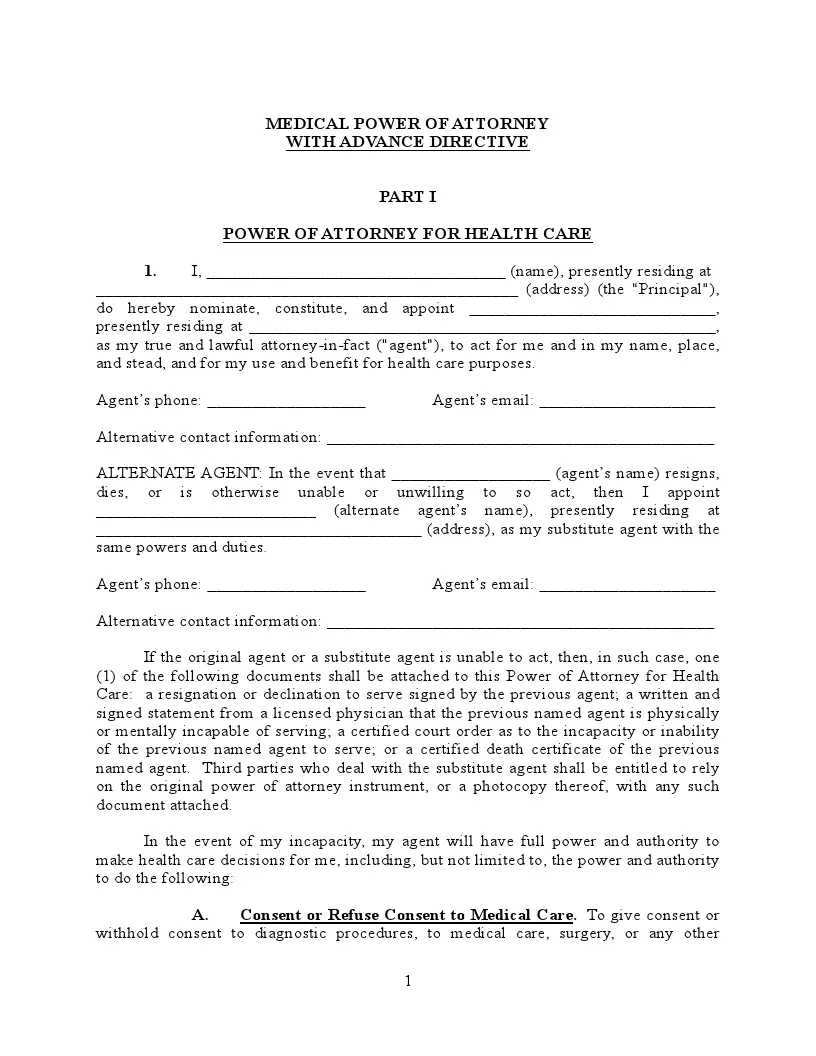

Medical Power of Attorney Form

A medical power of attorney form is by far one of the most common uses of PoA. This document grants the attorney-in-fact the power to make health care decisions for the principal if they’re incapacitated in any form including trauma that needs surgery, dementia, or mental illness. Since this document should have power after the grantor can no longer make decisions, it should be either springing or durable.

A medical power of attorney form is by far one of the most common uses of PoA. This document grants the attorney-in-fact the power to make health care decisions for the principal if they’re incapacitated in any form including trauma that needs surgery, dementia, or mental illness. Since this document should have power after the grantor can no longer make decisions, it should be either springing or durable.

Note that if the medical attorney-in-fact lacks financial power, this may restrain their ability to act in the principal’s best interest. For instance, they may not have access to finances to put the principal into treatment or retirement home. Hospitals can also be taxing concerning expenses, so make sure that your medical attorney either has access to banking or can ask for a spouse or another person to handle these expenses.

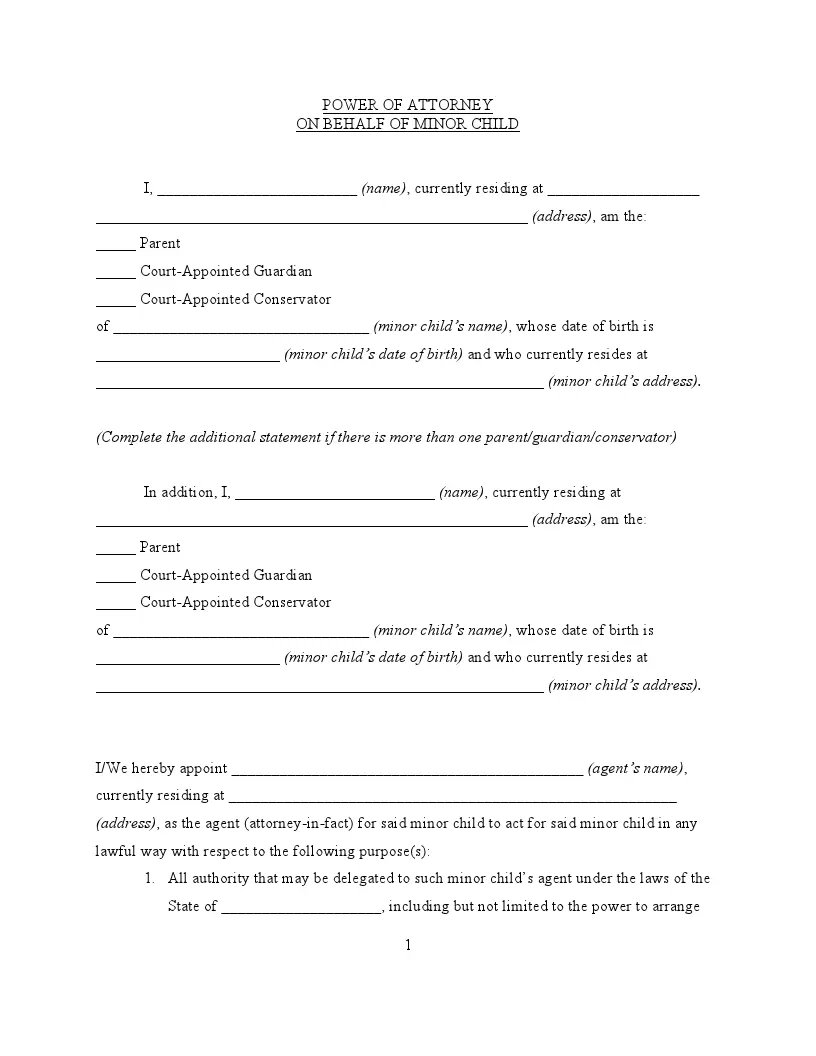

Minor (Child) Power of Attorney Form

A minor power of attorney form, or as it is sometimes referred to guardianship power of attorney, is a form that lets the legal guardian or a parent of a minor transfer the right to make decisions on behalf of their child to somebody else. This includes health care decisions and decisions on education. It is primarily used by businessmen or military servicemen who need to spend long amounts of time outside of the country and have no direct relatives or a spouse to take care of their child.

A minor power of attorney form, or as it is sometimes referred to guardianship power of attorney, is a form that lets the legal guardian or a parent of a minor transfer the right to make decisions on behalf of their child to somebody else. This includes health care decisions and decisions on education. It is primarily used by businessmen or military servicemen who need to spend long amounts of time outside of the country and have no direct relatives or a spouse to take care of their child.

Note that a single parent cannot sign the form unless they have sole custody. This form should be renewed every six months or a year depending on the law of the state that your minor resides in.

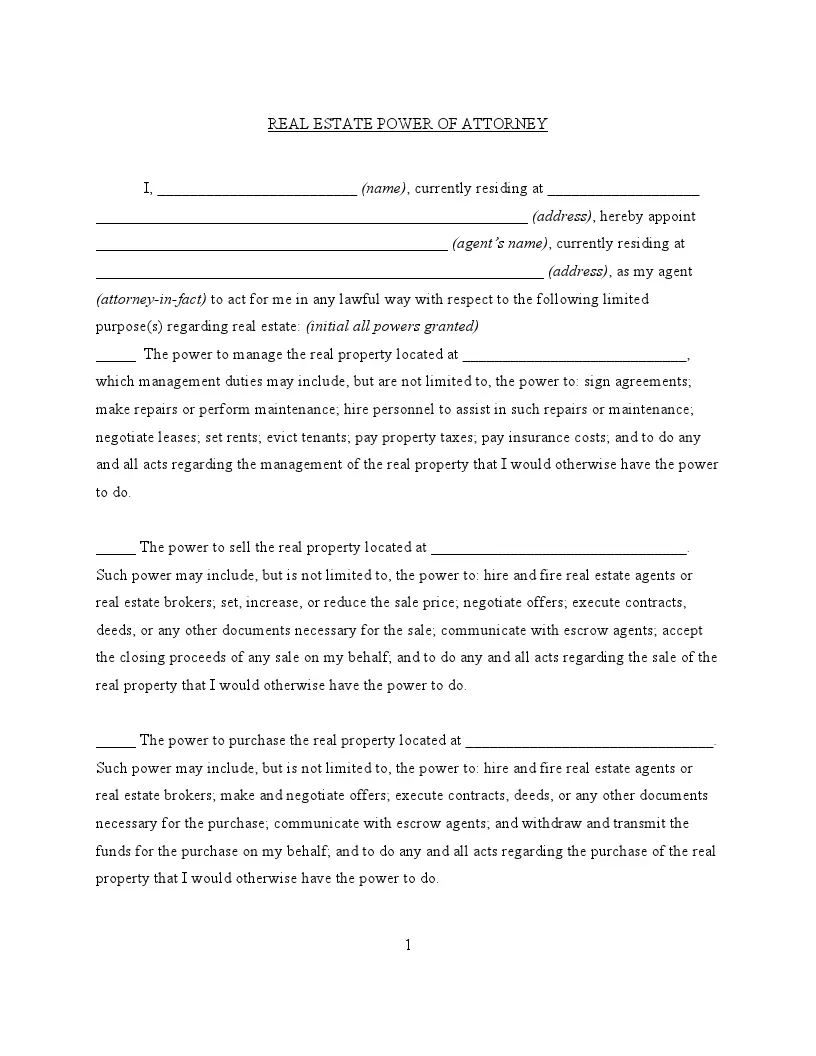

Real Estate Power of Attorney Form

A real estate power of attorney form grants the attorney-in-fact the right to manage the property for the grantor of said power. You can select which specific real estate operations you want your attorney-in-fact to manage for you and restrict the duration of their powers to a set time frame or for a single specific occasion.

A real estate power of attorney form grants the attorney-in-fact the right to manage the property for the grantor of said power. You can select which specific real estate operations you want your attorney-in-fact to manage for you and restrict the duration of their powers to a set time frame or for a single specific occasion.

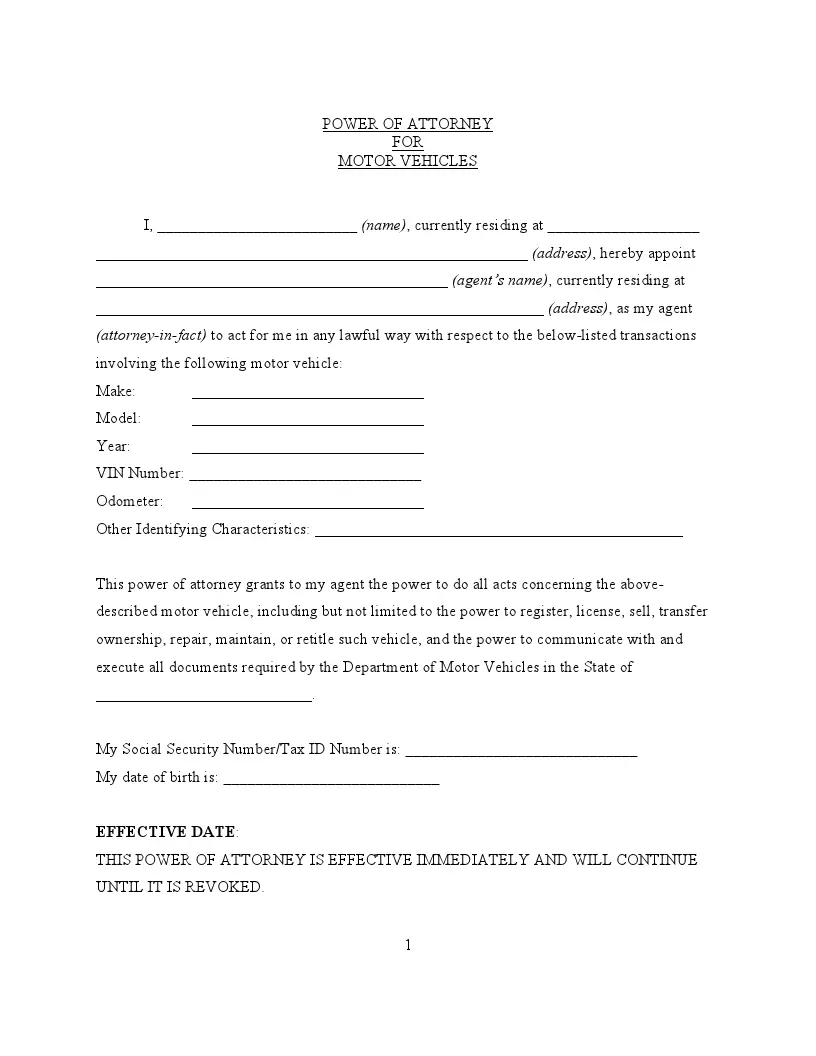

Motor Vehicle (DMV) Power of Attorney Form

The motor vehicle power of attorney form is needed when an individual or company wants to transfer the right to make financial decisions tied to their specific motor vehicle to someone else, known as the attorney-in-fact.

The motor vehicle power of attorney form is needed when an individual or company wants to transfer the right to make financial decisions tied to their specific motor vehicle to someone else, known as the attorney-in-fact.

When creating this document, you need to specify what operations you want the attorney-in-fact to perform, although you may indicate that they’re free to do any action. You also need to specify each vehicle you intend to make decisions on.

You may also need to give your attorney limited power over finances as that can be necessary for your purposes.

Note that you do not need this form to let someone drive your motor vehicle. You only need the authorization to drive a motor vehicle form.

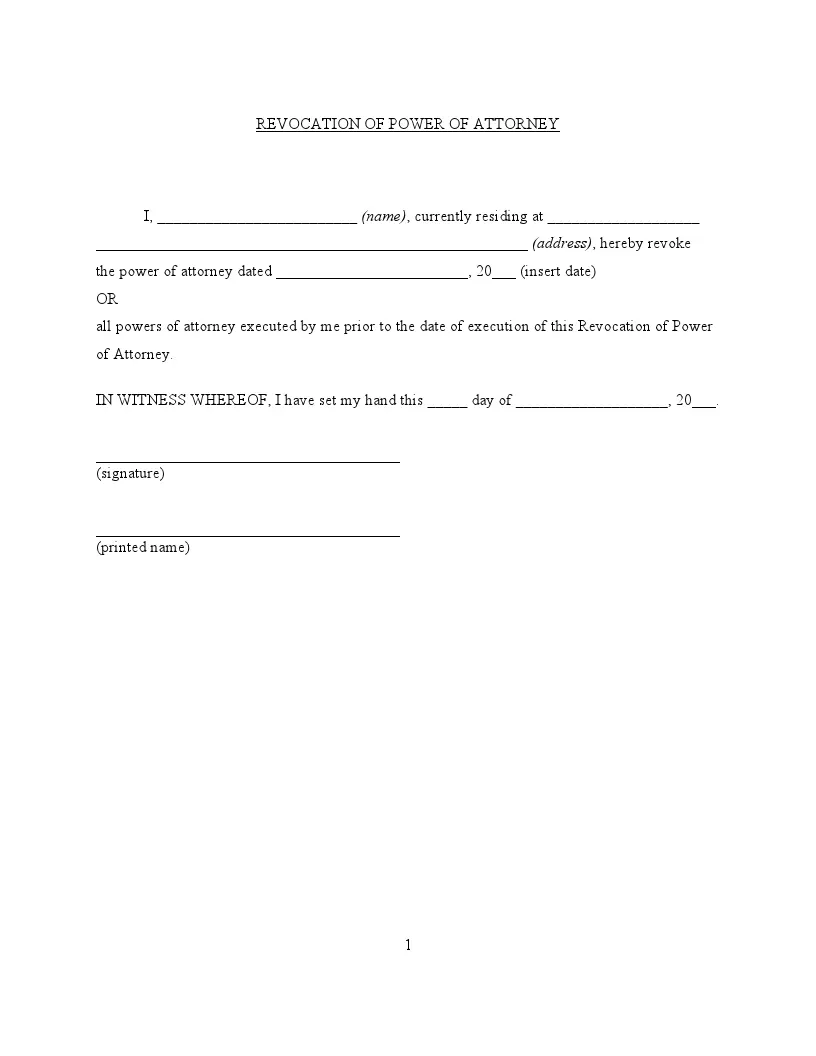

Revocation Power of Attorney Form

Whether the power of attorney is no longer needed or the agent you chose did not meet your expectations, you’ll need to create and sign the power of attorney revocation form. It strips the individual or individuals who now hold the power of attorney from said power at the time of signing.

Whether the power of attorney is no longer needed or the agent you chose did not meet your expectations, you’ll need to create and sign the power of attorney revocation form. It strips the individual or individuals who now hold the power of attorney from said power at the time of signing.

An important thing to note is that you’re required to send letters of revocation to the former attorney-in-fact and all of the institutions that may be in contact with them. If you’re not going to strip an individual of their attorney powers but want to limit them, you may not need the revocation form.

All the latest revisions of the PoA override the previous content. The changes are considered to be in effect upon signing and/or notarizing depending on your state. The original document loses power.

Disambiguations

Legal matters are not always clear-cut. After all, there’s a good reason that people study for years to become professional lawyers. For a simple citizen, some of the legal nuances may be hard to understand.

But it’s important to educate yourself about all possible confusion in this matter, especially since you’re about to give the power to make decisions about something as valuable as their property, vehicles, health, or children.

Power of Attorney vs. Durable Power of Attorney

This is by far the most crucial distinction on the list. In most states, a general power of attorney ends when the donor of a power of attorney becomes incapacitated. If you wish to sign a document that gives your attorney-in-fact the power to make decisions about your healthcare during a disease you’re fighting, you need to sign a durable PoA form. The same goes for business decisions and any other matters for principals who fear that they may become incapacitated due to a disease.

In some cases, a springing power of attorney is a better fit. It only grants the agent the power to make decisions in an individual’s name if that individual becomes incapacitated. Signing a general PoA may lead to the attorney-in-fact having to deal with the courts before they can make decisions.

Power of Attorney vs. Guardianship

Because one of the PoA forms is sometimes referred to as guardianship power of attorney, it’s easy to confuse the two. Guardianship PoA is a minor power of attorney that lets an individual who acts as the agent to make decisions on the behalf of the principal’s underaged child. A durable or springing PoA lets the individual who acts as an agent make decisions on the behalf of a principal who is incapacitated.

Guardianship is a result of a legal proceeding that decides which individual should become the legal guardian of an incapacitated individual. It’s often done when the individual who became incapacitated has no power of attorney in place.

Power of Attorney vs. Executor of Estate

Both power of attorney and executor of estate laws are used to handle the affairs of individuals who are approaching the end of their life for various reasons. The main difference between the two is that the individual who holds the power of attorney manages the principal’s medical and financial decisions while they’re still alive.

When the incapacitated individual dies, the power of attorney is considered legally void. From that point, the executor of the estate makes decisions on behalf of the deceased’s property and other affairs. That person should be named in the individual’s last will and testament.

Power of Attorney vs. Health Care Proxy

Typically, if an individual becomes incapacitated, the medical staff first reaches out to their spouse to ask them questions about how to handle that individual’s health. If the spouse cannot act as a decision-maker, they go to the individual’s first-degree relatives. If they’re not available for any reason, the health care proxy is one of the few legal documents that make it clear who is responsible for that decision.

To arrange this, you need to create and sign a medical PoA. A common problem in this matter is when your medical attorney-in-fact disagrees with the person in charge of financial decisions. This can lead to legal disputes, and it’s not the best-case scenario to wait for the court to rule when you’re on life support. If you suspect that this may be the case, you may need to extend the medical agent’s rights.

Durable Power of Attorney vs. Living Will

A living will, or an advanced health care directive, is a legally-binding document that details how the individual wishes to be taken care of in case they become incapacitated. While in some cases, it may come into force right after signing, healthcare professionals will always rely on communication first. If the individual is unable to communicate their wishes, only then will the medics rely on the living will. You can read more about the difference here – Living Will vs POA.

A durable medical power of attorney grants the attorney-in-fact the power to make medical decisions for the principal. The document stays in effect after the individual becomes incapacitated. Oftentimes, the principal may choose to add a living will to the durable PoA to make sure that their agent acts according to their directives.

Power of Attorney vs. Conservatorship

When an individual signs a durable or springing power of attorney form, they give all of the rights and powers that they want to their trustee of choice. Conservatorship is granted by a court when there is no PoA in place that would make the choice of your legal agent obvious. Before the court rules, the person seeking acceptance of conservatorship should provide proof that they’re the best for the job.

Besides the apparent delay between the principal’s becoming incapacitated and the ability to make decisions on their behalf, the conservator also enjoys some financial rights. This may not be what the principal would ideally desire, so it’s always best to sign a PoA in advance. Besides that, finding a sample power of attorney template is not that hard.

Power of Attorney vs. Spouse Rights

It’s a well-known fact that when an individual becomes incapacitated, the medical staff contacts their spouse first. They often act as the decision-maker when the individual cannot decide due to being in a coma or in a vegetative state. What isn’t a well-known fact is that PoA doesn’t automatically come into effect after marriage and any PoA signed by a principal overrides spouse rights.

This means if an individual has a spouse and a medical attorney-in-fact, the medical staff will have to contact the latter to make life or death decisions. This may become a problem if the two disagree since if the power of attorney only covers medical but not financial decisions, the spouse and agent may be at odds. If you suspect this may happen, address this issue in advance so that there are no questions left in the dire situation or ask your notary public to provide legal advice.

Power of Attorney vs. Personal Representative

A personal representative is a legal position akin to the executor of the estate. A personal representative is either listed in an individual’s last will and testament or is appointed by the court if there is no will. They have the power to rule over the deceased’s property, business dealings, or personal affairs.

When the individual is not dead but incapacitated in any regard, it’s the attorney-in-fact who makes financial decisions and handles their business matters instead of them. They only act in accordance with the power of attorney document that both parties agreed on. The principal may restrict or widen the powers of their attorney-in-fact as much as they wish or even add specific instructions.

Power of Attorney vs. Trustee

Even though it’s easy to mistake the term trustee for a person that you trust, it’s a legal term. This term refers to the person who manages trust funds and has full control over the financial decisions of that trust. However, they do not have power over an individual’s personal financial assets, real estate property, vehicles, etc.

An attorney-in-fact can act on the principal’s behalf when they’re incapacitated in some form. Agent authority can be related to financial decisions, real estate planning documents, motor vehicles, health care power, or anything else. They cannot control the trust funds unless it’s specified otherwise.

How to Create a Power of Attorney (General Guide)

Creating a power of attorney document is simple enough if you follow all the right steps and put in the appropriate language. Here’s a quick guide on how to do that.

Choose the powers

Start with choosing the specific powers that you want your attorney-in-fact to execute on your behalf. If you’re issuing the power of attorney to tend to a specific and limited matter, make sure to include all of the powers you want to give them. This may include the power to manage your business matters, make financial decisions, make decisions on motor vehicles, real estate or other property, sign health care forms, etc.

If you’re giving your attorney-in-fact general power of attorney, simply state that you want them to act on your behalf and in your stead. This is typically pre-written on most sample power of attorney forms.

The most important recommendation is not to keep anything off the record. Be clear with the explanation of the agent’s obligations and powers. Otherwise, you may leave a loophole to abuse the role or prevent proper PoA execution.

Choose the type of the document

The next step is choosing whether you want the document to be general, durable, or springing. This is a crucial distinction since a general power of attorney is considered legally void once the principal is incapacitated. If you want no legal questions to arise in case of your health condition, the document should be either durable or springing.

The durable power of attorney stays in power even when the principal is unable to give consent. Springing power of attorney only comes into power when the principal can no longer make decisions on their own.

Choose the attorney-in-fact

Wording aside, choosing the right person to represent you is one of the hardest things to do when creating a power of attorney. Since the individual’s attorney-in-fact can make legal decisions on their behalf, choosing one that will not abuse them is critical.

Many people choose their spouses or relatives to be their attorney-in-fact. If that’s not an option for you, make sure that the person you pick is reliable. There are a lot of considerations when choosing the right person for PoA nomination, but the best option is to make sure that the agent is going to act in your best interest. This obligation is implied in the document, but it’s always best to choose a reliable person.

The negative connotations of choosing the wrong attorney may range from as little as them forgetting to pay your bills to as much as them taking out loans in your name and leaving with them. You should also consider potential conflicts that can arise. For instance, your medical and financial attorney-in-fact are different individuals, and they may disagree, which can prolong the decision-making process.

Choose the free template

There is no point in writing the document yourself fully. This can only cause confusion or be potentially dangerous for the legality of the power of attorney. If you make a mistake in wording, it may not be considered a legal document.

If you can’t have your notary public create a form for you, it’s best to download a free fillable template for your exact purpose. Thankfully, there are dozens of blank power of attorney forms on FormsPal. You can choose the one that fits your needs and download it free of charge.

You can also use the power of attorney example forms and build your own form using the form builder.

Power of Attorney Form Details

| Document Name | Power of Attorney Form |

| Other Names | POA Form, Simple Power of Attorney |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 39 |

| Available Formats | Adobe PDF; Microsoft Word |

Fill out the document

Now that you have the right form, all you have to do is to fill it out either in writing or by typing in the correct fields. Make sure to check and double-check any bit of information you put on there.

Sign and notarize the document

Once the step above is done and you’re sure you’ve filled in every field correctly, sign the document. In most states, you must have two witnesses sign the document for it to come into power. In Utah, you only need one witness. Note that witnesses have to be unrelated to the principal, so it’s best to have your friends witness power of attorney.

In some states, having two witnesses is not enough. You need a notary public to sign the document as well, otherwise, it’s legally void. In the states of Florida, Iowa, Kansas, North Carolina, and Kentucky, you will need a notary public and two witnesses to sign your power of attorney document.

In many other states, there’s an option to have it signed either with two witnesses or a notary public. However, if you may need the power of attorney to work cross-state in one of the states above, you do need a notary public.

How to Write a Power of Attorney (Filling Guide)

Now that you have a general idea of how you should approach creating a power of attorney, let’s look at how you should go about filling it out. It’s a fairly easy process once you have all of the knowledge needed.

Research state law requirements

The very first thing you should do before filling in the blank is to do ample research on the laws of your state and the location that you intend the power of attorney to work in. This can prevent minor mistakes that may cost you a lot later on when a document becomes void in another jurisdiction.

For instance, some states require a notary public to sign the power of attorney. Others require either a notary public or two witnesses like the state of Tennessee. Some require both. Knowing this beforehand can save you time in a dire situation. If you’re at a loss, ask your notary public to provide legal advice.

Note that if you’re using a blank power of attorney form, you do not need to worry about the wording itself. All the legal language like mentioning the fact that the principal is in sound mind will be included in the blanks.

Fill in principal’s legal information

When you’re sure that your power of attorney complies with the state laws, take the sample PoA form on FormsPal and start filling in the principal’s legal information.

It usually goes on the very first sentence of the power of attorney. There should be one or several underlined blanks. Put your full name and a valid billing address with the zip code there. You do not need proof of residence to sign the form, just make sure that it’s the correct address and you can be reached. The principal’s phone number is not required but isn’t prohibited, either.

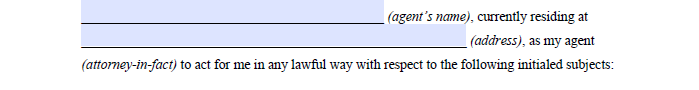

Fill in attorney-in-fact legal information

Once that is filled in, go on and list your agent or attorney-in-fact’s name and mailing address. Most sample power of attorney forms have spaces where that information should go underlined and marked appropriately.

Besides that, the wording makes it rather obvious. A typical power of attorney document would read “I hereby appoint John Doe as my one true attorney-in-fact.” Fill in the attorney’s name and billing address and carry on. You may not be required to provide the agent’s telephone number, but it may be a good addition.

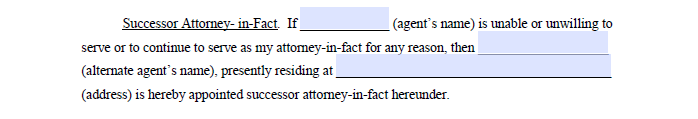

Fill in the successor agent’s legal information (optional)

In some cases, you may want to list a second attorney-in-fact in case your first choice cannot serve. If that’s your situation, add that to the power of attorney document you’re creating and list the co-agent’s full name and mailing address.

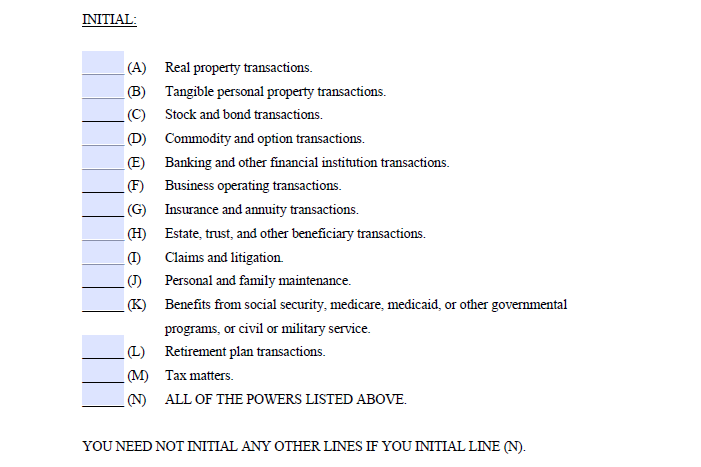

Describe the powers

You may be signing a general power of attorney document that allows the attorney-in-fact to perform any activities instead of the principal. In this case, the line will simply read, “to act in my name, place, and stead.”

However, in many cases, individuals who sign a power of attorney do not wish to give their agent unlimited powers. If that’s your case, you’ll need to select specific powers that you want to grant your attorney-in-fact.

To make it easier, download a sample power of attorney form for your specific cause. For instance, if you need your attorney-in-fact to handle a real estate operation for you, download a sample real estate power of attorney template. It will feature all of the powers you need to grant the agent.

Make sure to double-check in case it misses a specific power you need to give them, though.

If you feel the need to direct the attorney-in-fact even more closely, leave provisions on how to act in certain conditions and create assignments for them.

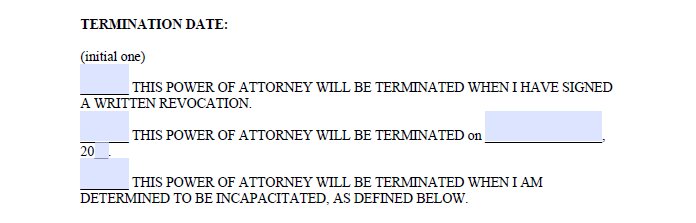

Specify the termination date

Many people want the power of attorney to have an expiration date or only apply to a single occasion. You may want your attorney-in-fact to only carry one business deal for you or handle your financial decisions for six months while you’re away.

Whatever is the case, you need to specify the duration of their powers. Add a clause that specifies that the power of attorney is to expire at said date and provide the date of your choice.

Alternatively, the principal may opt to make the power of attorney durable to make sure that even if they become incapacitated, the agent can carry on with their task. If your goal is medical decisions, you may go for a springing power of attorney. This type of document only comes into power when the principal is incapacitated.

Specify compensation of the attorney-in-fact

Some individuals pick their spouses or close friends to be their attorney-in-fact. In this case, the agent will probably perform their duties voluntarily and not require compensation.

However, other cases of power of attorney may include a paid third-party agent. In this case, you need to disclose the compensation in the document just like in the work contract.

There are no restrictions on what type of compensation you may put in the document. This can be a monthly or weekly fee for the duration of the power of attorney, a single payment when an agent finishes the matter, a commission, a gift, or any other compensation.

The only thing that’s required is that the attorney-in-fact and the principal agree on the power of attorney arrangement.

Fill in legal information about the witnesses or notary public

One of the final steps is to fill in the information of the people who witness the signing. This can be either two witnesses or a notary public. In some states, you need both witnesses and a notary public.

Check your state’s laws to know exactly who you need to witness the signing for the document to be considered legal. Some states like California only need two witnesses to co-sign the form. Others will require a notary public. When you’re sure about who you need as a witness, fill in their names and mailing addresses in the document.

Sign the power of attorney form

Now the document is ready. Print it out if you were filling in the information by typing and let all of the parties sign it. It’s crucial that everybody is present when you’re signing the power of attorney for it to be considered legal.

Use a free power of attorney form builder

Now, after all of these procedures, your power of attorney is ready and is in power at the moment of signing. However, many people who are not well-versed in law may not have a blank to fill in and find themselves asking, “Where do I get the power of attorney forms?” For general documents, you can download any free template from our site.

If you need to customize the power of attorney template, you can always use the free power of attorney builder provided by FormsPal. It can help you put together any document that you want. You can add specific restrictions about time or attorney-in-fact responsibilities without worrying about the proper wording.

How to Sign a Power of Attorney

Signing a power of attorney form is not a hard task. All you have to do is put your signature at the bottom of the document and you’re done. However, if you’re asking yourself, “Can I do a power of attorney myself?” the answer is no.

As you already know, you require either two witnesses or notary public to sign the document with you. This can differ in some states since some only require witnesses, some require either a witness or notary public, and some require both. Do your research and pick the right number of people to sign the power of attorney form with you.

Keep in mind that there are specific requirements about witnesses as well. For instance, some states require a medical professional to witness the signing of a medical power of attorney form. Note that the main requirement is that witnesses should be of legal age in all of the United States.

It’s best to keep copies of the form after signing for the odd chance of a court case. These records may be crucial for winning a court ruling. The attorney-in-fact is legally obligated to act in the best interests of the principal. If a close relative, spouse, close friend, or someone else believes that they do not fulfill their promise, they may try to override the power of attorney. That said, this can only be done by litigation. The challenger should prove that the attorney-in-fact is misusing their power and then the court will decide the status of the power of attorney. Since these proceedings may take months before hearing, the principal should only choose someone who will act in their best interest as an agent. Power of attorney only works when the principal is alive, even if they’re incapacitated. Although, you should keep in mind that the form should be either durable or springing to be applicable during the principal’s incapacitation. When the principal dies, the power of attorney ceases to function. From that point, it’s the executor of the estate who makes financial decisions about the principal’s property. An individual who is not the principal can only challenge the power of attorney in court, but waiting for the court order may not be the best answer to an emergency. It’s best to handle PoA revocation while the principal can make decisions. A principal can cancel the power of attorney by signing a power of attorney revocation form. That has to be done in front of witnesses or notary public, depending on your state’s laws. Send a revocation letter to the former agent by mail and the power of attorney is considered legally void. You do not need to wait for a response, though. A new version of the power of attorney overrides the previous ones when signed and notarized. Your new appointment will now take on the responsibility of being the agent and any previous appointments will have no agent authority. Be sure to send copies of revocation letters or new PoA to any institutions or government organizations that the previously appointed person dealt with. Accidents happen, and there’s a chance that an institution may still work with the previous agent unless notified. There are some limitations that the principal can enforce on their attorney-in-fact. The principal may give their agent as much or as little power as they want and declare that in the power of attorney document. That said, there are some legal restrictions as well. The beneficiaries of power of attorney cannot conduct activities after the principal’s death. It’s the executor of the estate who deals with their property after this. The attorney-in-fact also cannot sign the last will and testament instead of the principal, nor can they transfer the power to another individual. A limitation that is trickier to handle is that the agent is legally obliged to act in the principal’s best interests. This may be quite nuanced in some cases and may lead to litigation in court if abused. Power of attorney can last as long or as little as the principal desires, right up until they die. Just set the expiration date on the document you create and the power of attorney will be legally void from that point onward. If you need the power of attorney to function after the principal becomes incapacitated, however, you do need to sign a durable power of attorney form. A springing power of attorney is also a good choice when you need the PoA to come into power only after the principal is incapacitated. Printing cost aside, a power of attorney document can cost you anywhere from nothing to a couple of hundred dollars depending on your state and city. If you only need two witnesses to sign the document, it’s virtually free. If your state requires a notary public or you want to use their services regardless, the fee may be up to $200 per document. You should also add the compensation to the attorney-in-fact to the overall cost. Only the principal who issued the power of attorney can change their attorney-in-fact. They can revoke PoA or sign another PoA, informing their former agent their services are no longer needed. A third party like a loved one or a family member can only challenge the validity of the legal power of attorney in court. While a prison sentence does reduce an individual’s rights quite significantly, it doesn’t strip them of all of their rights. Issuing a power of attorney to their confidant is one of those rights. An inmate can file a power of attorney document from jail without any legal problems. They will, however, need help from their friends, relatives, and possibly a notary public to make that happen. Giving somebody the right to act on your behalf and in your stead always carries a risk, no matter how small. If the person the principal chooses to be their attorney-in-fact cannot be trusted to act in their best interest, it can end badly. The general rule is to only choose an individual who can be fully trusted to make the best decisions for the principal. Otherwise, the principal may suffer financially or even physically in the case of the medical power of attorney. This depends on the laws of the state you live in. Some states like Florida, Iowa, Kansas, North Carolina, and Kentucky require a notary public and two witnesses to sign the document. Plenty of others either need only two witnesses or can give the principal a choice between using witnesses or notarizing the document. Keep in mind that if you intend the PoA to be legal in the states listed above, you may have to notarize it to be on the safe side.

Frequently Asked Questions

Who can override power of attorney?

What happens after the principal's death?

How can I cancel a power of attorney?

What are the limitations of a PoA?

How long does a power of attorney last?

How much will I have to pay for a PoA?

Can I transfer a PoA to a different person?

Can someone in jail appoint a power of attorney?

What are the risks of giving someone a PoA?

Do I have to notarize a power of attorney?