Rental Lease Agreement Templates

Whether you own rental properties or you’re looking for a new home, you will be faced with the complicated task of securing an agreement. For some people, this detailed process will be delegated to their lawyers or legal counsel. However, most people do not have the luxury of hiring legal help and thus write contracts on their own. This leads to a lot of complications in the long run since some paragraphs or “clauses” can be deemed illegal in your state.

To save you from this headache, FormsPal offers free rental agreement templates for download. Feel free to go through our guide, too! It may give you valuable and updated insight into this leasing process.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- What is a Rental Agreement?

- Residential Rental Agreement Types

- Business Lease Agreement Types

- Lease and Rental Terms Glossary

- Disambiguations

- Security Deposit Laws by State

- How to rent out a residential property

- Landlord’s Access Laws by State

- Download Free Rent and Lease Agreements

- How to write a Residential Lease Agreement

- What Are the Rent or Lease Addendums and Disclosures?

- Frequently Asked Questions

What is a Rental Agreement?

Commonly known as a “rental agreement” or “contract of lease,” this legal document details the conditions set by the owner of the house, building, car, or equipment. More than anything, these conditions or lease terms should be based on state laws and fairly indicate who will become accountable for certain occurrences. The person who will be occupying the property for a certain period of time will then review the document, and if agreeable, abide by the rules of the contract for the period of their stay.

Here are the general terms that you will be encountering with the said agreement :

- “Landlord” or “Lessor” – the owner or authorized caretaker of the rental property

- “Tenant” or “Lesse” – a person who will be occupying or renting the property for a certain period of time

- “Leased Premises,” “rental unit,” or “Property” – the house, office, or area being rented

- “Leased Asset” – the car, equipment, or any other asset that can be rented.

Residential Rental Agreement Types

1. Fixed-Term Leases

This type of lease often entails the use of the entire rental property for a fixed period of time, often a minimum of one year with no limit for the number of years. These are typically used for houses, apartments, and condominium units. The downside of this residential lease is that the tenant may have to forfeit their security deposit if they leave before the term ends.

2. Periodic Leases or Rent

Periodic leases are also called monthly leases or “tenancy at will” because the agreement only lasts for a short period of time. They may renew the contract or terminate the rental agreement, provided there is a 15 or 30-day notice (depending on your state). This setup may not be for everyone since the landlord has the right to increase the month’s rent without notice.

3. Proprietary Leases

Some apartments or condominiums are run by co-ops. In such a case, the tenant will purchase “shares” or “stocks” to become part owners of the building. The co-op group will then act as the landlord to collect the month’s rent, become the building’s property manager, and facilitate day-to-day operations while the shareholders give their “monthly dues” instead of their month’s rent.

4. Sublease Agreements

In some cases, the landlord is also a residential tenant who has secured a fixed-term agreement with the property owner. This happens through subleasing (also known as “sub-letting”) where a smaller space like a room or a unit, for instance, is rented to someone else. However, it is important to go through the original rental agreement since this setup often becomes complicated in the long-run.

5. Rent to own

In this rare type of agreement, the landlord has the intention to sell the property but the potential tenant cannot make a big downpayment. In such a case, a bank loan may not be an option. So, the landlord accepts a higher security deposit and advanced rent payments. There is no limit to the number of months to pay off the rest of the “mortgage,” so the landlord and tenant can determine this in writing. Once complete payment has been made, the title will be transferred to the renter.

Business Lease Agreement Types

1. Commercial Lease

The most common type of lease for businesses is the commercial lease, where the property is located in a highly-populated area with high foot traffic. This location could be in malls, along major roads, or in business districts. In addition, the landlord may agree to use the address in the business registration of the tenant company.

2. Financial Lease or Capital Lease

Like the residential lease, this involves a higher month’s rent that lasts for a fixed and longer duration. Amount paid to the landlord may actually be more than the current value of the property because of interest and other lease charges. Due to the business potential of the property, however, some companies opt to rent rather than purchase.

3. Operating Lease

An operating lease allows the use of a property or asset for a short but fixed period of time. In this case, the tenant company will shoulder all additional expenses for the duration of use (e.g. maintenance, repair, utilities, etc.). Once the landlord and tenant decide to terminate the agreement, a notice will be required, as with a standard to a short-term rental agreement.

4. Conveyance-Type Lease

Similar to rent-to-own, this type of lease lasts for a few years with the intention to transfer the title to the tenant. This may be an option for growing businesses that may gain more with a rent payment scheme that allows them to gather more funds over time. Again, this type of rent may be rare and may possibly cost more due to interest.

5. Leveraged and Non-Leveraged Lease

Like a proprietary or co-op lease, the value of the rental property may exceed the financial capability of one person or company. In this case, he or she may find a co-owner and both share the cost of the mortgage. In a sense, both serve as the landlord and tenant of the property.

6. Tax-Oriented Lease or True Lease

A tax-oriented lease or a true lease is one that qualifies for some government tax benefits to either or both of the lessor and the lessee. To do this, the lessor may depreciate the value of the asset and claim tax credits. In turn, the lessee will also have lower rent for the said period.

7. Non-Payout and Full Lease

Sometimes, a tenant may fail to pay their month’s rent, so the same asset or property is leased by the landlord to another tenant until rent payments become stable. This is dubbed as a “non-payout” lease. On the other hand, the full lease helps the landlord recover the property’s full value by leasing it out.

8. Sales Aid Lease

In a sales aid lease, the rent payment for the asset or rental property is shouldered by both the tenant and the landlord through a sales agreement. Oftentimes, the tenant is the manufacturer or the supplier, while the landlord helps in the sales of the product. This partnership often results in a better return for the landlord if the business goes well.

9. Net and Non-net Lease

In a non-net lease, the landlord may retain total control and responsibility for the rental unit including maintenance and repair. In the case of net lease, the landlord does not concern himself with the above-mentioned issues, and the tenant shoulders any damage to the property. In some states, this may not be legal, so it’s best to check your state’s rental laws.

10. Specialized Service Lease

In a specialized service lease, an asset or special equipment is being rented. Because this special asset would require knowledge of its operation, the lessor will include the cost of a specialist or property manager to handle the equipment. This setup is common to construction equipment, high-value electronics, and studio devices.

11. Cross-Border Lease

A common lease agreement in the logistics industry, this rent allows for securing rentals in different countries. It is usually done on a fixed basis involving detailed contracts and securing government permits in addition to the lease agreement. This may also be an option for people who frequently travel back and forth to two or three different countries. However, a fixed payment location must be specified in this type of rent.

12. International Lease

Quite similar to a cross-border lease, an international lease happens when the landlord and tenant make the rental contract while they are in two different countries. In this case, they are also subject to the risk of currency fluctuations but may have no other option as the tenant will get his funds from the other country. This is a common setup for international students or businesses that are expanding their global reach. For this type of rent, you may want to hire a real estate agent.

13. Sale and Leaseback

Though somewhat complicated, sales and leaseback happens when the company or tenant sells one of their equipment or asset to the landlord. However, they remain to be its sole user and now pay the month’s rent for it. Legally, the landlord is now the owner of the equipment, but it remains with the tenant so that the company can sustain its business.

14. Import Lease

Import lease is another type done internationally but involves only equipment and not property. This happens when a person from the U.S., for example, rents a piece of equipment owned by a lessor from another country. In this case, the equipment is imported, because it is already in the U.S., but the payment is sent to another country.

| Related Documents | When to Use |

| Lease Renewal Agreement | Used to extend the lease without changing any of the existing terms and creating a new contract. |

| Notice of Lease Non-renewal | Can be used by tenants and landlords to notify the other party about the intent not to extend the lease agreement. |

| Rent Increase Notice | Used by landlords to notify tenants about the rent increase (amount, reason, etc.). |

Lease and Rental Terms Glossary

- Alterations — The act of changing any part of the leased premises either aesthetically (paint) or structurally (adding extensions or removing wall dividers). Permission to make alterations inside and outside of the property must be secured from the landlord in written form.

- Common Area Fee — In some apartments, condominiums, or subdivisions, a common area with additional amenities and spaces add to the expenses of the tenant.

- Furnishings — A rental property may include existing furniture such as beds, chairs, desks, or appliances like refrigerators or dishwashers. The landlord may declare this in the rental agreement to make sure that these items remain after the tenant has moved out. Owners of big estates would also need property managers to account for this.

- Governing Law — Legalities regarding leases vary from state to state. It is highly recommended that you check your municipal laws to make sure the agreement is enforceable.

- Guarantor — In some cases, a landlord may require a guarantor from the tenant’s party who may be a friend or a relative living nearby. The guarantor will be fully responsible for any fees or damages the tenant has incurred in case he or she fails to settle this responsibility. In some cases, the security deposit is enough to fix damages or settle past due rentals.

- Indemnity — This is a paragraph or “clause” in the agreement stating that the landlord will not be held responsible for any injuries, accidents, or damages that happen inside of the rental property. It is best to check the indemnity clause in detail as some of it may go against state laws like “accidents that occur due to landlord’s negligence in a common area.”

- Landlord or Lessor — The landlord is commonly the owner of the leased property who may or may not have fully settled the property’s mortgage payment but has the title under their name. In some cases, the landlord could also be the owner’s legal caretaker (see: power of attorney).

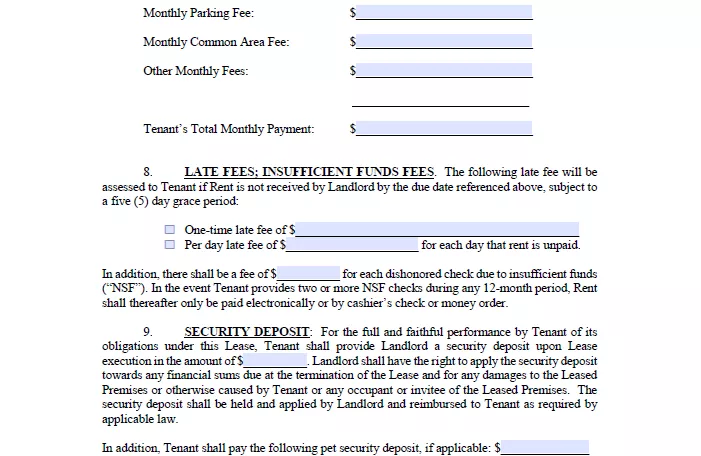

- Late Charges — For late rent payments, the landlord may stipulate a fixed amount per day, as long as this does not go above the state maximum. Some states have provisions for a certain grace period during which the tenant cannot be charged with penalties. Each state also differs in its guidelines for Insufficient funds (“NSF”) checks.

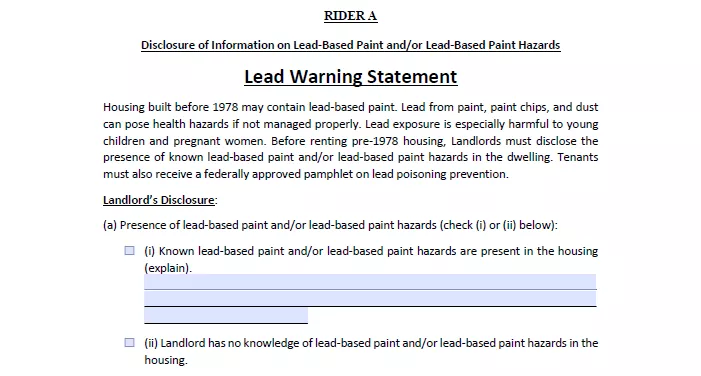

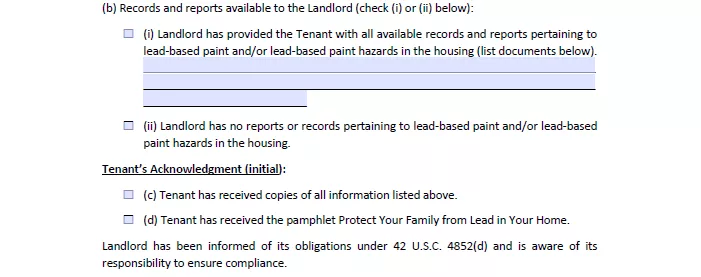

- Lead paint warning statement and disclosure — Any property built before 1978 most likely used lead-based paint. Since exposure to such is physiologically harmful to humans, it is important that the landlord discloses this information through a legal attachment.

- Leased Premises or Property — In a contract, this often refers to the house, office, or area being rented by the tenant. The rental agreement should stipulate the area and the perimeter of the property.

- Leased Asset — The automobile, equipment, or any other asset that can be rented by a person or a company.

- Maintenance — The landlord or tenant may agree on a periodical upkeep for the property’s maintenance like yearly painting, gardening, or fire safety inspections.

- Month’s Rent — The rent amount paid monthly on the date agreed upon. This should be stated clearly both numerically and in words.

- Notices — This is the written (mailed or e-mailed) letter sent to whoever is found violating the contract (either the tenant or landlord).

- Occupants — Those who live with the tenant inside the property for the duration of the agreement are called “occupants,” who may be relatives or friends. In this case, these occupants are also listed in the contract.

- Parties — The first paragraph of the rental agreement introduces the landlord and tenant. Each one is called a “party” based on legal terminology.

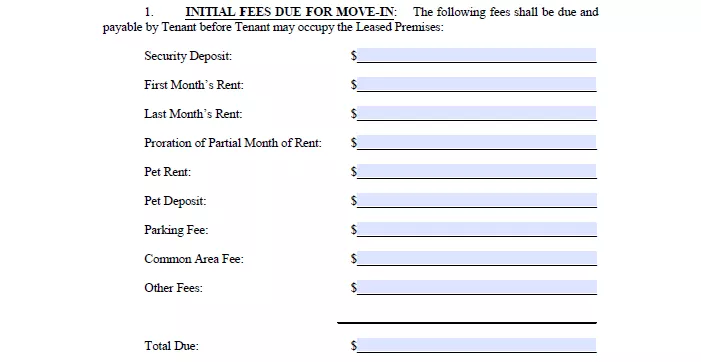

- Proration of Partial Month of Rent — Oftentimes, contracts are signed before a tenant moves into the property. However, if they do not stay in the property for a significant portion of the month, the month’s rent may be adjusted, so they can pay what is fair.

- Security Deposit — This is the amount given to the landlord before the first month’s rent. A security deposit is usually equivalent to one (1) or two (2) month’s rent, depending on your state. Most have no limit when it comes to the amount. It is used to cover the cost of damage or unsettled utility bills should the tenant leave the property without notice.

- Tenant or Lessee — This is a person who will be occupying or renting the property for a certain period of time. He or she may or may not have other “occupants” who are not signatories to the contract.

- Term — The duration or length of effectivity of the rent. This should be indicated in the agreement (See: Rent and Lease Agreements Types)

- Termination — Termination of the rent may occur when either the tenant or the landlord violates the contract.

- Utilities —Payment of utilities are often settled by the tenant. However, in some cases where there is no submeter for water or electricity (e.g. room inside a house), the landlord may opt to pay for this and just add a fixed fee on top of the tenant’s monthly bill.

Disambiguations

Rental vs. Lease agreement

The words “rent” and “lease” are typically used interchangeably. However, they do differ in connotation regarding the agreement’s duration and flexibility. For instance, a rental agreement gives the impression that the agreement is short-term, usually three to six months and renewable thereafter. In the case of renting a car or a stall, a one-page agreement may be signed. A lease agreement, on the other hand, is a contract that lasts up to a year or more. Since the duration varies, the length of the document may also be more detailed to ensure that the property is taken care of. Still, these two still fall under the same legal category, whether short-term or long-term. Both of these also have their pros and cons, so it’s best to carefully consider the conditions stipulated in the agreement to be fair to both parties.

Lease vs. Tenancy agreement

A lease agreement is often associated with commercial properties, which are rented for the purposes of business. Naturally, these would be for long-term use and have more stipulations that benefit both the landlord and tenant. One of these clauses may address concerns based on the Health and Safety at Work Act of 2015 since the property will be used by employees.

In contrast, a tenancy agreement is a technical term used for residential properties, where the conditions do not need to be as stringent as that of commercial rental properties. This is covered by the 1986 Residential Tenancies Act for the protection of both the landlord and tenant.

Lease vs. Leave and License Agreement

In a lease agreement, a “transfer of interest” may be possible, which results in an unauthorized sale of the landlord’s property by the tenant in ill-intent. Unlike the lease agreement, however, the Leave and License agreement tapers more toward the welfare of the landlord and prevents such occurrences from happening. The lease agreement is also transferable and inherited, but the leave and license cannot be passed onto others. Like an owned property, the lease agreement does not stop once the tenant has died, but the leave and license agreement automatically makes the rental contract subject to renewal. These differences protect the landlord from criminal acts in case he or she has failed to do a complete background check on the tenant.

Lease vs. Contract for Deed

The main difference between lease and contract for deed lies in the payment setup and owner of the property. In a typical lease agreement, the tenant cannot own the property but instead pays for the “right of access” to the property. He or she may then be evicted with notice should he or she fail to pay the month’s rent or violate the agreement.

Meanwhile, a contract for deed is the agreement for a rent-to-own set-up. Here, the seller or landlord keeps the title until the buyer or tenant completes the monthly payments. Though this may look advantageous in the long run, this payment scheme also has its cons. If the tenant fails to pay the monthly rent or “mortgage,” the property will become foreclosed and they will lose the down payment and rental.

What is the difference between a Residential Lease and a Commercial Lease?

A residential lease is for private and non-business tenants. These rental units may be located in residential areas and communities. In this type of lease agreement, the house rules are typically more lenient and have additional provisions for other occupants, pets, and upkeep maintenance. These agreements are also covered by the 1986 Residential Tenancies Act as well and requiring additional paperwork for houses that have lead-based paint.

Commercial leases are for properties located in business districts and busy areas. These typically have higher monthly rental fees, which businesses take as an investment in exchange for the prime location. These types of leases have more details than a residential lease and are tailored-fit for the tenant company’s industry and operations. For instance, malls include penalties for stores that do not open on time or remain closed during mall hours. On the other hand, buildings built for small offices may have provisions for the health and safety of their workers.

When do I need a Rent or Lease Agreement?

The landlord typically has the responsibility to come up with a rent or lease agreement for the tenant’s review. The landlord will need this as soon as he or she decides to rent out a property. On the first meeting with a potential renter, he or she will most likely ask the landlord about the rental agreement. Are pets allowed? How much is the parking fee? Who will be responsible for the upkeep? It is important to have a draft of the agreement even before renters come in so that no one’s time is wasted. Take note that the agreement may still be revised to balance out the needs of both parties, so it’s important for the landlord to know his or her non-negotiables.

Security Deposit Laws by State

| STATE | MAX. AMOUNT | RETURNING TIMELINES | STATE LAW |

| Alabama | One month’s rent | 60 days after termination of tenancy and delivery of possession | Alabama Code, Section 35-9A-201 |

| Alaska | Two months’ rent | 14 days (if tenant leaves on-time) or 30 days (if not on-time) | Alaska Statutes, Section 34.03.070 |

| Arizona | One and a half months’ rent | 14 days from move-out inspection (weekends and holidays are excluded) | Arizona Revised Statutes, Section 33-1321 |

| Arkansas | Two months’ rent | 60 days from termination of tenancy | Arkansas Annotated Code, Sections 18-16-304 and 18-16-305 |

| California | Two months’ rent (unfurnished) or three months’ rent (furnished) | 60 days from move-out date | California Civil Code, Section 1950.5 |

| Colorado | Not limited | One month (if mentioned in a lease) or two months (if not) | Colorado Revised Statutes, Sections 38-12-103 and 38-12-104 |

| Connecticut | One month’s rent (if tenant is 62 years or older) or two months’ rent (if younger) | 30 days from move-out date or 15 days from receiving tenant’s new address | Connecticut Revised Statutes, Chapter 831, Section 47a-21 |

| Delaware | One month’s rent (if 1-year lease) and not limited in other cases | 20 days from termination date | Delaware Code, Title 25, Section 5514 |

| Florida | Not limited | 30 days (with deductions) or 15 days (if no deductions) | Florida Statutes, Section 83.49 |

| Georgia | Not limited | One month from termination date | Georgia Code, Section 44-7-34 |

| Hawaii | One month’s rent (pet fee excluded) | 14 days from termination date | Hawaii Revised Statutes, Section 521-44 |

| Idaho | Not limited | 30 days (if mentioned in a lease) or 21 days (if not mentioned) | Idaho Statutes, Section 6-321 |

| Illinois | Not limited | 30 days (with deductions) or 45 days (if no deductions) | Illinois Compiled Statutes, Chapter 765, Section 710 |

| Indiana | Not limited | 45 days from termination date | Indiana Code, Section 32-31-3-12 |

| Iowa | Two months’ rent | 30 days after vacation of tenant | Iowa Code, Section 562A.12 |

| Kansas | One month’s rent (unfurnished) or one and a half months’ rent (furnished) | 30 days from termination date | Kansas Statute, Section 58-2550 |

| Kentucky | Not limited | 60 days from termination date | Kentucky Revised Statutes, Section 383.580 |

| Louisiana | Not limited | One month from termination date | Louisiana Revised Statutes, Section 9:3251 |

| Maine | Two months’ rent | 30 days (if fixed-term lease) or 21 days (if tenancy-at-will) | Maine Revised Statutes, Title 14, Sections 6032 and 6033 |

| Maryland | Two months’ rent | 45 days from termination date | Maryland Annotated Code, Section 8-203 |

| Massachusetts | One month’s rent | 30 days after vacation of tenant | Massachusetts General Laws, Chapter 186, Section 15B |

| Michigan | One and a half months’ rent | 30 days from end of occupancy | Michigan Compiled Laws, Sections 554.602 and 554.609 |

| Minnesota | Not limited | Three weeks from termination date | Minnesota Statutes, Section 504B.178 |

| Mississippi | Not limited | 45 days from end of tenancy | Mississippi Annotated Code, Section 89-8-21 |

| Missouri | Two months’ rent | 30 days from termination date | Missouri Revised Statutes, Section 535.300 |

| Montana | Not limited | 30 days (with deductions) or 10 days (if no deductions) | Montana Annotated Code, Section 70-25-202 |

| Nebraska | One month’s rent (pet fee is excluded) | 14 days from termination date | Nebraska Revised Statutes, Section 76-1416 |

| Nevada | Three months’ rent | 30 days from end of tenancy | Nevada Revised Statutes, Section 118A.242 |

| New Hampshire | One month’s rent or $100, whichever is greater | 30 days or 20 days (if property is shared with a landlord) | New Hampshire Revised Statutes, Sections 540-A:6 and 540-A:7 |

| New Jersey | One and a half months’ rent | 30 days from termination date | New Jersey Statutes, Sections 46:8-21.1 and 46:8-21.2 |

| New Mexico | One month’s rent (if 1-year lease and under), not limited (if more than 1-year lease) | 30 days from termination date | New Mexico Annotated Statutes, Section 447-8-18 |

| New York | One month’s rent | 14 days after vacation of tenant | New York Unconsolidated Laws, ETP Section 6; and Consolidated Laws, GOB Section 7-108 |

| North Carolina | Two months’ rent or one and a half months’ rent (for tenancy-at-will) | 30 days (if no deductions) and additional 30 days with deductions | North Carolina General Statutes, Sections 42-51 and 42-52 |

| North Dakota | One month’s rent (if no pets) or two months’ rent (with pets) | 30 days from termination date | North Dakota Century Code, Section 47-16-07.1 |

| Ohio | Not limited | 30 days from termination date | Ohio Revised Code, Section 5321.16 |

| Oklahoma | Not limited | 45 days from termination date | Oklahoma Statutes, Section 41-115 |

| Oregon | Not limited | 31 days from termination date | Oregon Revised Statutes, Section 90.300 |

| Pennsylvania | Two months’ rent | 30 days from termination date | Pennsylvania Consolidated Statutes, Title 68, Sections 250.511a and 250.512 |

| Rhode Island | One month’s rent | 20 days from termination date | Rhode Island General Laws, Section 34-18-19 |

| South Carolina | Not limited | 30 days from termination date | South Carolina Code of Laws, Section 27-40-410 |

| South Dakota | One month’s rent | 14 days (if no deductions) or 45 days (with deductions) | South Dakota Codified Laws, Sections 43-32-6.1 and 43-32-24 |

| Tennessee | Not limited | 30 days from termination date | Tennessee Code Annotated, Section 66-28-301 |

| Texas | Not limited | 30 days from vacation of tenant | Texas Statutes, Property Code, Section 92.103 |

| Utah | Not limited | 30 days from termination date | Utah Code, Section 57-17-3 |

| Vermont | Not limited | 14 days or 60 days (if a seasonal property) | Vermont Statutes, Title 9, Section 4461 |

| Virginia | Two months’ rent | 45 days from termination date | Virginia Code, Section 55.1-1226 |

| Washington | Not limited | 21 days from vacation of tenant | Washington Revised Code, Section 59.18.280 |

| West Virginia | Not limited | 60 days or immediately (if the property is re-rented within 45 days) | West Virginia Code, Section 37-6A-1 |

| Wisconsin | Not limited | 21 days from vacation of tenant | Wisconsin Statutes and Annotations, Section 134.06 |

| Wyoming | Not limited | 30 days from termination date or 15 days after receipt of renter’s new mailing address, whichever is later | Wyoming Statutes, Section 1-21-1208 |

How to rent out a residential property

Do you want to rent out your property, but don’t know where to start? Here is a step-by-step guide to help you through that process:

Step 1 – Research

The most crucial step in leasing your residential property is research. To attract a good tenant, you must check how the home compares with others. Consider the following when you do your research:

- Area – Is the property located in a good, peaceful community with nearby marketplaces, schools, and hospitals? Is it accessible by public transport or located far from the nearest busy area? These are some of the things you would want to check in comparison with other properties for rent.

- Amount— While deciding on the cost, you need to make your month’s rent somewhat at par with others, not too low and not too high. An appraiser can help you with finding out a good figure to start with.

- Inclusions— With today’s busy world, people look for more convenient ways to move into new homes. Therefore, it is good to know popular inclusions, which can make your offer more eye-catching. Is the property fully-furnished? Does it have appliances? Is it newly refurbished? These will also affect your pricing strategy, so it’s best to figure out what works best for you.

Step 2 – Get an agent or use online renting platforms

Most busy landlords prefer to get Real estate agents, who will take care of the first steps of the process. While this is the best decision for some, others prefer to do this on their own through posting on online renting platforms like Airbnb, HomeAway, and VRBO.

When doing this on your own, it is best to get high-quality photos that will showcase both the interior and facade of the real estate property as honestly as possible. Include your contact information and be prepared to answer phone calls and text messages throughout the day when this happens, as many potential tenants will want to get in touch. It will be useful to save a templated message so you can easily reply.

Step 3 – Schedule a viewing

It is best to free up your time on weekends or certain parts of the day for viewing. You may also assign someone reliable to handle this for you. Make sure to confirm the viewers’ identity and have someone with you for security purposes. Then, you may give a complete tour of the property.

Step 4 – Prepare a rental application and list of requirements

As soon as the viewing is done and the potential tenant shows interest, you may give them the rental application form, which will ask for the contact information of his or her references. This document may also contain a checklist of necessary requirements for their background check like a copy of the government-issued IDs and police clearance certifications.

Step 5 – Do a background check

Even with their papers, it is important to do a full background check. You may call their references or get in touch with their old landlord. In some states, the landlord is required to go through the strict process of declaring the rental transaction to help the tenant’s future landlord do a more thorough background check. You may also want to check each document that the tenant has submitted.

Step 6 – Draft and Revise the residential lease agreement

If you only made a checklist of your conditions, now is the time to integrate these into your rental or lease agreement. It is crucial to check the legal basis of each paragraph, so as not to make your rental agreement void or illegal. Some states may have specific caps on the financial aspect of leasing agreements and may have strict guidelines on upkeep, penalties, and termination. We know how difficult it is to check these details on your own, so we’ve prepared a free residential lease agreement form for you below:

After your potential tenant reviews the agreement, he or she may ask for certain revisions. It is up to you to negotiate or remain strict with the terms set forth in the agreement. If they agree, both of you must sign on each page of the document and get it notarized.

Step 7 – Secure necessary financial requirements

Once you have finalized the agreement, you must get the following:

- Security Deposit (equivalent to 30 days or 60 days, depending on state policy)

- An advanced deposit (usually equivalent to one month’s rent)

- A check for the first month (can be prorated)

- Post-dated checks for the succeeding months covered by the agreement

Make sure to formally “receive” the payment by giving him or her an official receipt or a signed paper stating the rental amount, date, and purpose of the transaction.

Step 8 – Turn over the keys

Likewise, the tenant must also properly receive the keys of the property. Both must document the completeness of the keys and test if they work. It will also be good to do a walkthrough inspection of the home and take further photos of damages, leaks, and other details that show the current state of the home. By doing so, both parties will know who will be responsible for future damages or wear and tear.

If you encounter hiccups along the way, make sure to document everything. It will be helpful to check for the legal basis of your actions since U.S. laws aim to protect both the landlord and tenant.

Landlord’s Access Laws by State

| STATES | Required Notice Periods | STATE LAW |

| Alabama | Two days | Alabama Code, Section 35-9A-303 |

| Alaska | 24 hours | Alaska Statutes, Section 34.03.140 |

| Arizona | 24 hours | Arizona Revised Statutes, Section 33-1343 |

| Arkansas | N/A | No Statute |

| California | 24 hours (if non-emergency), or 48 hours (if move-out inspection) | California Civil Code, Section 1954 |

| Colorado | N/A | No Statute |

| Connecticut | Reasonable notice | Connecticut Revised Statutes, Chapter 830, Section 47a-16 |

| Delaware | 48 hours | Delaware Code, Title 25, Section 5509 |

| Florida | 12 hours | Florida Statutes, Section 83.53 |

| Georgia | N/A | No Statute |

| Hawaii | Two days | Hawaii Revised Statutes, Section 521-53 |

| Idaho | N/A | No Statute |

| Illinois | N/A | No Statute |

| Indiana | Reasonable notice | Indiana Code, Section 32-31-5-6 |

| Iowa | 24 hours | Iowa Code, Section 562A.19 |

| Kansas | Reasonable notice | Kansas Statute, Section 58-2557 |

| Kentucky | Two days | Kentucky Revised Statutes, Section 383.615 |

| Louisiana | N/A | No Statute |

| Maine | 24 hours | Maine Revised Statutes, Title 14, Section 6025 |

| Maryland | N/A | No Statute |

| Massachusetts | Reasonable notice | Massachusetts Sanitary Code, Section 410.810 |

| Michigan | N/A | No Statute |

| Minnesota | Reasonable notice | Minnesota Statutes, Section 504B.211 |

| Mississippi | N/A | No Statute |

| Missouri | N/A | No Statute |

| Montana | 24 hours | Montana Annotated Code, Section 70-24-312 |

| Nebraska | One day | Nebraska Revised Statutes, Section 76-1423 |

| Nevada | 24 hours | Nevada Revised Statutes, Section 118A.330 |

| New Hampshire | Reasonable notice | New Hampshire Revised Statutes, Section 540-A:3 |

| New Jersey | One day | New Jersey Administrative Code, Section 5:10-5.1 |

| New Mexico | 24 hours | New Mexico Annotated Statutes, Section 47-8-24 |

| New York | N/A | No Statute |

| North Carolina | N/A | No Statute |

| North Dakota | Reasonable notice | North Dakota Century Code, Section 47-16-07.3 |

| Ohio | 24 hours | Ohio Revised Code, Section 5321.04 |

| Oklahoma | One day | Oklahoma Statutes, Section 41-128 |

| Oregon | 24 hours | Oregon Revised Statutes, Section 90.322 |

| Pennsylvania | N/A | No Statute |

| Rhode Island | Two days | Rhode Island General Laws, Section 34-18-26 |

| South Carolina | 24 hours | South Carolina Code of Laws, Section 27-40-530 |

| South Dakota | 24 hours | South Dakota Codified Laws, Section 43-32-32 |

| Tennessee | 24 hours | Tennessee Code Annotated, Section 66-28-403 |

| Texas | N/A | No Statute |

| Utah | 24 hours | Utah Code, Section 57-22-4 |

| Vermont | 48 hours | Vermont Statutes, Title 9, Section 4460 |

| Virginia | 24 hours | Virginia Code, Section 55.1-1229 |

| Washington | Two days (for repairs); one day (for showings) | Washington Revised Code, Section 59.18.150 |

| West Virginia | N/A | No Statute |

| Wisconsin | Advance Notice | Wisconsin Statutes and Annotations, Section 704.05 |

| Wyoming | N/A | No Statute |

Since most landlords do not want the hassle of writing their own rent or lease agreements, some of them go for a tried-and-tested rent contract. You may download a free PDF standard lease agreement form on our site. Alternatively, you can use our convenient step-by-step document builder to create your customized agreement and download the completed form. Make sure to check the Landlord-Tenant laws in your state while you are doing so.

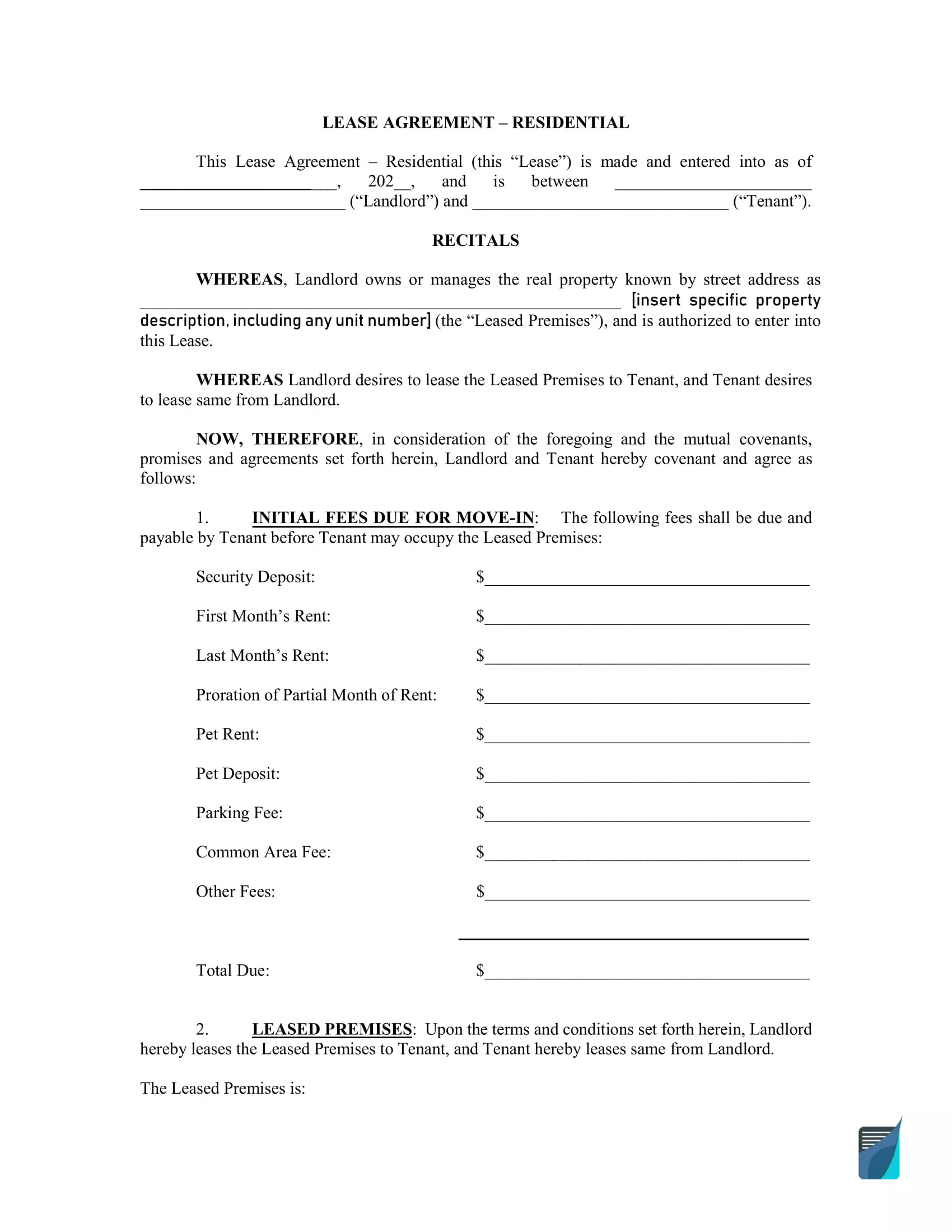

How to write a Residential Lease Agreement

Oftentimes, hiring a lawyer to write the agreement will be subject to attorney fees. However, one can easily find a legal agreement template on FormsPal. For those who want to further understand the content of a residential lease agreement and how to write one, here is a quick step-by-step checklist:

Step 1 – Identify the parties

At the very beginning of the agreement, the “landlord” (the lessor) and the “tenant” (the lessee) must be identified.

Step 2 – Determine the financial details

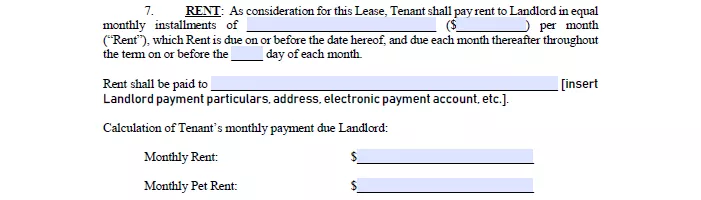

This part may be discussed in different paragraphs of the agreement but must include the monthly rent computation, penalties, grace period, security deposit, pet deposit, and additional fees.

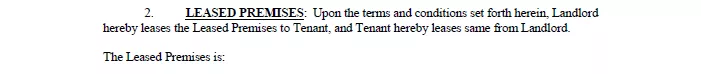

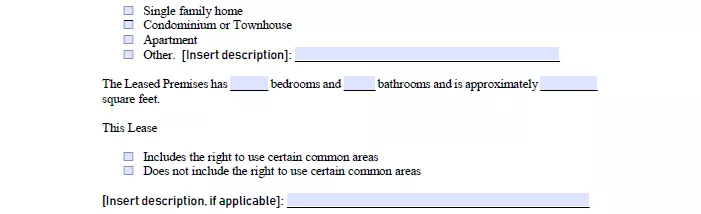

Step 3 – Write the property description in detail

The agreement will also contain the complete location of the residential property as well as a declaration of existing features such as furniture, appliances, pools, garden, parking, etc.

Step 4 – Indicate terms of use

Apart from indicating terms for use, the agreement must also contain specific house rules for pets, parking, and use of common areas. It must also list other conditions deemed necessary by the landlord but has to be fair to the tenant.

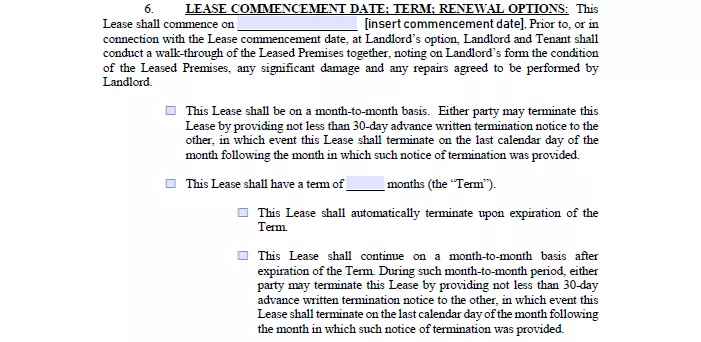

Step 5 – Identify the rent term

Depending on the type of rent, a duration must still be set. So, it is crucial to indicate the date of commencement as well as the ending date. This will be followed by the condition for renewal.

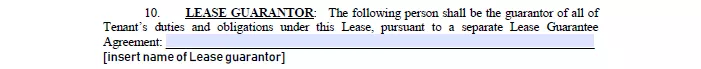

Step 6 – Identify a Guarantor (optional)

Some rental or leasing transactions require a guarantor. If the tenant’s credit score is enough to sustain the monthly rent, then a guarantor is no longer needed. However, some landlords are better assured with this additional “safety net” if the tenant’s income is not 40 to 45 times the monthly rent.

Step 7 – Assign responsibilities

Although the responsibilities between the tenant and the landlord are already governed by state laws, it is crucial to include these into the agreement. For instance, some states require landlords to cover the periodic maintenance and insurance of the home. On the other hand, the regular household duties (e.g. lawn mowing and trash collection) and repair of damages (caused by the tenant or the occupants) will be the responsibility of the tenant. These are discussed in the latter clauses of the contract leading up to the indemnity agreement.

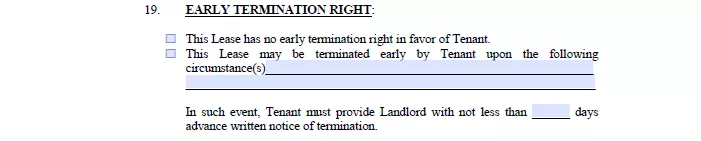

Step 8 – Conditions for termination or end of the contract

Once the contract is violated, written notices will be sent by either party. If violations continue, the agreement may be ended and a notice to terminate will be sent at least 30 days before the tenant is scheduled to vacate the premises. However, the security deposit may be withheld by the landlord until the tenant can properly turn over the property.

Step 9 – Attach a disclosure statement (if applicable)

If a home is built before 1978, it may contain harmful lead-based paint. Some homes have some safety hazards like termites or mold, which can affect the living condition of the tenant. Therefore, it is important to have this rider attached to the main contract.

What Are the Rent or Lease Addendums and Disclosures?

Declaring things that may affect either party is crucial to maintain transparency. Otherwise, this could affect the agreement and the party that withheld information may be held liable for violations. Here are some addendums and disclosures one must attach to the agreement prior to the commencement of the rent or lease.

- Pet addendum – An additional provision for pets stating the breed and size.

- Smoking addendum – This addendum indicates which areas of the home smoking is allowed in.

- Renovation addendum – In some cases, renovations occur while the lease agreement is being finalized. As such, it is important to declare which parts of the property were changed for the benefit of the tenant.

- Bed bug addendum – Since bed bug infestation is quite serious, the landlord may opt to add this as a rider to the agreement so the tenant can become aware of their responsibility to prevent such.

The Landlord also has the responsibility to disclose any information that may affect the tenant’s living and health conditions such as water damage, mold, and use of hazardous materials (e.g. lead-based paint, asbestos, and radon). These can be disclosed by adding riders to the contract.

Frequently Asked Questions

Can a lease agreement be handwritten?

Yes. Before typewritten agreements, all legally binding agreements were handwritten. It is still true up to this day. However, a handwritten agreement must be scrutinized, since one can easily add terms after it has been signed by both parties. One way to prevent this is to sign right below the last paragraph on each page to make sure that nothing is added.

Is a verbal rental agreement binding?

Verbal contracts are only binding between the two parties who agreed. However, should complications arise and the problem is taken to court, the he-said-she-said nature of this agreement will delay the process, negatively impacting both parties. Without a written contract, questions cannot be answered and the governing law will have difficulties in determining the winning party.

What makes a rental agreement valid?

According to the Civil Code, a contract is “a meeting of minds between two persons whereby one binds himself, with respect to the other, to give something, or to render some service.” To make an agreement valid, the following must be present:

Consent – There should be evidence of an agreement.

The name and signature of both the landlord and the tenant must be seen in all pages of the contract. Furthermore, their mailing addresses and Identification Card numbers should be reflected in the document as proof of identity. This strengthens the agreement’s enforceability.

Object – These are goods or services.

In this case, this is the property being rented. The following additional details regarding the said property should also be discussed in the agreement:

- Address of the property

- Monthly rent amount

- Security deposit

- Other applicable fees

Cause – This is the reason for the agreement, which is often for mutual benefit.

This is stated in the beginning and must contain the duration of the rental agreement.

In order to avoid complications in rental or lease agreements, it is best that other arrangements are also written in detail. Both the landlord and the tenant may include clauses for the following:

- Who is responsible for the payment of utilities?

- Who is responsible for repair and maintenance?

- What will be the contract termination procedure?

- What are the conditions for the use of furniture or appliances? (if applicable)

- What features of the property may affect living conditions? (See: Rent or Lease Addendums and Disclosures)

Can I use my lease agreement as proof of residency?

Yes. Initially, you may show the agreement as proof of residency. However, the tenant will need to get a clearance or an official identification card later on. These are better proofs of residency.

What are sublets and subleases?

Both a sublet and sublease have someone else involved in the agreement. The main difference is who remains to be responsible for the property. In a sublet (also known as “relet”), the third-party tenant becomes responsible for the property and directly pays the landlord. On the other hand, the original tenant will still be responsible for the entire property in the case of a sublease.

How can I break my lease agreement?

A lease can be broken with a series of violations made by either the tenant to the landlord or vice versa. However, it is always best to end the agreement in good terms through a simple written notice. If this will push through, the party who wishes to break the agreement may have to pay fees or surrender a portion of the security deposit. Should there be a dispute, a lawyer may have to step in and both will be required to pay the corresponding attorney fees.

What is rent-to-own?

In a rent-to-own agreement, the landlord is “selling” the property but is giving the tenant time to slowly pay off the mortgage. In the meantime, the title is still with the landlord and doesn’t turn it over until the full rent payment has been made. This happens when a potential tenant may not have enough credit score to make a bank loan, but the landlord wants to sell the house instead of renting it out. So, both parties agree on this mutually beneficial setup.

What should a landlord do in case of a tenant violation?

Depending on the Landlord-Tenant Act of each state, a violation is often addressed with a written notice. However, once it recurs, the landlord has the option to terminate the agreement by sending a Notice of Termination of Lease at least 30 days before the tenant’s last day unless otherwise specified by the state. After this, the landlord may withhold the security deposit until a thorough check of the property’s condition has been finished.

What is the difference between a month-by-month lease and a fixed-term lease?

A month-to-month lease is short-term and is often renewed at the end of the month. In contrast, a fixed-term lease is long-term and often lasts a minimum of one year. The guidelines for each may be checked with your state’s Landlord-Tenant Act.

Can a lease be changed after it is signed?

The agreements in the rental contract can be changed by attaching an amendment to the contract. This amendment must also detail the cause of the change with the new agreement. Like the original rental or lease agreement, it must also be signed by both parties and notarized.

Can a rental agreement be backdated?

Backdating is permissible for some cases in order to make the commencement of rent more accurate. This happens when a tenant moves in earlier than expected and the landlord agrees to this. However, legally, this is questionable and is often the source of fraud and other complications.

What is a rental agreement notice period?

The guidelines and minimum period for giving notices may vary from state to state, but it often arises out of the following:

- Pay Rent or Quit – Gives the tenant time (usually three to five days) to pay the month’s rent or vacate the unit. This happens when the grace period has lapsed or the failure to pay rent has become a habit.

- Cure or Quit – This allows the tenant to solve any property damage or violation within a certain time depending on the gravity. Otherwise, they will have to vacate.

- Unconditional Quit – The unconditional quit happens when the tenant commits a grave violation and has to leave within a certain period. He or she is given no opportunity to solve the problem.

A written contract is the most crucial document in a leasing agreement. Still, renting and leasing in the United States does not have to be overly complicated. There are already templates available for use that have gone through legal review. One of these is our rental agreement form, which you can download above. These contain provisions to make sure that the agreement is fair. Still, landlords and tenants must review state laws, which are in place to protect the welfare of both the landlord and tenant.