Limited Power of Attorney Form

There are many different kinds of power of attorney and almost any of them can be a limited power of attorney (LPOA). These documents allow you (the Principal) to designate someone as your agent or attorney in fact as well as selecting what kinds of power of attorney form you’d like to grant.

You can also restrict these powers of attorney in other ways, which makes the limited (special) power of attorney a slightly more flexible document.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

What is a Limited Power of Attorney?

A limited power of attorney is used to create a more constrained POA, either in the scope of powers that you grant to your agent, by time frame, or circumstance. It is also called “special” or “specific” power of attorney.

When you appoint an agent under this document, you give that agent the authority to act on your behalf in more limited ways than a general POA. These special forms are non-durable by default, meaning that they are no longer valid if you become incapacitated. But there are a few circumstances where you can make a limited power of attorney durable, especially if you’re creating a medical limited power of attorney document.

Many limited power of attorney forms are created to give an agent power for a specific period or a specific purpose.

For instance, if you are traveling out of the country but need someone to manage your financial concerns in the meantime, you may create a limited POA to let them conduct business for you while you’re gone. When you return, you can revoke powers by signing the appropriate part of the form.

Alternatively, you can also use LPOA forms to give someone power of attorney for a predetermined length of time that automatically ends on the date you choose.

A limited power of attorney can also be used to create a springing power of attorney that only kicks in under specific circumstances.

These special documents can be used to give all or only some of the powers that any other POA can grant. That includes:

- The right to buy and sell your property

- The right to make medical decisions

- The right to complete a business transaction

- Handle medical care in case of incapacitation (durable power of attorney only)

- The right to manage your real estate

That’s only a small sample of the powers you can grant your agent. Your agent is also required to execute any other documents you have created as a principal. If you grant your agent limited powers to make medical decisions, they will also have to listen to any advanced directives you’ve also created along with your living will.

When to Use a Limited Power of Attorney

Limited power of attorney forms are a good idea anytime a general power of attorney is too broad or when you want to limit the authority of your agent. These forms are especially useful for creating a power of attorney for a limited time.

Since you add the powers you’re granting into a limited power of attorney form, they are also a good idea if you are concerned that another form might be misinterpreted and grant powers you didn’t intend to grant.

Here are a few common situations where it might be useful to appoint an agent with limited powers:

- You are leaving the country but need someone to handle a business transaction for you.

- You need a medical procedure and would like someone to manage your affairs while you recover.

- You need an agent with a standard power of attorney but only for a limited time.

- You need an agent with limited power(s) but do not want to create a medical or financial attorney with greater general powers.

- You need someone to manage your investments and other finances.

- You are in the military and have to go abroad but you need someone to take care of your financial affairs in the US.

- You own property in another state and want to sell it without going there yourself.

- You want someone to handle your business matters while you’re on a vacation.

Remember that you need the durable POA form if you want it to be valid when you are incapacitated due to illness or injury. It’s also your responsibility to keep the document up to date if your personal information changes or if you want to change the scope of the rights and responsibilities you’re granting.

You do not need to authorize your spouse with an LPOA since your marriage already gives the authority to act on your behalf unless you specifically state otherwise in a prenup or other marriage documents.

You should also know that creating another power of attorney does not invalidate the first one. You can have several of these documents active at any time. Each LPOA can grant different authorities so long as they don’t contradict one another. That means that you can have several different people empowered to act on your behalf.

Limited Power of Attorney Form Details

| Document Name | Limited Power of Attorney Form |

| Other Names | Special Power of Attorney, Temporary Power of Attorney |

| Subtypes | Vehicle POA; Real Estate POA; Tax POA |

| When to Use? | To manage finances, business transactions, investments, or other affairs for a limited period. |

| Avg. Time to Fill Out | 9 minutes |

| # of Fillable Fields | 34 |

| Available Formats | Adobe PDF; Microsoft Word |

Steps to Getting a Limited POA

Getting a limited power of attorney is usually a simple process. If you already have a lawyer, you can consult with them and they will create a limited POA suited to your purpose(s). Otherwise, you can use the limited power of attorney form we provide and customize it yourself with our document builder.

Here’s what you need to do:

Step 1: Select Your Agent

Think about who would be a good person to trust with the powers and responsibilities you’ll be giving them.

Ideally, this should be someone you’re close to. If you’re giving them access to a large amount of your property or a high-value transaction, it’s a good idea to choose someone who also has a financial interest. They are typically someone named in your estate who wants your finances to stay healthy.

Step 2: Choose the Powers You’re Granting

The next step is to choose the types of powers you want to grant. These are often one-time or limited duration powers, and you can customize the powers as exactly as you’d like.

You should keep the power in mind while selecting an agent as well to make sure the person is a good match for your purposes.

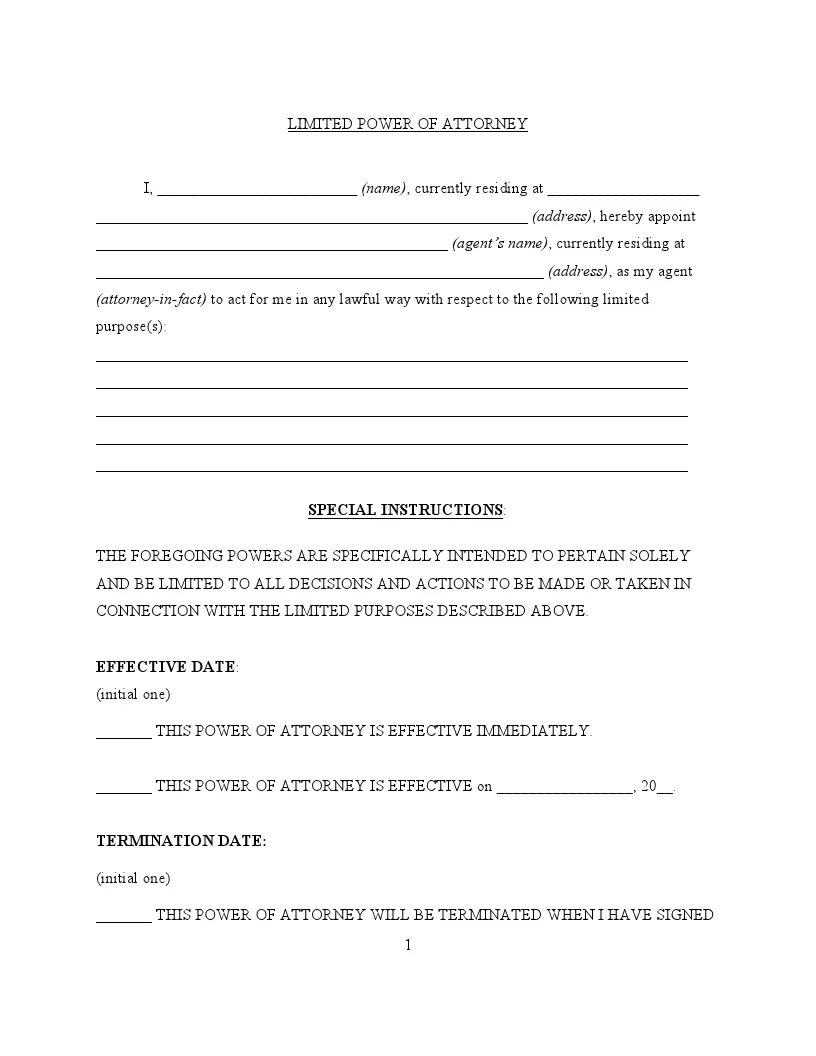

Step 3: Fill Out the Limited Power of Attorney Form

Once you have the powers and your attorney in fact selected, you need to fill out the LPOA form. Make sure you’ve filled it out completely without missing any initials or allowing any power you don’t want to grant.

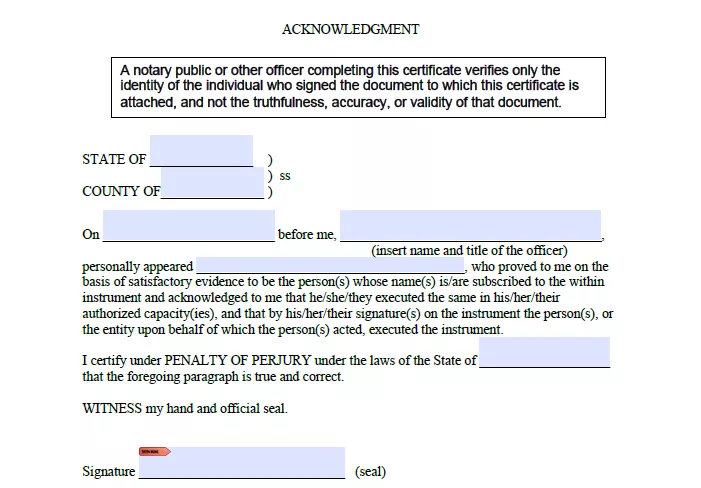

Step 4: Get Your LPOA Notarized

The last step is to get your special power of attorney form notarized in front of witnesses. You’ll also need to make sure that all signature lines are signed at this time.

Your state may not require your form to be notarized, especially if you aren’t granting financial rights. However, it’s still a good idea to get the form notarized because it’s less likely to face a legal challenge if you do.

Step 5: Keep the Form Available

Everyone involved should have at least two copies of your LPOA available. That way, you can be confident that your agent can always prove that they have the right to sign a contract on your behalf along with any other rights you give them.

Your state may also require that you file the document with them depending on what powers you’re granting.

Video Guide: Limited Power of Attorney

How to Fill Out a Limited Power of Attorney

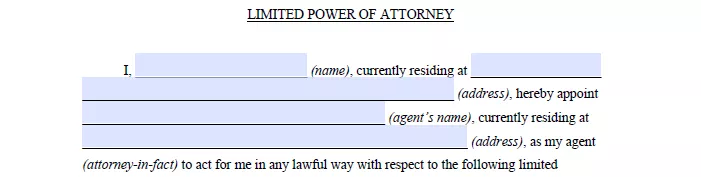

Step 1: Fill Out Personal Information

You will need to fill out your personal information as the principal (your name and address) as well as your agent’s personal information. The names and addresses are required, but you can also provide other contact information for more assurance.

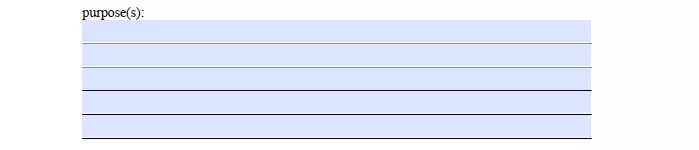

Step 2: Choose Agent Powers and Authority

Since these documents can be used for a wide variety of situations, you will need to choose what rights you want to grant to your agent, including when and how they have the authority to act on your behalf. This can be as many rights as you choose.

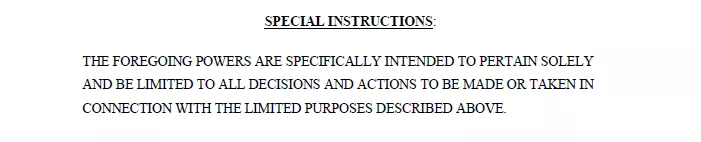

Step 3: Fill Out Special Instructions

This section will allow you to create an indemnification clause or any other provisions for the rights included in the document. You can also choose when the document becomes active and when it will be revoked.

You can leave the revocation blank, and your agent will have the rights you specify until you say otherwise. Or you can set a specific duration for the document and it will automatically become ineffective at the end of that period.

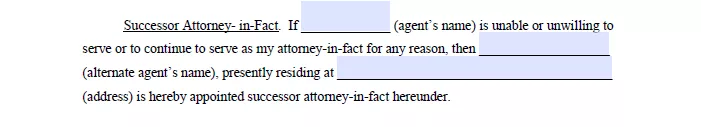

Step 4: Choose a Replacement Attorney-in-fact (optional)

Choosing a replacement attorney-in-fact, or a backup agent, gives you a little added protection. Having backup agents helps to make sure there is another person available when you need them to act in case you become incapacitated or your first agent cannot be reached in time or is unavailable.

Step 5: See a Notary Public

Once you have the details of your limited power of attorney ready, it’s a good idea to get it notarized in front of witnesses. Your state may also require this step, depending on what responsibilities are included in your LPOA.

After the form is notarized, you will need to keep a copy yourself, give one to your agent, give one to your lawyer, and file one with your state if required.

You may also want to leave another copy with a trusted friend or family member as a backup.

How to End a Limited Power of Attorney

There are several ways that you can end a limited power of attorney. The document will include a termination date field, and you can fill that out if you can determine when the LPOA should expire. Otherwise, you can fill out a POA revocation form whenever you’re ready to withdraw the power of attorney.