Bill of Sale Template

A bill of sale is a legal document used to record the details of a private transaction between yourself and another person or entity (“Buyer” and “Seller”) and serves as a proof of purchase. This form is similar to a receipt or a stub but can also contain additional terms, just like a purchase agreement.

We provide fillable bill of sale templates for any type of property and every US state. They are readily available for download via the links under the “Types” and “State” sections below. Try our document builder and create a custom bill of sale step-by-step.

Free Bill of Sale Forms by State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Free Bill of Sale Forms by Type

This article contains a comprehensive guide on many aspects of using bill of sale forms. That includes the basic terms, an extended definition, standardized form types, and a detailed template completion process. If you want to find out more about all the relevant aspects, we invite you to continue reading and watch our video guide below.

If you are not interested in learning more about this form, you can jump straight to the creation process by clicking the “Create My Document” button or downloading one of our free fillable templates in PDF and creating your document.

What Is a Bill of Sale?

A bill of sale acts as a receipt and documents a sales transaction. It proves that an item was passed from one party(seller) to another (buyer). A bill of sale contains all of the essential information about the sale and the condition of the personal property being sold. It is usually used in car, motorcycle, watercraft, and gun deals.

Obtaining this document is often required during vehicle registration and title transfer.

After you complete a bill of sale, ensure both parties involved sign the form and keep its copy to protect the buyer and seller from legal claims by either side.

Short Video Guide to Bill of Sale Documents

Key Terms

As-Is – This term is used in most bills of sale and means that the item is “sold or purchased from a private party in its current condition.” From the legal perspective, it implies that the buyer accepts and acknowledges any defects or faults of the item at the time of purchase and cannot use those against the seller in a lawsuit. An as-is bill of sale also protects the seller from being forced to refund the buyer for any defects, even if they are discovered after the purchase.

Buyer – the purchaser of a service or item.

Seller – the person or party who gives up an item or service for sale.

Gift – this is legally defined as giving something to a “buyer” without expecting any monetary compensation or consideration.

Payment – any legal method used to pay for an item or service in a transaction.

Notary public – a third-party public officer without any stake in the transaction who can confirm the legitimacy of the signatures for both the seller and buyer.

Trade-In – a transaction where a buyer offers an item to the seller for another item. The buyer’s item is considered the same in value or acts as a small discount for what the seller offers. For example, a motor vehicle owner might decide to “trade in” their used car for a slight discount on the vehicle owned by the seller or go for an equal exchange.

VIN – this is a Vehicle Identification Number, a 17-character code comprising letters and numbers that serves as a unique piece of identifying information for a vehicle. A VIN must be stated in any bill of sale form that involves a vehicle transaction.

Bill of Sale Types

The contents of a bill of sale can vary depending on the type of property you sell. The main property categories are motor vehicles, animals, and personal property.

Besides property, the contents of this document can change if the buyer wants to specify certain conditions regarding the method of payment or the item sold. You can learn more about this classification below.

Absolute

A bill of sale is called absolute when the buyer pays the whole amount during the private sale, and there are no warranties or ownership conditions specified. Hence, after the transaction, neither party owes anything to one another.

Example: If you buy a used vehicle in “as-is” condition and pay for it fully during the vehicle transfer, the seller will draft an absolute bill of sale.

Every bill of sale form available here is considered absolute until you add some special instructions, which can be done in any template we offer.

Conditional

A bill of sale is called conditional if the seller includes any special conditions regarding the payment or ownership of the object being sold.

Example 1: You want to buy a used car and pay for it in installments. In such a case, you will have the right to own this car only if you pay off each installment according to the conditions written in the bill of sale. If you fail to meet these conditions, you might get the car removed from your physical possession.

Example 2: You want to buy a kitten, but the seller will give it to you only once it reaches the age of six months. You can fill out a bill of sale with such a condition beforehand and receive the kitten once this condition is met.

When to Use a Bill of Sale

A bill of sale should be used by anyone selling personal property of significant monetary wo and especially if you don’t know the other participant of the deal very well (for instance, when buying or selling online). This document provides a layer of security for both parties of the transaction. Some cases of using a bill of sale form include:

- You need a bill of sale when buying (or receiving as a gift) any vehicle that requires registration to finalize the title transfer in your local Department of Motor Vehicles (DMV).

- You want to provide certain conditions when selling a high-value item (explained before under the Types section).

- You want to have some kind of transaction proof for accounting purposes.

- You want to get a layer of legal protection when selling firearms or something of high value.

When Not to Use It

There are cases when you don’t need to use a bill of sale, or when it is better to use a different document. Such instances include the following:

Business or stock sales. Selling a business is not the same as selling a car; it is usually much more complicated. Hence, we recommend using a business purchase agreement. It is much more flexible and provides more protection for both parties. And for stocks, you can use a stocks purchase agreement template.

Real estate sales. Selling a house or apartment generally involves a lot of paperwork, and a bill of sale won’t do for such a complex matter. In such a case, you would be better off creating a real estate purchase agreement. This template covers most aspects of such a sale and can be supplemented by numerous addendum forms if needed.

Inexpensive things. You can create a bill of sale for any personal property transaction, but for many people, selling a toaster or an old carpet isn’t worth dealing with additional paperwork.

What to Include in the Form

It’s essential to provide accurate and comprehensive details in a bill of sale to be fully valid and useful to both parties. That way, it will serve as solid evidence to prove ownership transfer and as a reliable legal instrument should future disputes arise. Therefore, if you are thinking about drafting a bill of sale form yourself, it is recommended to include the following:

1) Parties’ details. First, you should identify the parties of the deal—the buyer and seller. It’s necessary to indicate the full name and address of each person involved. Remember that there can be more than one buyer or seller in case the object sold is or will be owned jointly. You should also include emails and phone numbers for easier communication in the future if such is needed.

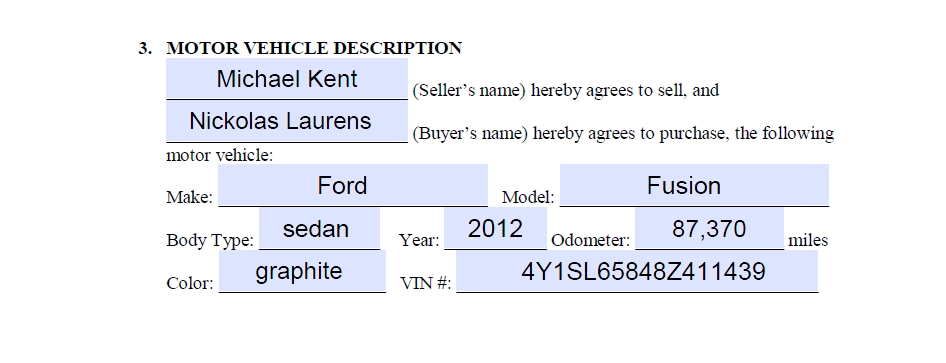

2) Property details. It’s essential to identify the property that’s being sold. You will need to include a detailed description of the item and its serial number, if any. For a vehicle, such a description would include at least the vehicle’s make, model, year of manufacturing, an MVR (vehicle history report) including the odometer reading disclosure, and a vehicle identification number (VIN).

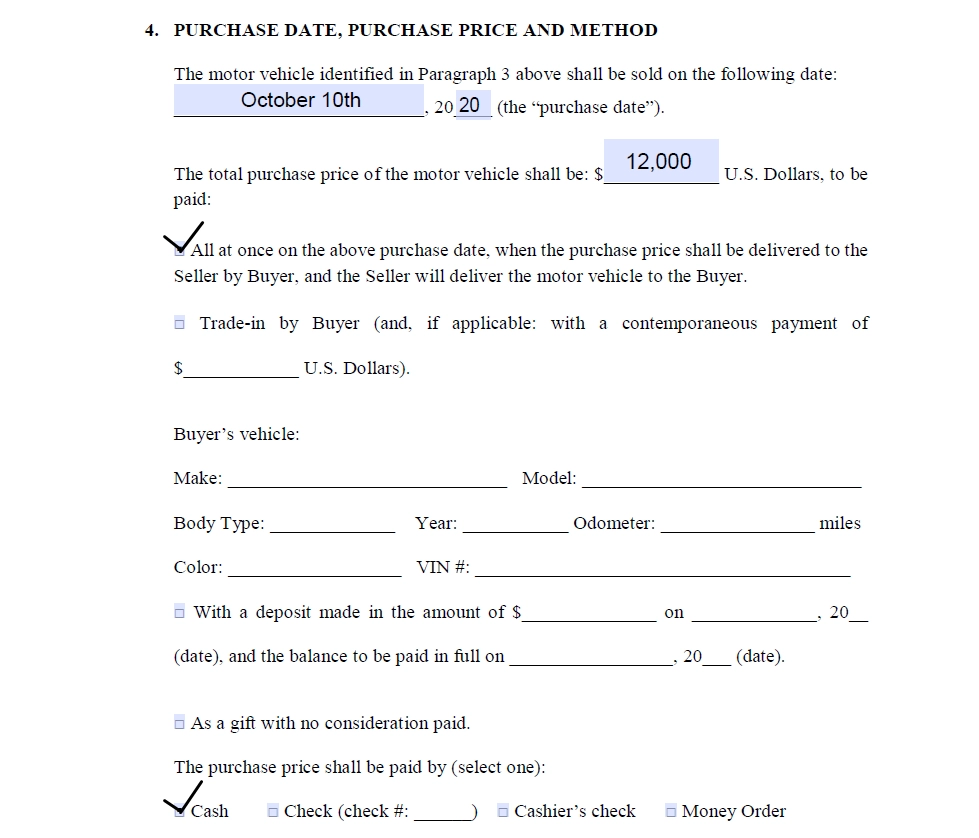

3) Purchase price and method. The amount of money paid for the property and the payment method are also required to be in your bill of sale. Any encumbrances, such as liens or loans on the vehicle’s title, should also be mentioned in the document. It is also a good idea to mention if the sales tax is included in the purchase price.

4) Warranties and representations. If there are any warranties or representations from the seller, they all need to be described in the bill of sale. If there are no warranties, the document should state that the property is sold “as-is,” without warranties.

5) Date and signatures. After you fill out a bill of sale, you will need to indicate the date of the transaction and sign the document. The buyer’s signature is not required, but it would be better if they also signed the form.

How to Write a Bill of Sale Form

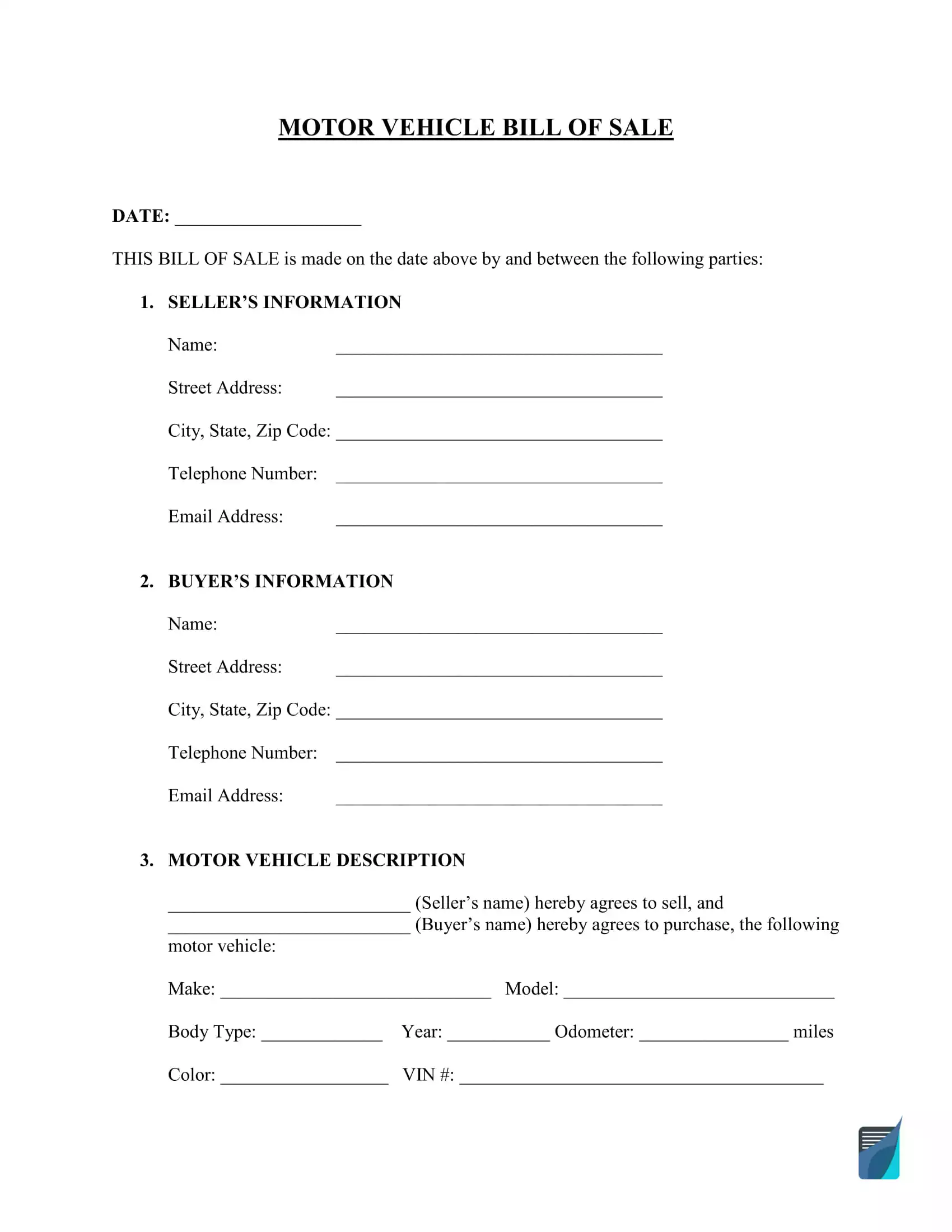

Step 1. Open a Bill of Sale Template

Programs like Microsoft Word, Adobe PDF, or OpenDocument Text can let you edit and print out downloadable templates that you can use to create a bill of sale yourself by filling out the blanks. You can download our free template in Adobe PDF or Microsoft Word (DOCX) format.

You can also create a personalized bill of sale with our document builder. You can start by clicking the “Create My Document” button.

Sample Bill of Sale Preview

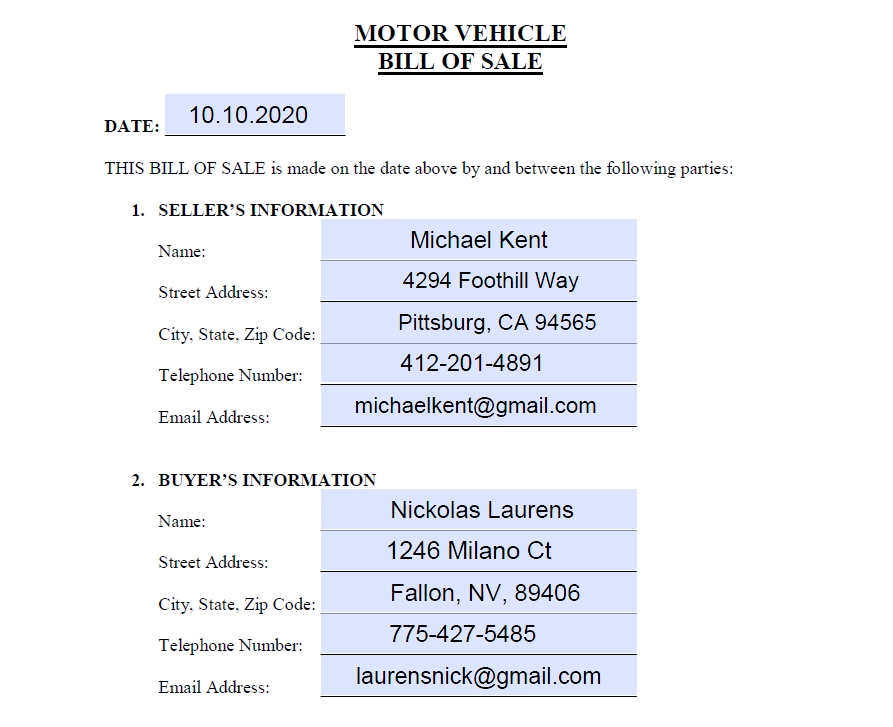

Below are detailed instructions on how to write a bill of sale using our free printable template for a vehicle deal.

Step 2. Provide Seller and Buyer Information

Start by typing in the transaction date and the buyer and seller’s full names, addresses, and contact details. The contact details are optional but recommended.

Step 3. Specify Item Information

Write down the vehicle particulars, namely, its make, model, body type, color, year of manufacturing, odometer reading, and 17-character vehicle identification number (VIN). All this serves as crucial information to identify a specific vehicle.

Step 4. Indicate Transaction Type and Purchase Price

Proceed with the transaction type: choose whether it is a full payment, payment in parts, trade-in, or gift. In case it’s not a trade or a gift, you need to specify the total selling price of the vehicle and how the buyer will pay this amount: cash, check, money order, etc.

Our bill of sale template provides an option to pay in parts in case the buyer doesn’t have enough funds. If want to go with it, choose the amount of the first payment (deposit) needed and the date by which the buyer must pay the rest.

A promissory note for a car might be a better choice for a vehicle purchase that involves installments as it offers more legal protection. Please check it out first if you are considering this payment method.

If you are trading, you will have to describe the trade-in vehicle offered by the buyer. It includes all the details we described in the previous step.

Step 5. Check Taxes

The first checkbox states that the municipal, county, state, and sales taxes related to the item or motor vehicle are included in the price. Taxes may not apply if the deal concerns a different kind of personal property.

If you tick the second one, it will indicate that the buyer must pay all related taxes themselves.

It is wise to leave an additional spot open for any applicable terms and conditions. For instance, if it is a car bill of sale document and the vehicle being traded includes the floor mats or other accessories, leave space for specifying this below the VIN and sales tax information.

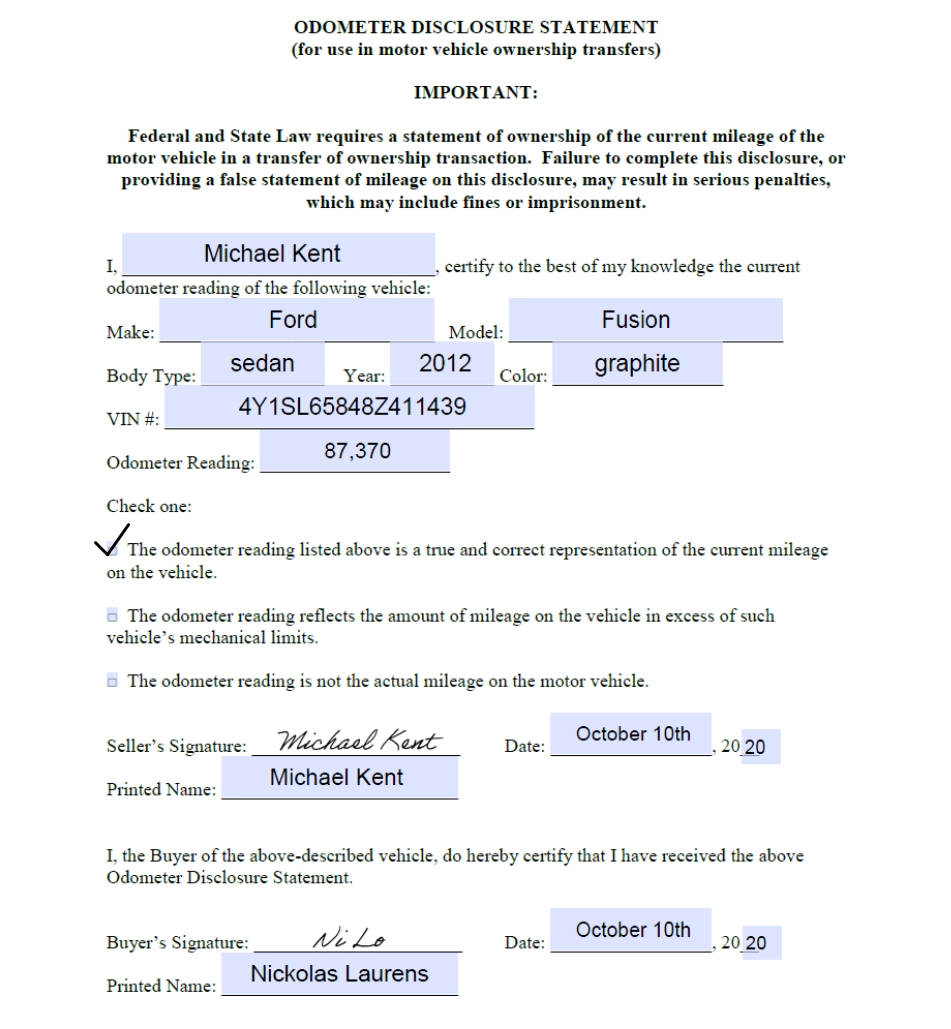

Step 6. Complete Odometer Disclosure Statement

Every motor vehicle bill of sale requires the Odometer Disclosure Statement, which is included in our template. This confirms that both the buyer and seller knew what the vehicle’s actual mileage was at the time of the transaction. The first three steps are simple:

- Indicate the seller’s full name.

- Re-enter the vehicle details.

- Type in the odometer reading.

Then, you need to choose one of the three statements:

- The reading is accurate.

- The reading exceeds mechanical limits.

- The reading can’t be verified.

The second option implies that the reading rolled over the 99,999 miles mark on a five-digit odometer or the 999,999 miles mark on a six-digit odometer.

Option three means the rightful owner of the vehicle doesn’t know if the mileage is correct because the odometer has been replaced or broken.

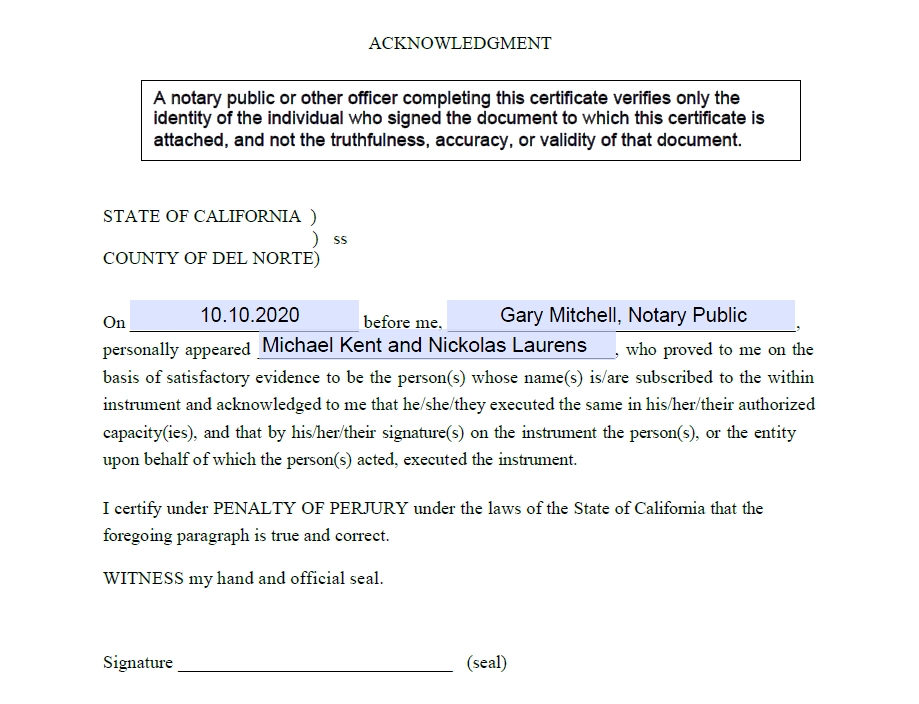

Step 7. Add Certificate of Acknowledgement

Our template includes a Certificate of Acknowledgement at the bottom of the document. A notary public should fill this part out during the item transfer or document signing.

A notary public should fill this part out during the item transfer or document signing.

It is also recommended that both parties keep a copy of the finalized bill of sale for any future procedures that might need it.