Real Estate Purchase Agreements

A real estate purchase agreement is a document that is meant to outline the purchase price, date, and other important details of the real estate deal. It is a crucial agreement in every real estate transaction as it fixes the terms of sale and gives legal protection for both parties.

Purchase Agreement Addendums – real estate contract addendums are documents that you can attach to the agreement to include any information that hasn’t been included in the original document. Addendums can also override clauses from the initial purchase agreement without crossing off anything in the original copy.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

How to Purchase Real Estate?

The real estate sale process is never quick and requires attention, patience, and following certain formalities. Let’s look at all the steps that all home buyers would go through when purchasing a residential property.

1. Look for a home or apartment for sale

There are several common ways to search for homes for sale.

- Through a real estate agent. It is a licensed professional who puts property buyers and sellers together and acts as their representative in negotiations. It is common to sell and buy real estate, but finding a good agent might be tricky. The best idea is to ask your friends or relatives about real estate agents with whom they had a good experience. Another idea is to check whether an agent has the National Association of Realtors (NAR) certification.

- Through special property platforms such as Zillow and Realtor. They let a buyer see a lot of options in one place with the most important details about real estate.

- Through neighbors or familiar people who might be selling homes.

- Through real estate listings in newspapers and magazines such as Homes and Land Magazine.

2. Obtain a pre-qualification letter

If you don’t have the entire sum to pay for the home of your dream and are about to get a mortgage, your chances of making a deal will drastically increase with a pre-qualification letter. Such a letter is provided by a bank and proves that an individual can obtain financing from the issuing entity. This fact influences sellers and makes them more eager to show their property to prospective buyers.

3. Find the right real estate agent

Acting as an important partner in every property purchase deal, a real estate professional can provide you with information that is not easily accessible to the public. They also possess important skills such as negotiation skills, knowledge of the home purchasing process, and know the area the buyer wants to live in. This might be very valuable when buying a home or apartment, which is why buyers who want to be sure they have viewed the best options in their area should use the help of a professional agent.

Moreover, the standard practice is that the seller pays a commission to a property agent, meaning a buyer shouldn’t pay real estate professionals anything. But this fee is usually wrapped into the price of the home, so ultimately, the buyer pays for property agent services.

4. Get private showings

Once you have decided on your price range, you can move on to scheduling an attending of actual properties. It can be done by a buyer themselves or their agent. Usually, a prospective buyer is given some time to look at the dwelling on their own before deciding on making a purchase offer to the seller.

5. Craft a real estate purchase agreement and sign it with the seller

This is the stage where the parties show their intent to enter into a legal real estate purchase agreement. The buyer should make a purchase agreement draft and offer the seller to sign it. The latter might accept the offer or reject it. In the case of acceptance, the seller will sign the sale agreement. After it becomes legally binding, their terms and conditions apply to both parties.

One of the first obligations of the buyer in the purchase agreement is to make the down payment in the amount agreed with the property seller.

6. Check the disclosures

After the purchase agreement is signed, the seller should provide the buyer with federal and state-required disclosures. They are needed to notify the buyer of any hazards or needed repairs in regards to the premises.

One of the most important disclosures is the lead-based paint hazard disclosure. It is the only disclosure that is required on the federal level and applies to houses built before 1978. The main hazard with lead paint is that it can crack over time and leave a very toxic powder on the floors that can be easily picked up by children. This is why the seller is obliged to give the seller a federally-approved pamphlet about lead-based paint hazards in building materials.

If the buyer has made an escrow payment, the seller is also obliged to provide them with an earnest money deposit receipt. It will be the buyer’s protection in case the seller tries to invalidate the purchase agreement, and the seller’s guarantee of the property return if the buyer doesn’t follow their intent to purchase the house.

Another disclosure the seller should make is a property disclosure statement. It is the form that is filled by the seller that is meant to inform the buyer of the current status of the parts of the property. If there are any physical problems and defects that the seller is aware of, they all should be included in the statement. The seller who fails to notify the buyer of any defects they were aware of is punishable, however it cannot be applied to defects that the seller wasn’t aware of. This is why there is always a need for a home inspector who will check the house before it will be bought.

7. Invite an inspector

It is essential to get the premises inspected by a professional inspector before closing the deal as this person has a good understanding of the defects that usually happen to homes. If a real estate professional is involved in the deal, they will help the buyer arrange the inspection shortly after the seller accepts the purchase offer.

Once the inspection is finished, both the buyer and seller should get a report. In case an inspector detects any signs of significant damage or things that should be fixed, the buyer will have a chance to renegotiate the offer or take it back along with the earnest money deposit without any fees. If there are things that can be fixed, the buyer can ask the seller to fix the defect on the property. Then, the seller can have a walk-through on the property and check whether the issue was solved before closing the deal.

What does “caveat emptor” mean?

Caveat emptor is a law principle that obligates a buyer to check goods and products thoroughly before purchasing them. “Caveat emptor” is a Latin phrase meaning “let the buyer beware” and implies that if the buyer reveals some defects after the purchase, they will not be able to hold the seller liable and change or return the product.

In real estate transactions, caveat emptor means that a purchaser gets the property on an “as-is” basis and is responsible for conducting all the necessary inspections to ensure that they are satisfied with the property’s condition. After buying the property, the buyer will not be able to back out of the deal. Note that most states do not adhere to this principle and protect buyers’ interests.

Real Estate Purchase Agreements Laws by State

| STATE | Is the state “caveat emptor” (buyer beware)? |

| Alabama | Yes |

| Alaska | No |

| Arizona | No |

| Arkansas | Yes |

| California | No |

| Colorado | No |

| Connecticut | No |

| Delaware | No |

| Florida | No |

| Georgia | No |

| Hawaii | No |

| Idaho | No |

| Illinois | No |

| Indiana | No |

| Iowa | No |

| Kansas | No |

| Kentucky | No |

| Louisiana | No |

| Maine | No |

| Maryland | No |

| Massachusetts | Yes |

| Michigan | No |

| Minnesota | No |

| Mississippi | No |

| Missouri | Yes (sellers inform buyers whether the property was previously used for methamphetamine production) |

| Montana | Yes (if the property is being sold by an agent, agent is required to disclose any “adverse facts” to the buyer) |

| Nebraska | No |

| Nevada | No |

| New Hampshire | Yes (but sellers are also required to disclose certain details) |

| New Jersey | Yes (there is a “common law” requirement that buyers need to be informed about known property defects) |

| New Mexico | No |

| New York | No |

| North Carolina | No |

| North Dakota | No |

| Ohio | No |

| Oklahoma | No |

| Oregon | No |

| Pennsylvania | No |

| Rhode Island | No |

| South Carolina | No |

| South Dakota | No |

| Tennessee | No |

| Texas | No (but law covers only single-dwelling properties) |

| Utah | No laws that require to inform buyers about defects unless the property has been contaminated due to storage, manufacturing, or use of methamphetamine |

| Vermont | Yes |

| Virginia | Yes |

| Washington | No |

| Washington D.C. | No |

| West Virginia | Yes |

| Wisconsin | No |

| Wyoming | Yes |

How to Fill out a Real Estate Purchase Agreement?

When it comes to a residential real estate purchase agreement, it is a comprehensive document that involves a lot of important information on the property, the buyer and seller, terms and conditions of the purchase, inspections, and so on. All information should be carefully proofread before signing the sale agreement.

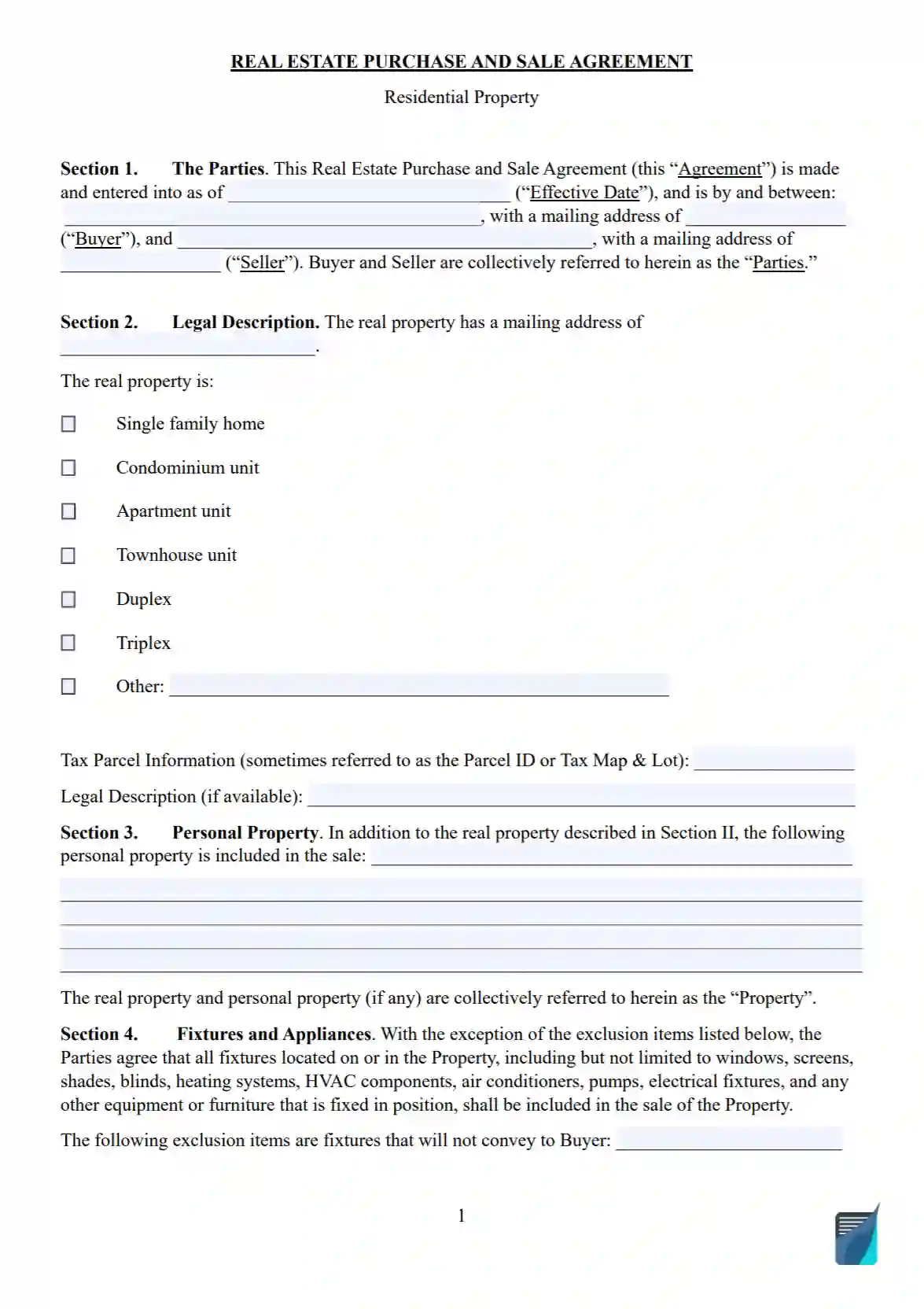

Step 1

The very first step in purchase agreements is introducing the document, the buyer and seller, and the effective date of the real estate purchase agreement.

Step 2

Add the legal description of the property. It includes a mailing address and the type of residential property – apartment, single-family home, condominium, etc. Also, write down the tax parcel information.

Step 3

A separate section should describe the personal property that is included in the sale along with the residential property. Further, include the statement that all the fixtures and appliances are included in the sale price and leave the space for items that the seller will decide to not convey to the buyer.

Step 4

The next section should be devoted to the earnest money deposit. It should mention the sum of the earnest money deposit and the date when it will be made. It should also specify whether the earnest money deposit will be placed in a separate trust or escrow account.

Step 5

Here comes the paragraph about the purchase price of the property. The section should include the price of the real estate written both in numbers and letters.

Step 6

The next paragraph should outline the buyer’s contingencies. For instance, it should include the statement on whether the purchase is dependable on the buyer’s ability to get financing or not. It might also include the statement on whether the buyer should sell another property when making a property purchase.

Step 7

Further, the purchase agreement should have a section that will be devoted to the terms of getting a loan by the buyer. It should state that obtaining financing should happen within a reasonable time following the execution of the purchase agreement. It might also elaborate on what constitutes a default by the buyer, for example, if they fail to provide all the necessary information to the lender in order to obtain financing.

Another piece of information that might be included here is the date when the buyer should provide the seller with a letter that will verify the buyer’s capability to make an earnest money deposit and get funds to close the deal.

The section should also state that the seller has the power to terminate the real estate purchase agreement in the event the buyer does not provide them with the verification letter.

Step 8

Another important piece of information to include in the purchase agreement is the buyer’s due diligence. It should tell about the buyer’s right to conduct the property condition assessment, its appraisal, and a survey before closing. The paragraph should state whose obligation to pay it will be (usually it is the buyer’s obligation) and the period within which the buyer should notify the seller of any issues that are deemed a defect in the title to the property if any. It should also specify what happens in case the seller does not fix the title defects.

Step 9

This section of the purchase agreement should tell how the title to the property shall be conveyed when the title report is ordered, and how many days the buyer will have to notify the seller in case they find some details in the title report unacceptable. It should also state how much time the seller will have if they want to correct the matters described in the objections.

Step 10

The following section is devoted to the property condition. The buyer has already checked the property and is familiar with its condition, so in the purchase agreement, the seller should take an obligation to maintain the property in its current condition from the effective date of the purchase agreement to the closing date. The section should also tell that the buyer can order any inspections and tests in order to check the condition of the premises. Along with that, there should be a paragraph with a deadline before which the buyer can present identified defects to the seller to let them fix those issues. The parties might also agree to change the purchase price.

Step 11

The next paragraph should include the buyer’s obligation to commission an appraisal of the property purchase price and the period for re-negotiating the price by the buyer and seller in case the house does not appraise to at least the amount of the purchase price or in some other cases.

Step 12

This section should touch on the closing costs and how they will be shared between the buyer and seller. Apart from closing costs, it should also tell the closing date and where the closing should take place.

Step 13

A separate section in the purchase agreement should be devoted to the funds at closing. It should detail that the seller has to ensure providing all necessary costs to an escrow agent. It might also state that taxes, fees, and other expenses related to the real estate for the year in which the sale is closed shall be prorated as of the date of closing.

Step 14

If the buyer is purchasing a home, there should be a section in the purchase agreement stating that all rights in regards to the soil are transferred to the buyer. They might include rights to water, oil, minerals, etc.

Step 15

Another piece of information that might be included in the section at step 10 or made as a separate section is the consequence of the damage or destruction of the improvements on the property that happened before closing, if any.

Step 16

An indemnification clause is one of the most important provisions in every purchase agreement. It lets to protect the seller from any claims that are made by the buyer after the closing. It should state that the buyer is purchasing the home on an as-is basis and there are no implied warranties regarding the property provided by the seller.

Step 17

The next statement should be the agreement of the parties to cooperate and provide necessary documents to each other to make their deal effective. It should state that the provision is relevant both before and after the closing.

Step 18

The termination section in the purchase agreement should state the consequence of the termination of the purchase agreement which is usually the return of the buyer’s earnest money deposit, except in the case of the buyer’s default.

Step 19

Federal law requires parties in a real estate purchase agreement to include the provision about sex offenders. It should state what punishment sex offenders might face and where more information on the matter can be found.

Step 20

The next two sections should elaborate on what is considered the default of the buyer and seller. In the case of the buyer, their liability is usually limited to liquidating damages in the amount of the earnest money deposit. If the seller will be considered as the party failing to fulfill their obligations, the buyer may decide to terminate the agreement and return their earnest money deposit along with the damages incurred to the buyer.

Step 21

The following sections of purchase agreements should concern dispute resolution including ones regarding earnest money deposit. One of them might state that the matter should be submitted to mediation as provided in the real estate purchase contract before starting arbitration or court proceeding.

Another provision should also tell how the costs of mediation will be shared between the parties. It would be wise to include in the provision exclusions, that is, the situations where mediation and arbitration measures of dispute resolution can not be applied.

Step 22

The next provision should state what laws are considered governing for the real estate purchase agreement. Usually, it is the state where the property is located.

Step 23

A real estate purchase contract typically comprises a purchase offer, which should be outlined in this section. It should state that if the seller signs the offer, the agreement will be considered reached, and the seller should send a counteroffer. The provision might also note that the seller is not obliged to reserve the property for the buyer before there is a notification of acceptance.

Step 24

The following provisions of the real estate purchase agreement should touch on the binding effect, business days, and severability.

Step 25

The next sections should clearly state when the offer is considered expired and what is deemed an acceptance.

Step 26

One of the last provisions in the real estate purchase agreement is the possession of the property after closing. Here, the fact that the buyer gets possession of the property after closing should be stated. The paragraph should also explain that the property shall be delivered free of tenants, the seller’s personal property, and trash.

The other provision should tell within what period before closing the buyer can have a walk-through on the property in order to make sure it has the condition required by the real estate purchase agreement.

Step 27

Last but not least information that should be included in a real estate purchase agreement is the disclosures that are required from the seller by federal and state laws. For example, the lead-based paint disclosure is required for all residential buildings built before 1978. The provision should also state that the required disclosures will be attached to this real estate purchase agreement.

Step 28

Real estate purchase agreements usually end with the signatures of the parties including their print names and dates.

If you want to get a customized real estate purchase agreement that will include all of the important details of the deal, use our document builder. It will let you get a legally binding purchase agreement in less than 10 minutes.