Promissory Note Template

A promissory note is a legally binding written agreement to pay back a specific amount of money on a specified date or on-demand. The parties to a promissory note are called “borrower” and “lender.” A borrower is a person who receives the money and a lender provides the money to the borrower. A promissory note sets out all the terms and conditions relating to debt such as:

- Payment schedule

- Interest rate

- Collateral security

- Due date

- Penalty if the borrower defaults

A promissory note creates legal rights, and it is important to follow a proper procedure while creating it. You can try our simple document builder to create a customized promissory note based on your specific needs. Also, we offer promissory note templates that are simple, easy to understand, and can be filled out easily.

- When to Use

- Promissory Note vs. Loan Agreement

- Secured vs. Unsecured Promissory Note

- What Information Should Be Included in a Promissory Note?

- What Payment Options are Available With a Promissory Note?

- Maximum Rate of Interest Laws by State

- Steps to Creating a Promissory Note

- Filling out the Promissory Note Template

- Frequently Asked Questions

- Download a Free Promissory Note Form

When to Use

Promissory notes are important to ensure that money borrowed is paid back. They act as an important document of record to hold the borrower accountable for the money due and provide protection to the lender against non-payment. By agreeing to all the terms and conditions in advance, the parties avoid chances of future disputes or ambiguities.

A promissory note template can be used for various purposes. Some of the common purposes for which they are used are:

- Real estate sell-purchase, real estate down payments, or real estate mortgages

- Loans of personal nature between family members, friends, or colleagues

- Students loans for tuition fees and college expenses

- Business and commercial loans

- Car, automobile, or vehicle loans

Promissory Note vs. Loan Agreement

A loan agreement is different from a promissory note. While both of them aim to secure the principal amount, a loan agreement is more complex than a promissory note.

Simple vs. Complex: A promissory note is short, simple, and used for smaller loans. It is typically used for personal loans where the borrower and the lender know each other. A loan agreement contains extensive clauses and is mostly used by banks and financial institutions for formal loans.

Signature: A promissory note template only needs to be signed by the borrower. A loan agreement should be signed by both parties.

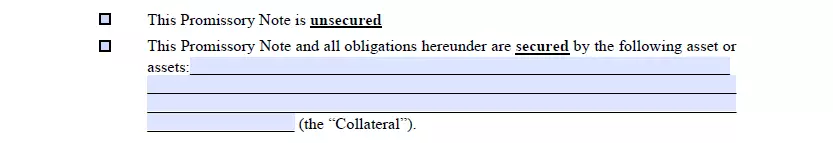

Secured vs. Unsecured Promissory Note

A promissory note is of two types:

Secured: A secured promissory note provides for collateral security in the form of real assets such as a house or car as a remedy against failure to pay. If the borrower defaults, the lender can seize the property to obtain repayment of the loan. A lender must ensure that the property specified in a secured promissory note is of sufficient value to cover the principal plus the interest in case of default. If the borrower undergoes bankruptcy, then the lender’s right to claim a repayment from the specified property will come before the right of other unsecured creditors.

Unsecured: An unsecured promissory note does not provide any collateral security as a remedy against failure to pay back. If non-payment by the borrower occurs, the lender will have to file a lawsuit in court to recover the loan from the borrower. If the borrower undergoes bankruptcy, then the lender will have no preferential right over other unsecured creditors.

A lender should use a secured note while lending money to have extra safety.

There is also a promissory note for a car sale, designed specifically for vehicle purchase. It acts as a promise to pay out a car loan and records the key transaction details.

What Information Should Be Included in a Promissory Note?

A promissory note template should include the following information:

- Identifying Information: The note should identify and specify the name of the borrower and the lender. The borrower and the lender can be either a person or an entity such as an LLC, corporation, or partnership. Other details such as the address and occupation of both parties should also be mentioned. If there is more than one borrower or lender, then the details of all of them should be included.

- Co-signer Details: If the parties decide to have a co-signer or guarantor who will pay the debt if the borrower defaults, then the details including the name and address of the co-signer should also be specified.

- Principal Amount and Interest Rate: The note should clearly specify the amount of money borrowed and the interest rate applicable. If there is a late fee for uncleared dues by the borrower, the same should be mentioned.

- Payment Plan: The note should contain payment details of when and how the loan due must be paid by the borrower, whether on a specific date or on-demand. It should specify if the repayment will be made in installments or in a lump sum. The installment amount and the due date of the final amount payable should also be mentioned.

- Collateral Security: If the note is a secured note, then the details of the assets named as security should be mentioned. If the collateral is a vehicle, then the lender can ask the borrower for insurance details of the same.

- Default Clause: The note should contain a default clause specifying the rights of the lender if the loan is never paid back. It can contain terms related to the seizure of collateral by the lender or the right of the lender to take legal action in a court.

- Signatures: The note should contain the signatures of all the borrowers. Although the signature of the lender is optional, it is better to have the same in the note. If there is a co-signer, then his or her signature should also be there. A note without the signature of a borrower will be unenforceable under law.

How to Calculate Payments

All the numbers relating to repayment structure should be mentioned in the note itself. Importantly, a promissory note should specify the following three numbers:

- Total interest payment

- Final total payment

- Installment payment

To calculate these three numbers, you will need to know the principal amount, total repayment period, and interest rate. Using an example, we’ve explained below some simple methods to calculate them.

Example: I borrowed $6,000 at a 10% annual interest rate for a period of six months. It is to be cleared in quarterly installments.

Total Interest Payment

To calculate the total interest payable, you’ll have to first calculate the annual interest amount (because the interest rate is provided on an annual basis). After that, divide the annual interest amount by 12 (to arrive at the interest amount for each month). Now, multiply the monthly interest amount by the total number of months in the loan period.

For the example given above, this will be calculated as follows:

- Annual interest amount = 6,000 x 10/100 = 600

- Monthly interest amount = 600/12 = 50

- Total interest amount = 50 x 6 = 300 (as the loan duration is for 6 months)

Final Total Payment

To calculate the final total amount payable, add the principal loan amount and the total interest payable.

For the example given above, this will be calculated as follows:

Final total payment= 6,000 + 300 = 6,300

Installment Payments

To calculate the installments payable, divide the final total amount payable by the number of installments.

For the example given above, there will be two installments as the loan duration is for six months and it is to be paid quarterly (once in three months). Therefore, 6/3 = 2.

Now 6,300 divided by 2 = 3,150

Therefore, in the example given above, the loan will be paid back in two installments of $3,150, each payable after three months and the total final payment will be $6,300. In the same example, if the installments were payable monthly instead of quarterly, then the total final payment will be divided by six, and the loan will be paid back in six installments of $1,050 each.

What is a Maximum Interest Rate?

The current market rates can be used as an equivalent comparison of the interest rates to be charged. If you are not sure about the interest rate to be charged, you can use the Prosper Loans or Wells Fargo Calculator to know the rates for personal loans.

It is important to keep in mind that most state laws specify a maximum interest rate that can be charged. These are called usury laws. For example, in California, the maximum rate (usury limit) permissible under the law is 10%. Before drafting your note using our promissory note template, make sure to check the maximum rates permissible under law.

What Payment Options are Available With a Promissory Note?

There are four repayment structures that are generally used in a note:

- Regular Installment Payment: Principal and interest payable are paid in regular installments on specified dates.

- Installment with Final Balloon Payment: Interest payment is made in regular installments and the principal amount is paid on the maturity date.

- Lump-Sum Payment: The total amount including the interest accrued and the principal amount is paid on the maturity date.

- Payable on Demand: No specific due date is provided and the borrower has to pay back the lender whenever demanded by the lender.

- Amortization: This is used for long-term loans by creating a payment schedule. The schedule is created in such a way that the payment towards interest keeps decreasing over time and the payment towards the principal keeps increasing over time.

Payment made is typically first applied towards the interest payable and then the loan amount.

What to do if payment is late?

The note should specify late fees which can either be a flat fee or a percentage of the amount due for missed due dates. The lender can issue a demand letter informing the borrower that he has missed his due date and needs to pay late fees. The note should specify the time period after which late payment will be considered as default.

What to do if the borrowed money is never paid back?

If the note is a secured note, then the lender can obtain the property of the borrower in accordance with the loan contract. The lender will have to typically file a lawsuit to legally obtain foreclosure rights on the collateral. If the note is an unsecured note, then the lender can seek repayment through Small Claims Court. Small claims are usually limited to loans of $10,000 or less depending upon the state law.

Maximum Rate of Interest Laws by State

| STATE | MAX. RATES | STATE LAW |

| Alabama | 8% – for written contracts; 6% – for verbal agreements | Alabama Code, Section 8-8-1 |

| Alaska | 5% above Federal Reserve interest rate on the day the loan was made; 10.5% per year – if amount is more than $25,000 | Alaska Statutes, Section 45.45.010 |

| Arizona | No limit – for loan agreements in writing; 10% per annum – if not in writing | Arizona Revised Statutes, Section 44-1201 |

| Arkansas | 17% | Arkansas Annotated Code, Section 4-57-104 |

| California | 10% – for personal, family, or household purposes; For any other loans – allowable rate is the higher of 10% or 5% over amount charged by the Federal Reserve Bank of San Francisco | California Constitution, Article XV |

| Colorado | 8% – legal rate of interest; 45% – general usury limit; 12% – for consumers | Colorado Revised Statutes, Sections 5-12-103 and 5-2-201 |

| Connecticut | 12% | Connecticut Revised Statutes, Chapter 673, Section 37-4 |

| Delaware | 5% over Federal Reserve discount rate | Delaware Code, Title 6, Section 2301 |

| Florida | 18% – general usury limit; 25% – if loan is over $500,000 | Florida Statutes, Section 687.03 |

| Georgia | 7% – if no written contract; 16% – if loan is below $3,000; 5% per month – if loan is above $3,000 | Georgia Code, Section 7-4-2 |

| Hawaii | 10% – if no written contract; 12% – general usury limit; 10% – on judgments | Hawaii Revised Statutes, Sections 478-2 to 478-4 |

| Idaho | 12% – legal rate of interest; 5% – on money due on court judgments | Idaho Statutes, Section 28-22-104 |

| Illinois | 9% – general usury limit | Illinois Compiled Statutes, Chapter 815, Section 205/4 |

| Indiana | 8% – if no agreement; 25% – for consumer loans other than supervised loans | Indiana Code, Sections 24-4.6-1-102 and 24-4.5-3-201 |

| Iowa | 5% (if otherwise agreed upon in writing, maximum is set by Iowa Superintendent of Banking) | Iowa Code, Section 535.2 |

| Kansas | 10% – legal rate of interest; 15% – general usury limit | Kansas Statute, Sections 16-201 and 16-207 |

| Kentucky | 8% – legal rate of interest; general usury limit – 4% greater than Federal Reserve rate or 19%, whichever is less | Kentucky Revised Statutes, Section 360.010 |

| Louisiana | 12% – general usury rate | Louisiana Revised Statutes, Section 9:3500 |

| Maine | 6% – legal interest rate (unless otherwise stated in an agreement) | Maine Revised Statutes, Title 9-B, Section 432 |

| Maryland | 6% – legal interest rate; 8% – if a written contract | Maryland Annotated Code, Commercial Law, Sections 12–102 and 12–103 |

| Massachusetts | 6% – legal interest rate (unless a written contract exists); over 20% is considered criminally usurious | Massachusetts General Laws, Chapter 107, Section 3; and Chapter 271, Section 49 |

| Michigan | 7% – if a written contract; otherwise – 5% | Michigan Compiled Laws, Section 438.31 |

| Minnesota | 6% – legal rate of interest; 8% – usury limit | Minnesota Statutes, Section 334.01 |

| Mississippi | 8% legal rate of interest – 8%, “Contract rate” – 10% or 5% above Federal Reserve rate, whichever is greater | Mississippi Annotated Code, Section 75-17-1 |

| Missouri | 10% | Missouri Revised Statutes, Section 408.030 |

| Montana | 15% or 6% above the rate of Federal Reserve System, whichever is greater | Montana Annotated Code, Section 31-1-107 |

| Nebraska | 16% | Nebraska Revised Statutes, Section 45-101.03 |

| Nevada | Without agreement – current prime rate of the largest Nevada bank; no usury limit | Nevada Revised Statutes, Section 99.040 |

| New Hampshire | 10% | New Hampshire Revised Statutes, Section 336:1 |

| New Jersey | 6% – without a written contract; 16% – with a written contract | New Jersey Statutes, Section 31:1-1 |

| New Mexico | 15%- if no written contract | New Mexico Annotated Statutes, Section 56-8-3 |

| New York | 6% – legal rate of interest; 16% – general usury limit | New York Consolidated Laws, GOB Section 5-501; and BNK Section 14-A |

| North Carolina | 8% – legal rate of interest (but consumers and creditors can contract for a higher rate) | North Carolina General Statutes, Section 24-1 |

| North Dakota | 6% – legal rate of interest; max. contract rate – 5.5% higher than current cost of money and can’t be less than 7% | North Dakota Century Code, Sections 47-14-05 and 47-14-09 |

| Ohio | 8% – if a written contract | Ohio Revised Code, Section 1343.01 |

| Oklahoma | 6% (unless otherwise agreed between parties) | Oklahoma Statutes, Section 15-266 |

| Oregon | 9% – legal interest rate (but other conditions apply to business and agricultural loans) | Oregon Revised Statutes, Section 82.010 |

| Pennsylvania | 6% – legal rate of interest | Pennsylvania Consolidated Statutes, Title 41, Section 201 |

| Rhode Island | 21% (but alternate rate of 9% + domestic prime rate may be applied) | Rhode Island General Laws, Section 6-26-2 |

| South Carolina | 8.75% – legal rate of interest | South Carolina Code of Laws, Section 34-31-20 |

| South Dakota | No limit – if a written agreement; 12% – if no agreement | South Dakota Codified Laws, Sections 54-3-4 and 54-3-16 |

| Tennessee | 10% (unless otherwise expressed in contract or by law) | Tennessee Code Annotated, Section 47-14-103 |

| Texas | 10% (unless otherwise stated in contract law) | Texas Statutes, Finance Code, Section 302.001 |

| Utah | 10% (unless otherwise agreed between parties in a written contract) | Utah Code, Section 15-1-1 |

| Vermont | 12% (exceptions in certain circumstances may apply) | Vermont Statutes, Title 9, Section 41a |

| Virginia | 6% – legal rate of interest; 12% – with a contract | Virginia Code, Sections 6.2-301 and 6.2-303 |

| Washington | 12% or 4% points above average bill rate for 26-week treasury bills | Washington Revised Code, Section 19.52.020 |

| West Virginia | 6% – legal interest rate; 8% – with a written agreement | West Virginia Code, Section 47-6-5 |

| Wisconsin | 5% – legal rate of interest (but there are different rates exist for various types of loans | Wisconsin Statutes and Annotations, Section 138.04 |

| Wyoming | 7% – if no agreement | Wyoming Statutes, Section 40-14-106 |

Steps to Creating a Promissory Note

A promissory note is an important document that’s considered legally binding, considering, of course, it is written correctly. But the good news is that it’s much shorter than less complicated than most agreements or contracts. Hence, there’s no need to hire a law firm or have a law degree to create this document.

With the help of our free form and instructions, you can complete your promissory note in under ten minutes. Besides that, you can use our document builder that will lead you step-by-step to your personalized document in no time.

1. Mutual Agreement

Before formally writing the agreement, the parties should sit down and mutually agree upon all terms verbally. They should discuss and agree upon terms relating to the loan amount, interest rate, payment plan, late fees, security, default, and co-signer. This will ensure that each party knows, understands, and agrees to all the terms in the same sense.

2. Background Check

It is always advisable to do a background check on the opposite party. A lender should run a credit check to find out if the borrower has other outstanding debts. A lender should also know if there is any other claim or mortgage on the collateral. Before doing the credit check, the lender must obtain a written authorization from the borrower to do the same. Equifax, Experian, and TransUnion are some of the reputed credit reporting agencies. Similarly, a borrower should also make sure that the money given legally belongs to the lender.

3. Collateral and Co-signer

Parties should specifically identify the collateral and the co-signer if they decide to include them. They should also discuss the value of the asset to be provided as security. The person who will be the co-signer should be informed about all the terms and his consent should be obtained beforehand.

4. Writing the Promissory Note

After following the above-mentioned steps, parties should meet, write, and sign the agreement. Loan money should be given to the borrower after signing. For detailed guidelines on how to fill FormsPal’s promissory note template, refer to the next section.

5. Loan Release

After the borrower has made payments in time and in accordance with the promissory note, the lender should sign a loan release form. The loan release form will certify that repayment has been made in accordance with the agreement. It will relieve the borrower from any further liability.

Filling out the Promissory Note Template

A promissory note is easy to understand and can be filled out by understanding the basic terms of the note. Even if you don’t have any legal background, you can use our promissory note template by following the below-mentioned steps where we explain how to fill out our note.

We will use our previously mentioned illustration of a debt of $6,000 given at a 10% annual interest rate in California for a period of 6 months and repayable in quarterly installments.

Step 1 – Enter the Basic Information

In the first line, enter the complete date including the day, month, and year. For example, it can be written as November 11, 2020.

Next, enter the principal amount, which is the original amount of the loan excluding any interest. Enter the amount in both words and numbers. In the given example, this amount is $6,000 and can be written as $6,000 (six thousand U.S. dollars).

In the next paragraph, enter the full names and addresses of the borrower and lender in their respective blanks including house number, street, city, and state. For example, the lender can be James Fuller with an address of 22 Boulevard Street, San Jose, California 95013.

Lastly, enter the interest rate charges. For example, in California, the maximum permissible rate under the law is 10%, so we will enter 10%.

Step 2 – Select a Quarterly or Monthly Payment Date

Decide whether installments will be made quarterly or monthly. A calendar year has quarters consisting of 3 months or 90-92 days each. These are January-March (Q1), April-June (Q2), July-September (Q3), and October-December (Q4).

If you decide to make payments each month, select the first option and enter a date on which installment is to be paid each month. A date in the last week of a month is typically selected. For example, you can enter the 25th day of each calendar month.

If you decide to make payments each quarter, then select the second option and enter a date of each quarter on which installment is to be paid. Usually, a date in the last week of the last month of a quarter is selected. For example, you can enter the 85th day of each calendar quarter. You can also enter “last day” or “second to last day” of each calendar quarter.

Step 3 – Select a Payment Plan

Decide whether the payment will be made in regular equal installments of principal and interest or amortized over a period of time.

If you decide to get payment from the borrower in equal installments of principal and interest, then select the first option. If you selected the monthly option in the previous step, then $1,050 (calculation explained above) will be entered. If you selected the quarterly option in the previous step, then $3,150 will be entered.

If you decide to amortize the loan, then enter the number of years over which the loan will be amortized in the second option. You can use various online calculators to prepare an amortization schedule. Attach the schedule to the promissory note.

Enter the maturity date, which is the final date by which total payment, including the principal and the interest, should be made.

Step 4- Select the Type of Note – Secured or Unsecured

If the borrower has not provided any collateral against default, then select the first option.

If the promissory note is secured with collateral by the borrower, then select the second option and enter all the details of the asset.

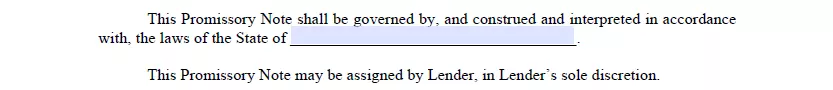

Step 5 – Select the Governing Law State

Select the governing law state. The state of the lender should be entered. Here, we have chosen California as the lender resides in California.

Step 6 – Signature

The borrower and the lender should come together to put their signature. If there are multiple parties, then all of them should sign the note. Although not required, it is advisable to have an impersonal third party sign the document as a witness to add an extra layer of legality. Lastly, include your full signature, full name, and title.

Frequently Asked Questions

What Makes a Promissory Note Invalid?

A promissory note can become unenforceable under the law if it is not written correctly.

- If the note is not signed by the borrower, it becomes invalid.

- If the interest rate exceeds the maximum limit under the state law, the note may become invalid.

- If the note is altered without mutual agreement, it becomes invalid.

- Notes with ambiguous terms such as unclear dates or missing party details can also become invalid.

Additionally, a promissory note is a contract, and just like any other contract, it should fulfill all requirements of a valid contract such as minimum legal age of the parties, soundness of mind, and legal objective.

Is it possible to sell or transfer my note?

Yes, lenders can sell, transfer, and even use their notes as a substitute for money. Notes can be transferred between lenders. When a lender wants liquidity and does not want to endure the risk of a long term loan, he or she can sell the note to reputed note buying companies at a discount. Notes can also be transferred between family members and friends to offset another loan.

However, the law varies from state to state regarding transferability. It is important to keep proper records of the note and to include clear language in the note to enable selling or transferability of the note. The note should include the terms “payable to order” or “payable to bearer.”

Can there be more than one lender or borrower?

Yes, there can be more than one lender or borrower. If that’s the case, their names and other identifying details should all be written in the note.

What is a demand promissory note?

A demand promissory note is one in which payment becomes due upon demand by the lender. It does not have a specified maturity date written in it. However, the lender must provide a reasonable notice period to make payments to the borrower.

What is a master promissory note?

A master promissory note (MPN) is a legally binding contract between a student and the United States Depart of Education. Before a student takes a federal student loan, he or she needs to sign an MPN and agree to adhere to all the terms contained therein.

What is a Debt Settlement Agreement?

It is an agreement to resolve an outstanding debt between a debtor and a creditor. When a debtor is under indebtedness to a creditor but does not have sufficient funds to pay, they can agree upon a lesser sum of money to be paid. This will help the debtor to clear outstanding dues, avoid legal action, and improve his or her credit health. The creditor will be able to minimize the losses, avoid expenses of hiring a lawyer, and get liquidity in a shorter period of time with lesser efforts as compared to a court order.

Download a Free Promissory Note Form